A week ago, beleaguered for-profit college biggie Corinthian — which operates the Everest University, WyoTech, and Heald College chains — confirmed that it would be meeting with the Dept. of Education to discuss its plan to sell off some of its campuses in an attempt to free up student loan money and allow classes to continue while the school is investigated by state and federal regulators for allegations of misleading marketing and questionable loan application processes. The two parties met on Tuesday, but no deal was reached. [More]

kaz

FTC Helps Stop Debt Collection Operations Attempting To Solicit Allegedly Fake Payday Loan Debts

There are few things more disruptive and frustrating than receiving a phone call demanding you pay a debt. Those feeling are amplified a thousand times when you don’t actually owe a debt. Yet, that was the case for consumers contacted by a Georgia-based company that was recently shut down at the request of the Federal Trade Commission. [More]

Senators Hope To Block New Student Enrollment At For-Profit Corinthian Colleges

Days after the U.S. Dept. of Education brokered a deal with Corinthian Colleges — the operator of for-profit school chains like WyoTech, Heald Colleges, and Everest — that would allow these programs to remain open while it faces numerous state and federal investigations, a dozen Senators have asked the Education Secretary to block continued enrollment at Corinthian-owned schools. [More]

For-Profit Corinthian Colleges To Sell Off Campuses, Phase Out Programs

Corinthian Colleges, the company that operates for-profit education chains like WyoTech, Everest, Heald Colleges, and others has been the subject of both state and federal investigations that have kept it from opening up any new campuses. Today, Corinthian announced it’s working on a deal with the U.S. Dept. of Education that would keep its schools operating while it sells off a number of campuses and phases out others. [More]

Report: States Have The Power To Rein In For-Profit Colleges, They Just Don’t Use It

The for-profit college industry has been widely criticized for spending a disproportionate amount of its money — much of it coming from federal student loans — on marketing while having a dropout and loan default rate that is much higher than non-profit schools. Is it possible to have for-profit schools that aren’t just student loan mills? [More]

Bank Of America Agrees To Scan For Illegal Payday Lenders In NY

Payday lending is illegal in more than a dozen states, including New York, but some lenders manage to fly under the radar by operating online or hiding their loans as part of another business. In an effort to crackdown on loans that violate state laws, New York has created a database for banks to use to help identify sketchy lenders, and Bank of America — no stranger to the issue of questionable loans — is the first to sign on. [More]

For-Profit Schools Are More Flexible & Convenient Than Community Colleges, But Can Land You In Debt Hell

Whether it’s for financial, academic or personal reasons, a traditional four-year college isn’t in the cards for everyone. Community colleges have long offered the opportunity for people to get started (or restart) their education without having to go into debt, so why have so many Americans recently opted for more expensive for-profit colleges that are regularly criticized for spending more on acquiring students than they do on teaching them? [More]

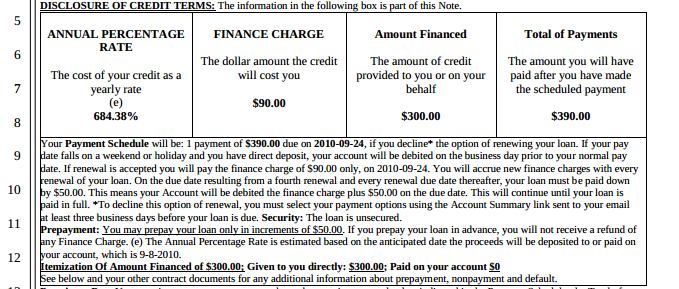

This Is One Of The Scammiest Payday Loans We’ve Ever Seen

Many payday loans have confusing terms and questionable fees that end up costing the borrower a lot more than they’d planned on when they took out the short-term loan. But it’s mind-boggling how one predatory lender managed to squeeze money from borrowers through an automatic opt-in renewal program that turns a $300 loan into $975 worth of payments in only a few months. [More]

SCOTUS Decision Proves States Have Power Over Payday Lenders Claiming Tribal Affiliation

While a U.S. Supreme Court decision yesterday in the case of a Michigan Native American tribe’s allegedly illegal casino appears to have nothing to do with payday lending, experts say it’s a game changer in states’ efforts to rein in the often predatory industry. [More]

