Yesterday’s Morning Edition featured confessions from former Ameriquest mortgage employees. The confessions included startling revelations, such as:

lending

BusinessWeek: The Poverty Business

Business Week’s top story concerns the “subprime” lending industry in the United States. It’s a good read, one of those articles that makes you feel smarter for having read it. It’s shocking too, reading about a Navajo woman who makes $15,000 a year being lent $7,922 at 24.9% (to buy a 1999 Saturn with 103,000 miles on it) makes us slap our foreheads in frustration. But that’s how it goes when you’re poor. Your bank is a car dealer, your tax accountant is Jackson Hewitt and you’re screwed. —MEGHANN MARCO

How To: Avoid Foreclosure

Since 1.1 million of you will soon be forced out of your homes due to the subprime mortgage debacle, we thought we’d link this extensive article in the Washington Post detailing the various strategies one can use to negotiate with lenders and hopefully stay in your home.

Ask The Consumerists: Get A Lower Rate Without Hurting My Credit?

Hi Meghann, nice work on Consumerist. You all do a great job, and I enjoy the blog, read it a lot, and learn a lot from it. I thought I would run a situation/question by you and see if you all have any answers or know where to find them.

Subprime Mortgage Debacle Makes General Motors Cry

Hey, you may be asking yourself, why are GM’s profits down 90% from this quarter last year?

There Goes The Housing Market, Home Sales Experience Worst Drop In 18 Years

“Even if they’re not trying to sell their house or getting hammered with problems with a subprime mortgage, consumers can’t ignore the headlines.”

Everything You Ever Wanted To Know About The Subprime Mortgage Meltdown

About 85 percent of mortgage borrowers have credit scores of 620 or higher. So far — knock on wood — most of these prime customers needn’t worry about being turned down for home loans on the basis of their riskiness as borrowers, so long as they’re willing to let the lender verify their incomes and assets.

Other sections include an analysis of the Federal debate, and “Lender Implosion” which declares that the industry has itself to blame.—MEGHANN MARCO

Sallie Mae To Be Sold To JP Morgan Chase, Bank of America

… Currently, the company is carrying $142 billion in private and guaranteed loans on its books, about 27 percent of American student loans in the United States.

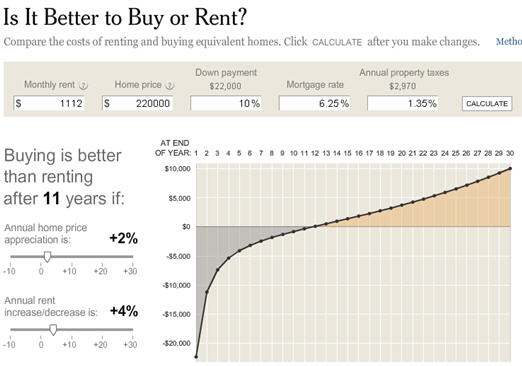

Is it Better To Buy or Rent?

The New York Times has a nifty calculator that will help you decide if its better to rent or buy. It told us that based on our rent vs what it would cost to buy a place similar to the one we rent…buying was only better after 24 years. Sobering news. —MEGHANN MARCO

$1 Billion Pledged For Refinancing Subprime Mortages, But It's Not Nearly Enough

The Neighborhood Assistance Corporation of America announced that they have set aside $1billion for the refinancing of subprime mortgages, but it’s not nearly enough. From the Washington Post (emphasis ours):

NACA requires that people who ask for its help attend intensive housing counseling workshops. It also assesses the person’s ability to own and maintain a home. It then helps the person obtain a mortgage with one of its partner lending institutions, the biggest ones being CitiGroup and Bank of America.

Student Lending Investigation Could Lead To Criminal Charges

An investigation into student lending practices by New York Attorney General Andrew Cuomo could lead to criminal charges being filed, he says.

Foreclosure Spike Due To Natural Economic Forces, Not "Risky Lending?"

NYT has a sobering counterpoint to the recent gangbanging of the subprime mortgage market in the press and in Washington. It’s main points:

NPR: Elizabeth Warren On The Credit Card Industry

Reader Jaime alerts us to an interesting interview from Fresh Air on NPR. In the interview Harvard Law Professor and credit card industry expert Elizabeth Warren dishes on abusive lending practices, the ever-malleable interest rate, universal default and all that fun stuff.

Car Title Loans Banned In Iowa

Car-title loans have astronomical and unjustified interest rates, typically 264% and sometimes 360%. On top of that, the consumer puts his or her car at risk – the car-title loan company takes a lien on the car and actually takes keys to the car to make repossession easier.

Which Mortgage Is Right For You?

So many lifestyles, so many loans…which one goes with which? Bankrate has a tool that matches your lifestyle to one of 8 different types of mortgages. You’re bound to match one of them, right? —MEGHANN MARCO

More Payday Lenders In Arizona Than McDonald's And Starbucks Combined

“According to data supplied by the Children’s Action Alliance, there are now more payday loan facilities in Arizona than there are Starbucks and McDonalds combined,” she says.

Sallie Mae Is Still Ruining Your Life!

The FDSL just sent me a loan cancellation letter. They have decided that they will only take federal loans now to consolidate and Sallie Mae is primarily a private lender, and that is what they report my loan as. What the difference between a federal guaranteed loan and what they consider a federal loan through a private company is beyond me.

Lawsuit: US Department Of Education Overcharging On Student Loans?

Has the US Department of Education been unfairly overcharging millions of Americans despite “repeated warnings that it was breaking the law?” According to a lawsuit filed yesterday, the Department of Education may have some explaining to do.