Hot on the heels of foreclosure and eviction freezes by GMAC/Ally, JPMorgan Chase and Bank of America, the Attorney General for the state of Texas has become the latest AG to request that loan servicing companies put a temporary halt to foreclosures. [More]

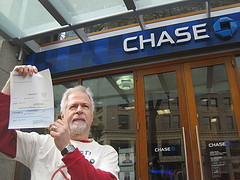

jpmorgan chase

JPMorgan Chase Suspends 56,000 Foreclosures

JPMorgan became the second major lender after GMAC/Ally Bank to halt pending foreclosures, halting proceedings on 56,000 homes. This follows revelations that “robo-signer” “foreclosure mills” were filing paperwork that would be gracious to call “sloppy,” at the rate of 10,000 a day. [More]

JPMorgan Chase Wants To Repay Bailout Money

JPMorgan Chase, Morgan Stanley and Goldman Sachs are seeking permission to repay government bailout funds, says Reuters.

Chase and Citi Shut Door On Mortgage Brokers

You’re cut off! JPMorgan Chase and Citi announced they’ll no longer accept mortgages submitted by mortgage brokers. The move seems to be a way for the banks to exercise more control over the loans they undertake. At first blush, this sounds like a good thing, for banks to be looking their borrowers in the eye, a throwback to the days when credit was earned instead of splooged out like candy in a parade (days epitomized in this 1950’s short, “The Wise Use of Credit,” posted inside…) On the other hand, it could be more just a way to snag market share and shut out the competition, which can lead to higher interest rates, borrowing costs, fees, and lower service.

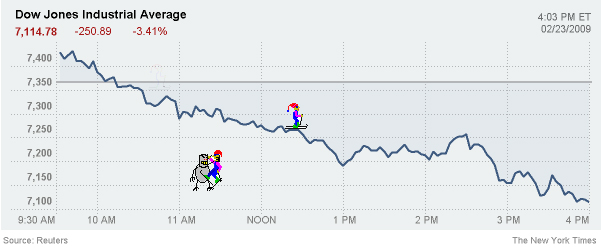

Freak Out Continues: Markets Close At Lowest Level Since 1997

Bad day on Wall Street today, folks. The S&P 500 closed at the lowest level since April 1997.

9 In 10 Executives At Bailed-Out Banks Kept Their Jobs

Over 100,000 people have been laid off by banks, but 9 in 10 executives at banks that accepted bailout money are still working says the Associated Press.

WaMu To Close 299 Branches, Many In Chicago

Chase has announced that they will be closing 299 branches, 57 of them in the Chicago-area alone. The Daily Herald says that most of the branches are across the street or down the block from existing Chase branches and consolidation is necessary. The remaining WaMu branches will be converted to the Chase brand.

JPMorgan Chase: WaMu Customers Should Bank As Usual

It’s official, WaMu customers are now JPMorgan Chase customers. In the interest of keeping you from pulling your money out, Chase has posted a FAQ for concerned WaMu customers that explains how the transition will take place. Most importantly, Chase says that if you bank at Chase and WaMu already — your accounts are still insured separately by the FDIC — for now.

JPMorgan Chase Accidentally Breaks Into Your House And Steals Everything You Own

Bobo and Joy Dickson bought a house had been headed for foreclosure, but JPMorgan Chase apparently didn’t get the message that the former owners had moved out and the new owners were in residence. So, naturally, they hired a firm to drill the Dickson’s locks and take everything they owned, including their food. Now JPMorgan Chase is “taking it seriously.”