The first question that must be asked about any home office in order for it’s expenses to be deductible is, is the workspace used exclusively and regularly for business? The answer to both of these questions must be yes before any deduction can be taken. If the workspace is used for both business and personal use, then it is not deductible. Furthermore, the space must be used on a regular basis for business purposes; a space that is used only a few times a year will not be considered a home office by the IRS, even if the space is not used for anything else. These criteria will effectively disqualify many filers who try to claim this deduction but are unable to substantiate regular and exclusive home office use. It should be noted that it is not necessary to partition off the workspace in order to deduct it (although this may be helpful in the event you are audited.) A simple desk in the corner of a room can qualify as a workspace, provided you count only a reasonable amount of space around the desk when computing square footage.

IRS

../../../..//2008/01/21/as-of-january-11th-you/

As of January 11th, you can now start e-filing your taxes. Let the fun begin! [Bankrate]

Self-Employed? Here's How To Do Your Taxes

Being self-employed can be a source of personal satisfaction, but also headache, especially when it comes to doing one’s taxes. Fortunately, there’s an extremely lucid step-by-step guide posted over at E-How. They’ll walk you through everything you need to do, from determining your status, to your expenses and deductions. The guide points out important things to remember, like the extreme importance of using exact numbers when claiming deductions. Rounded numbers might be easier to add, but they’re also a red flag to IRS auditors (if you learn nothing else from Girls Gone Wild, let it be this).

../../../..//2008/01/19/more-audits-for-all-says/

More audits for all, says the IRS! Especially the rich. 1 out of every 11 millionaires was audited in 2007. The rest of us earning less than $100,000 had only a 1 in 100 chance of receiving the Torquemada treatment. [Mercury News]

Get Basic Tax Info With Publication 17

Are you totally clueless about your taxes? Don’t worry, the government is here to help! The IRS puts out a 300-page document called Publication 17. It can serve as a getting started guide for doing your taxes and answer questions like what to do when you have a baby, retire, or sell stock. Pub 17 also covers some of the new changes in store for 2008, like the expiring capital gains tax, IRA deduction increases, changes to child’s investment income, and ever so much more. No, you don’t have to read the whole darn thing. It’s a PDF so you can search for specific keywords and phrases. If you’re doing your taxes yourself and have some basic questions you need answering, Pub 17 is a good place to start.

$800-$1600 Rebates Expected In Bush Stimulus Plan

It looks like Bush’s economic stimulus package is going to take the form of instant cash bonuses: $800 for individuals and $1600 for married couples. That’s dumb, everyone should get Costco coupons! All kidding aside, the NYT says the ~$500 rebates granted after the 2001 recessions proved “surprisingly effective…people spent most of the money rather than salting it away in savings or using it to pay down credit card debt. A 2004 study by economists at the Department of Labor, Princeton University, and the University of Pennsylvania found that households spent between 20 and 40 percent of the rebate within three months and another third in the following three months.” Will this “wealth surge” be just what the countries needs to beat back the forces of recession holed up in our economy, terrorizing our financial well-being? Bring on Operation Cash Dump.

Stay Away From Tax Refund Anticipation Loans

I saw a big billboard for Jackson Hewitt showing a broadly smiling woman of indeterminate ethnicity holding a fistful of money that she just got by getting a refund anticipation loan, and it reminded me of how we need to do our annual telling of people to once again stay away from said refund anticipation loans.

../../../..//2008/01/10/if-youre-looking-to-invest/

If you’re looking to invest in mutual funds and avoid capital gains tax, Vanguard Tax Managed International Fund (VTMGX) and Third Avenue Value Fund (TAVFX) are recommended as funds to look into, along with index funds and ETFs (exchange traded funds) in general. [WSJ]

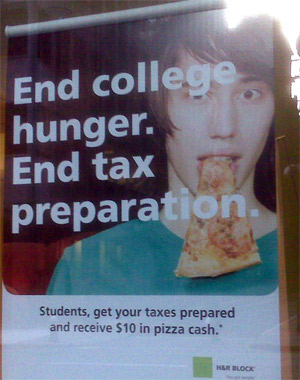

H&R Block Lures College Students With $10 In "Pizza Cash"

Kevin sent in this ad for H&R Block trying to market to college kids by giving them $10 in “pizza cash” if you file through H&R Block. This sounds tasty, except that due to their low income, most college kids won’t have to pay any taxes and it’s pretty easy to do with FreeFile through the IRS.gov website, for free, natch. But file through H&R Block and you’ll probably be paying at least $60. So, you could buy yourself $10 of pizza, or pay $50+ for H&R Block pizza. They still teach math in college, right?

Last Chance To Donate Money In 2007

Today represents your final opportunity to donate money to charity for tax year 2007! CharityNavigator has some tips for holiday giving, and of course, you’ll want to brush up on the tax implications of your generosity.

TSA Declares Victory, Achieves Same Vaunted Status As IRS

The IRS is celebrating the results of an AP poll that ranks the TSA as the most hated arm of the federal government. More than anything, Americans apparently hate being inconvenienced by seemingly pointless and arbitrary security checks.

The AP poll, conducted Monday through Wednesday, found that the more people travel, the less they like TSA.

Congress Postpones AMT Expansion For One Year

Today, Congress approved a one-year postponement of the Alternative Minimum Tax, which is good news for an estimated 25 million Americans (mostly middle-class) who would have qualified for it this year. The IRS said that due to the last-minute nature of the change, some refunds may be delayed: “Changes in the tax code require substantial work, especially in reprogramming I.R.S. computers.” The IRS says that “within 72 hours it would post on its Web site revisions to a dozen forms affected by the change.”

../../../..//2007/12/07/more-end-of-the-year/

More end of the year tax tips, this time from Bankrate. [Bankrate]

Find Out What Your IRS Refund Will Be

What’s your tax refund for 2007 going to look like? Go to this withholding calculator at the IRS website with your paycheck at your side, answer the questions, and they’ll give you a good estimate of what your refund will be. They will also give you suggestions for changing your withholdings.

The IRS Has $110 Million In Refund Checks For You

If you’ve moved recently and did not get your refund check, you might want to contact the IRS and see if it was returned as undeliverable.

../../../..//2007/11/26/4-ways-for-small-business-owners/

4 ways for small-business owners to save on next year’s taxes. [WSJ]

../../../..//2007/11/15/are-companies-that-offer-free/

Are companies that offer free e-filing of IRS tax returns, linked from the IRS website, actually charging customers? [6abc]

House Passes AMT Fix

The House voted 216-193 on Friday to keep 21 million middle-class taxpayers from paying the alternative minimum tax (AMT) next year. Republicans opposed the measure because the bill is funded by raising the tax on carried interest, paid exclusively by investment bankers, from 15% to 35%.

Friday’s bill would extend AMT relief for one year, at a cost of about $51 billion. It includes another $30 billion in largely popular tax relief measures, including expanding the child tax credit, providing a property tax deduction to some 30 million families and extending a tax exemption for the combat pay of military personnel.