The central bank of Iceland has increased overnight borrowing rates to 15.5%, meaning you can get some damn high yields investing in their currency. Those numbers piqued my interest.

investing

5 Signs That It's Time To Fire Your Financial Planner

Just because an angry bear market is mauling your portfolio doesn’t necessarily mean that it’s time to fire your financial planner. But you may want to break out the axe at the sight of the following five warning signs…

Oil Prices Drop, Sadly

The price of oil dropped $2.19 today, to $117.91, spurring a stock market and dollar rally. Sounds like good news. Except that it’s dropping because the market thinks more people won’t be able to afford to drive their cars as much. Who’s up for a “staycation?”

Personal Finance Roundup

The Promotion That Got Away: 5 Ways to Bounce Back [Yahoo HotJobs] “Nearly everyone has been passed over for a job they ‘deserved.’ If and when that happens there are five important steps to take.”

Why You're Going To Need A Million Bucks To Retire

Over at ABC News columnist David McPherson is responding to some reader backlash stemming from an article in which he used an example of somebody retiring with $500,000 in an IRA. The readers accused him of being out of touch with reality. Well, rather than apologize, he’s upped the ante. Now he says you’ll need $1 million to retire.

Personal Finance Roundup

Seven Websites That Saved Me Money in the Last Week [The Simple Dollar] “Here are seven websites I used to directly save money over the last week, my exact purchases and savings, and how much cash they saved me.”

S&P 500 Enters Bear Market

Since the Dow made it look so fun, the S&P today dipped into its first official bear market since 2002. A bear market is usually defined as a 20% drop in securities prices from their high (Not a hard feat when the financials were hyped up on imaginary money from worthless mortgages). Is it time to sell, sell, sell? Not unless you’re retiring tomorrow, tomorrow, tomorrow. Investopedia says the best thing to do when you see a bear in the market is the same as when you see one in the woods: “Tuck in your arms and play dead!” In other words, don’t go crazy selling stocks at a loss. In both cases, fighting back can leave you bleeding, although toughing it out won’t be a pleasant experience either. And if you have money leftover after filling up your car, it’s actually a buying opportunity. Which I guess is like playing dead in front of the momma bear while your buddy gathers up all the cubs while mamma is occupied and then later you and your buddy train them to harvest honeycombs for you.

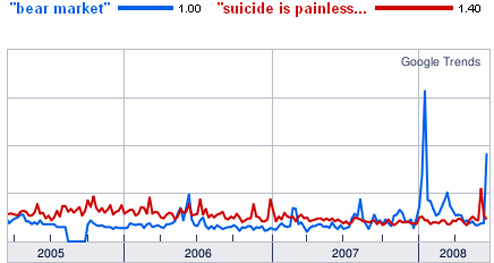

Dow Enters Bear Market

Finally having lost over 20% from its October high, the Dow has entered into a bear market. An unrelated story about an investor-fleecing hedge fund manager who tried to make his disappearance prior to his incarceration look like he took his own life provides context in a Google Trends graph.

Personal Finance Roundup

9 big credit card myths [MSN Money] “What you don’t know could hurt you.”

../../../..//2008/06/18/is-a-commodity-bubble-the/

Is a commodity bubble the new housing bubble? [NPR]

Your Complete Portfolio in Only Seven Investments

It’s almost part of human nature to make investing more complicated than it needs to be. Seemingly endless investment options, elaborate tax shelters, real estate “no money down” programs and the like certainly muddy the investment landscape. But CNN Money has taken the opposite view and attempted to simplify a model portfolio into a list of only seven basic investments…

