For the third quarter in a row, the Treasury Dept. has released its report card detailing how the country’s largest mortgage servicers are doing with processing loan modifications. And for the third consecutive quarter, both Bank of America and JPMorgan Chase will not receive incentive payments from the Treasury because the banks are doing such a craptastic job at complying. [More]

jpmorgan chase

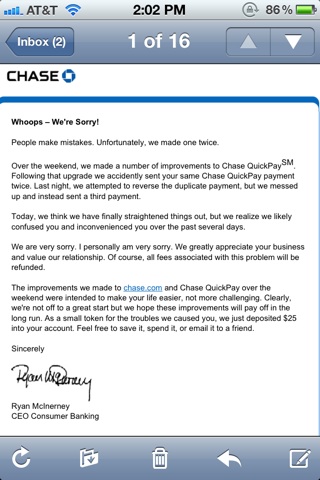

Chase Admits To Accidentally Deducting Payments Multiple Times

In the last few days, we’ve received a couple of e-mails from readers who were getting strange explanations from Chase about why automated payments had been deducted twice from their accounts. But before we could figure out what was going on, the bank has issued a “my bad” to affected customers, and thrown in $25 in “we’re sorry” cash. [More]

Chase Pulls Plug On Tests For Two New Fees

Like several of its fellow mega-banks, Chase has been testing out various new checking account fees in different regions of the country. But a pair of those tests have come to an end — and will hopefully never be seen again. [More]

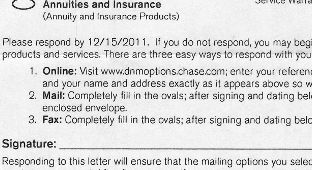

Chase Sends Letter To Non-Customers To Tell Them They Have To Opt Out Of Receiving More Unwanted Mail

It’s one thing to receive unwanted mail from a bank you don’t patronize. It’s another to receive a letter from that bank telling you that if you don’t reply to the letter, you’re opening the floodgates to even more unsolicited shredder-fodder. [More]

SunTrust Drops Monthly Debit Card Fee

With banks taking more and more heat from the banking public — and oodles of people reportedly switching accounts to more consumer-friendly credit unions — SunTrust announced today that it is eliminating the monthly debit card fee for Everyday Checking and will be refunding that fee to customers who have already paid. [More]

Bank Of America, Chase, Wells Fargo, Visa, MasterCard Sued Over ATM Fees

Have you ever glared angrily at the ATM, knowing that you’re going to be saddled with fees and wishing you could sue everyone involved? Well, it looks like more than one person has followed through on this idea. [More]

Chase Freezes Couple's Account, Screws Up Their Life, With No Explanation

A Washington state couple with tens of thousands of dollars in their Chase checking, savings and retirement accounts recently came home to find a letter from the bank telling them that, oh, by the way, your accounts are now frozen. [More]

Slew Of Foreclosed Homes To Hit The Market In Early 2012

Last year, several of the country’s largest mortgage servicers — Bank of America, GMAC/Ally, JPMorgan Chase, among others — were forced to hit the pause button on foreclosure procedures after it was revealed that many foreclosure documents were being rubber stamped by untrained, ill-informed “robo-signers.” This delay caused a bottleneck of foreclosure-worthy properties waiting to be reviewed. But now it looks like those homes are starting to trickle out into what could be a flood in early 2012. [More]

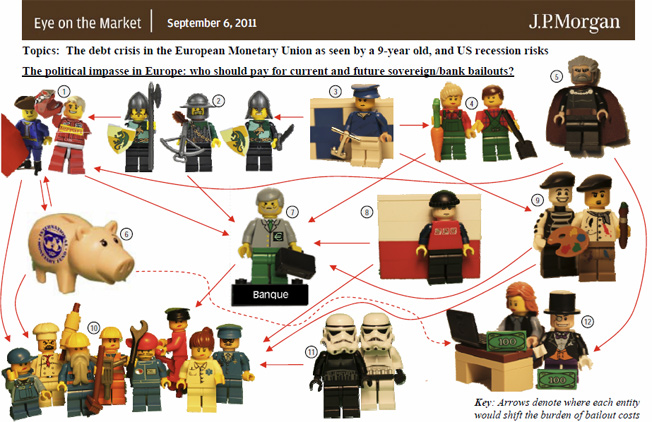

JP Morgan Explains Euro Debt Crisis With Legos. Really.

In order to explain the Euro debt crisis, Michael Cembalest, the Chief Investment Officer of JP Morgan’s private bank, sent around a research note that used Legos to depict the different players. The Legos were fashioned by his 9-year old son. This really happened. Here’s the legend to explain which parties each figure represents, or you can play a fun game and guess on your own first. [More]

Can You Access BofA & Chase Credit Card Account Info With Just 4-Digits And A Phone Number?

Last week, ConsumerWorld.org claimed that anyone could access credit card account info for Chase and Bank of America customers armed only with the customer’s phone number and the final four digits of their credit card. That’s certainly alarming, so MSNBC tested it out. [More]

Chase, Bank Of America, Citi & Wells Fargo Allowed To Start Foreclosing Again In New Jersey

It’s been a quiet 2011 on the foreclosure front in New Jersey, as several banks froze seizure proceedings late last year following the revelation that foreclosure documents were being rubber-stamped by untrained “robo signers.” But a judge in the Garden State has given the go-ahead for Bank of America, JPMorgan Chase, Citigroup and Wells Fargo to resume uncontested foreclosures. [More]

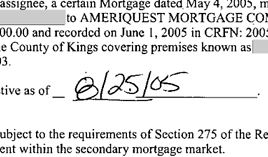

Paperwork Shows GMAC Created Fake Document To Foreclose On Property

Last summer, GMAC was looking to foreclose on a property here in Brooklyn. Only problem was, it didn’t have documentation proving that it actually owned the mortgage and the original lender, Ameriquest, couldn’t help because it had gone the way of the dodo a few years earlier. So what’s a mortgage servicer to do but fabricate the paperwork? [More]

Chase Wants To Alert You To Important New Policy Change… Four Days After It Goes Into Effect

Consumerist reader JP is a Chase customer who uses his debit card to pay for gas. Thankfully, the folks at Chase sent him this e-mail today explaining an important change to how the bank processes “pay at the pump” charges. Of course, it wasn’t important enough for Chase to actually send the e-mail before — or even a couple days after — the policy kicked in. [More]

Bank Of America's Bad Decisions Could Turn JPMorgan Chase Into Country's Biggest Bank

When Bank of America swooped in to save swooning Merill Lynch and Countrywide in 2008, it achieved its goal of becoming the largest bank in the U.S. Three years on, those same acquisitions could be dragging BofA into a second-place position behind JPMorgan Chase. [More]

Chase Says No To Credit Increase On One Card But Nearly Doubles Limit On Other Card Without Asking

The inner workings of Chase’s credit card business have Consumerist reader Jon scratching his head. After being turned down for small limit increase on one credit card, the bank goes ahead and nearly doubles the credit limit on a second card with an already higher limit. [More]

Bank Of America, Chase, Wells Fargo Penalized By Treasury For Really Sucking At Loan Modifications

Yesterday, the Treasury Department released a scorecard of just how well (and poorly) the largest mortgage servicers are doing at meeting certain benchmarks of its Making Home Affordable program. Not surprisingly, Bank of America, Wells Fargo and JPMorgan Chase — the three largest servicers — were called out for needing “substantial improvement,” meaning that the banks will not receive millions of dollars in federal incentives until they get their acts together. [More]