Eric writes:

You’ve had a lot of press about the stimulus plan that’s about to send some cash my way. There’s been coverage all over the place, and everyone misses the most important part. What, EXACTLY, do I have to do to get this credit? I know I qualify. Do I have to send in an extra form? Is there a box I check? Am I supposed to expect the gov’t to actually do something right and take care of it themselves?

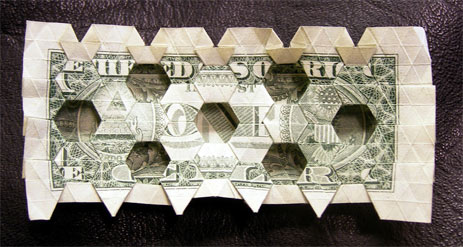

Yes. This is (probably) the easiest $600 you will ever made. Just file your taxes, sit back, and wait for the hot government scrizzle to come pouring into your mailbox.