CFPB Report Confirms Payday Lenders And Debt Collectors Are The Worst

For decades, payday lenders and debt collectors did their work while being largely ignored by federal financial regulators. And a new report from the Consumer Financial Protection Bureau, which recently gained oversight authority over the largest of these businesses, calls out many of the sketchy, sometimes illegal, practices some in these industries have been getting away with for far too long. [More]

FTC Shuts Down Texas Debt Collector Who Threatened To Arrest Consumers

Debt collection is a generally unsavory operation. Thankfully, there’s now one less scummy, lying collector calling consumers. A Houston-based company is out of business and must pay $1.4 million after being charged with unsavory practices. [More]

Your College Education Might Be A Better Investment For Goldman Sachs Than It Is For You

Americans have always viewed a college education as an investment in a student’s future, but there’s another sort of investment going on behind-the-scenes, and it’s nearly risk free. With access to a revolving door of prospective students and a continuous supply of federal aid, some colleges are turning hopes and dreams into big returns for Goldman Sachs and other investors. [More]

Payday Lenders Can’t Use Tribal Affiliation To Garnish Wages Without Court Order

For years, a handful of sketchy payday lenders have been using purported affiliations with tribal lands to try to skirt federal and state laws. But courts and regulators have recently been cracking down on these operations, saying that a tribal connection does not shield a business from prosecution. One operation facing charges from the Federal Trade Commission has now agreed to pay nearly $1 million in penalties over charges that it illegally garnished borrowers’ wages and wrongfully sued them in tribal courts. [More]

Proposed For-Profit College Watchdog Group Would Call Out Which Problem Schools To Avoid

For-profit colleges have been dominating the news cycle lately; from a newly proposed “gainful employment” rule to federal agencies suing schools for deceptive marketing tactics. The fight to rein in these sometimes predatory higher-education institutions doesn’t appear to be losing steam. Legislation proposed last week aims to improve the coordination between federal agencies that oversee the industry, while providing student with a list of unsavory schools. [More]

Believe It Or Not, Outlawing Payday Loans Will Not Lead To Looting & Pillaging

Critics of payday lending say the practice traps many borrowers in a debt spiral, forcing them to take out additional loans to pay back the first. Yet these short-term loans do have proponents (many of them profiting from the industry) who claim that without this pricey option for quick cash, desperate consumers will turn to more unsavory means, leading to increased crime rates and other doom and gloom predictions. But does that really happen? [More]

CFPB In “Late Stages” Of Working On Rules To Stop Predatory Payday Lending

Lisa took out a payday loan to help pay her rent. When she couldn’t repay the loan after 14 days she rolled it over, bringing her total debt to $800. After repaying more than $1,400, she remains stuck in the revolving door of debt associated with payday lending. It’s stories like these that the Consumer Financial Protection Bureau aims to stop with new rules to regulate the payday loan industry. But those in the payday industry say Lisa should have simply known better. [More]

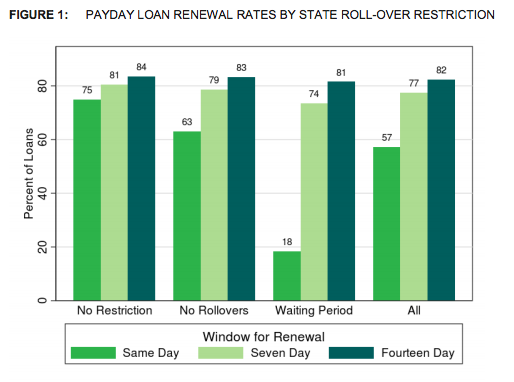

4 Out Of 5 Payday Loans Are Made To Consumers Caught In Debt Trap

The revolving door that is the payday lending debt trap is real. The high-interest, short-term loans may even be more damaging to consumers that previously thought. Four out of five payday loans are rolled over or renewed every 14 days by borrowers who end up paying more in fees than the amount of their original loan, a new Consumer Financial Protection Bureau report finds. [More]

Montana Consumers Win Fight Against Online Payday Lender, Loan Debt Will Be Forgiven

Montana consumers fill the winner’s column after winning a long-standing fight with the online payday lending industry. After three years of litigation, hundreds of hundreds of affected borrowers in the state will have their loans forgiven and receive their share of a $233,000 settlement. [More]