The IRS is warning consumers of a new email scam going around posing as the IRS and soliciting donations for the California wildfire victims.

IRS

IRS Grants Tax Relief To California Wildfire Victims

The IRS is extending deadlines for those of you within the Presidental Disaster Area caused by the wildfires.

Taxpayers in the Presidential Disaster Area — consisting of Los Angeles, Orange, Riverside, San Bernardino, San Diego, Santa Barbara and Ventura counties — will have until Jan. 31, 2008, to file returns, pay taxes and perform other time-sensitive acts.

13,000 People Are Getting A Surprise Audit!

13,000 lucky Americans will soon receive letters from the IRS explaining that they’ve been selected for a random audit. The hapless participants are rounded up as part of the IRS’ National Research Program, which seeks to explain why the Treasury receives $300 billion less than we Americans collectively owe. A random audit is nothing to fear unless you are a tax cheating yutz.

IRS Struggles To Give Away $8 Billion

Free money! Free money! We shouted, begged, implored you to take the free money that was rightfully yours, but no, you would have none of it. The free money was too good for you. Too much effort, you said, to fill out a simple line on your tax return to celebrate phone ownership and our victory in the Spanish-American War. And now, $8 billion beautiful bucks lie cluttering our treasury, taking up valuable space needed for Social Security IOUs.

../../../..//2007/10/09/dont-withhold-more-taxes-than/

Don’t withhold more taxes than necessary, you could be missing out on valuable interest earnings. [Kiplinger]

IRS Launches Special Website Section For People Facing Foreclosure

The IRS has launched a special section of its website aimed at helping people who are facing foreclosure navigate the tax issues that surround debt forgiveness.

Attention All Coaches: Belichick's Cheating Is A Business Expense

According to the WSJ Law Blog, the common consensus is that Patriots coach Bill Belichick will be able to deduct his $500,000 cheating fine as an “ordinary and necessary business expense.” Hooray?

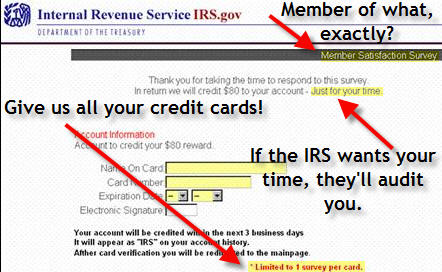

IRS Still Warning People About Email Phishing Scams

The new IRS email phishing scam involves a fake customer satisfaction survey that asks for sensitive personal information such as your SSN, bank account numbers, credit card numbers, and even the security code from the back of the card.

Now In Churches: ATMs!

Churches are stocking up on ATMs thanks to a new IRS rule that requires taxpayers to closely document their charitable giving. By placing an ATM in the lobby, congregants can collect a paper trail, and churches can collect tithings. It’s win-win. According to Time, the practice isn’t new:

Large urban churches have been accepting credit cards for several years, tapping into the Generation P (for Plastic) aversion to carrying cash. Pastors like to tell jokes about parishioners collecting Frequent Flier points on the way to heaven. A recent Dallas Morning News poll found that 55% of 200 local churches accept credit and/or debit cards.

Please Don't Ask IRS Agents To Change Their User Name Or Password

If you ask nicely, thoughtless, gullible, IRS agents are willing to give you their user name and change their password, according to a recent report from the Treasury Inspector General. The report condemns our tax collectors for failing to observe the most basic security measures, despite recent entreaties for employees to be extra vigilant about protecting sensitive taxpayer data. From the AP:

- “Only eight of the 102 employees contacted either the inspector general’s office or IRS security offices to validate the legitimacy of the caller.

Forgot To Claim The Telephone Tax Refund? File An Amended Return.

We know it’s summer and you don’t want to think about taxes, but the IRS really wants to make sure you got that telephone tax refund, so they’re asking you to file an amended return if you forgot to claim it. With the money you’ll get you can buy lots of baseball hat cup sundaes!

It Takes 192 Days to Pay for Government Spending and Regulations

Seems like a huge burden to bear, huh? But like everything else, there are two sides to the story, as CNN Money reports :

Pay Your Taxes Or The Government Will Cut Power, Internet, Phone, Television, And Mail Service To Your Compound

You know those kooks who go around not paying their taxes and saying there’s no law to make them? Well, a pair of tax-evading renegades in New Hampshire are finding out the hard way that tax evasion can lead to an armed standoff with federal agents. Ed and Elaine Brown of New Hampshire haven’t paid income taxes since 1996, despite being convicted in January of evading taxes on almost $2 million of income generated by Elaine’s dental practice. The pair have cloistered themselves inside a 110 acre compound where they enjoy the glorified lives of tax fugitives. From the LA Times:

Man Dodges Taxes For 10 Years, Wins In Federal District Court

You know those kooks who go around not paying their taxes and saying there’s no law to make them? Well, one of them just won.

Back-To-School State Sales Tax Holidays

Just in time for back to school, Raising4Boys has posted a list of which states have state sales tax holidays. He lists when they occur, what goods are applicable, and if there’ s a maximum dollar amount. We’ve always found that state-sales-tax-free white glue is better for peeling off your hands…

../../../..//2007/07/03/starting-2008-kids-making-more/

Starting 2008, kids making more money off investments are subject to higher taxes.

IRS Fails Audit: Free File "Did Not Always Accurately Compute Taxes"

A Treasury Department audit found that Free File users with kids may have missed out on several significant tax credits. Free File allows “low-income” Americans – taxpayers making under $52,000 per year – to file their taxes for free. The audit discovered that the program’s online affiliates “could not handle simple returns,” resulting in the following failures:

Make More Money By Adjusting Your Witholdings

Why give the IRS an interest-free loan throughout the year? Instead, boost your monthly earnings by changing the amount of withholdings you claim. Kiplinger offers an easy 3-question calculator to help you figure out the right number.