A Lisbon man cut off his finger in the middle of court after a judge refused his offer to settle his 170,000 euro ($219,436) debt. “My intention was to tear up all the case papers and splatter them with blood so I could prevent the expropriation order for my land,” said Orico Silva…

loans

Debt Collectors Incessantly Harass Dead Son's Parents

Debt collectors are illegally harassing Vincent’s parents for debt their son owes. Vincent died last year at 27 from a sudden heart attack during a softball game. “I’m afraid to pick up the phone in my own home,” said Roco Crimeni, father. “That’s the hard part, to tell them my son is dead. How many times do I have to repeat it?”

Despite Having A S*%!load Of Our Money, Banks Still Aren't Lending

Gripped by “catatonic fear,” banks still aren’t thawing credit markets, “leaving taxpayers propping up an industry that won’t lend to them.” [Bloomberg] (Photo: The Joy of the Mundane)

How Universities And Credit Card Companies Make Money Off Of Students

How can an educational institute act in its students’ best interest if it stands to make money off of increasing their debt load? The symbiotic relationship between universities and credit card companies is being questioned more than ever by student groups and politicians, writes the New York Times.

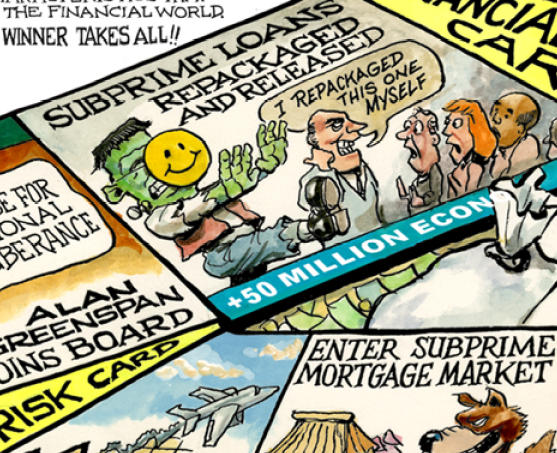

The Economist's Credit Crunch Game Makes Subprime Loans Fun Again!

We think the idea of “Credit Crunch,” a print-it-yourself board game in this week’s issue of The Economist, is great. We’re not convinced it’s exactly cost-effective to print the board, cards, and money with your own equipment, though—as someone suggests in their comments section, maybe a web-savvy reader should create an online version.

HELOC Cuts, The Hows And Whys

Did your Home Equity Line of Credit (HELOC) suddenly trail off in the forest recently? Here’s some straight-talk on why, and what, if anything, you can do about it. [Examiner.com] (Photo: Getty)

Auto Bailout Passes House, But May Get Stuck In The Senate

The Auto Bailout Bill passed House yesterday, but is expected to encounter strong Republican resistance in the Senate.

Illinois Stops Doing Business With BoA Until It Restores Window And Door Company's Credit

The state of Illinois has suspended doing all business with Bank of America until they restore the line of credit to Chicago-based Republic Windows & Doors necessary for paying their workers.

What Do I Need To Know Before I Refi?

I am going to meet with him after work today, but was wondering, what sort of things do I need to look out for, and know, going into this? This is my first mortgage ever (I’m 21) and don’t know too much about what’s normal and what’s not. If you could give me any hints or suggestions, that’d be awesome! Thanks so much, and have a great day!

Auto Makers Going Out Of Business, But Still Have Enough Money To Lobby Congress

CBSNews is reporting that while, at this very moment, the big three auto bosses are testifying in front of the House Financial Services Committee (watch this now at CSPAN, if you like.) about how they need emergency bridge loans in order to continue functioning — they still apparently have enough money to continue to spend millions lobbying our government.

Capital One Inspires Man's Loathing

Mr Bill says his latest dealings with Capital One have him “wanting to spit venom.” Whence this reptilian impulse? There is apparently no structure to refinance your loan with them. They consider it makes you a new customer, and they aren’t making any new loans. This takes several hours and several phone calls to figure out. There also seems to be no way to pay off a loan with a credit or debit card. This also takes several hours and phone calls to figure out. It’s really just totally frustrating for Mr. Bill. “What is this, 1987?” he writes. So he’s taking his business elsewhere. His misanthropic misadventure, inside…

Circuit City Gets A Loan, Lives To Fight Another Day

Circuit City has secured a loan from Bank of America that will pay for its operating expenses until it emerges from bankruptcy next year, says Bloomberg. This financing gives CC a new lease on life — Yes, we may yet see the bankrupt retailer rise from the ashes to continue its proud tradition of ignoring customers who are standing at the register.

Fannie And Freddie To Announce More Sweeping Loan Modifications

Fannie Mae and Freddie Mac are expected to announce today plans for accelerating and expanding mortgage loan modifications for distressed homeowners. The new guidelines will apply to specific kinds of past due loans and try to bring their debt to income ratio down to 38%. Washington will also prod other big banks to do the same. “It could apply to a broad range of borrowers,” reports WSJ. Expect the full details at a 2pm eastern Federal Housing Finance Agency press conference.

Debt Collector Bullying Me To Sign Affidavit Saying I Can Pay More Than I Can

Sarah has $40k+ in student debt that went into default after she got sick and had to spend a lot of money on medical care. She’s been paying it off, but one of the companies that owns one of her loans, NCO Financial, has told her that unless she signs a legal document that says she can pay $260 a month, they’re going to place her account back in collections and start harassing her even more than they are now (they’re already calling her daily at home and work)…

Attention: Credit Card Companies Have Realized That You Are Broke

The New York Times has an article detailing what promises to be the next fun financial crisis — credit card debt! Apparently, credit card companies have only just now realized that you people are broke! Whoops.

Consumer Reports: 10 Car Shopping Mistakes And How To Avoid Them

Consumer Reports has compiled a list of common car shopping mistakes from their Smart Buyer’s Guide to Buying or Leasing a Car, which, of course, you can find in bookstores.

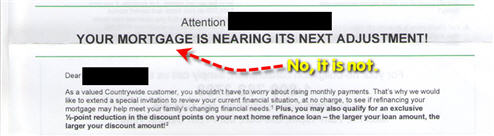

Countrywide To Fixed Rate Customer: Your Mortgage Is About To Adjust!

Countrywide either doesn’t know, or doesn’t care that reader Graham has a fixed rate mortgage, because they keep sending him “notices” that his mortgage is about to “adjust.”

../../../..//2008/10/22/the-wall-street-journal-says-1/

The Wall Street Journal says that the troubled California real estate market may be healing, but not without considerable pain. [WSJ]