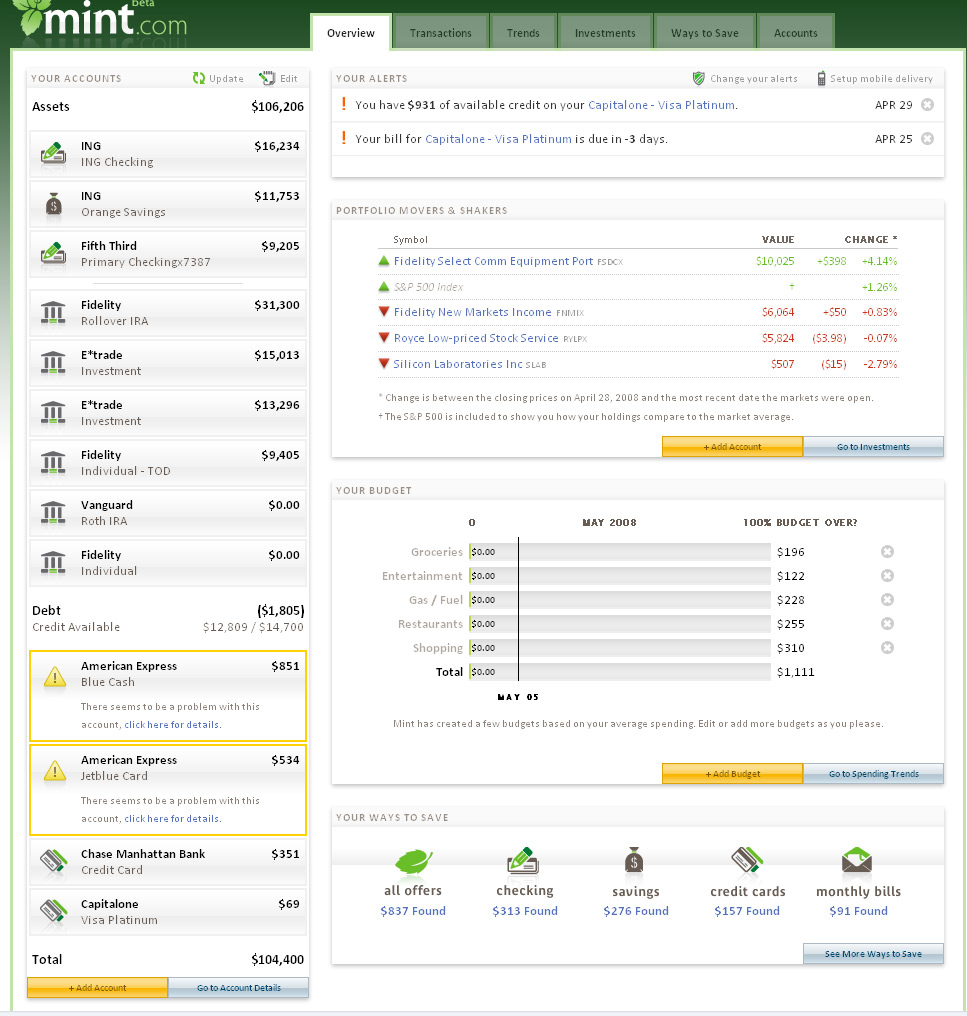

Mint.com's Plans For Portfolio Recommendations

I asked Mint.com whether they would be adding some features to their new investment tracking tool similar to what they do with credit cards and banks. When you add your credit cards and banks to Mint, it has a section where they recommend different credit cards to switch to and show you how much savings or lower APR you can get. In response, CEO Aaron Patzer said that in the future they will identify the lowest cost brokerage for you based on how often you trade and with how much money, as well as, and, this is very important, exposing management fees and expense ratios.Very cool. Investors could really benefit by such transparent access to investing-rleated feesFor a good perspective on how fees can really chew up your nest egg, read our post, “How Your 401(k) Is Ripping You Off“

Review Of Mint.com's New Investment-Tracking Features

I got to check out personal finance management site Mint.com’s new investment-tracking component before the private beta launches tomorrow. You can now add Brokerage, IRA, 401k and 529 assets. The two biggest things it offers are line graphs, and a way to see all the fees, dividends, deposits and withdrawals in one, clear, organized window. Unlike with the credit card tracking, they don’t seem to be making any suggestions about how you might save money by switching to a different investment firm. You also can’t yet push assets between accounts through Mint. As before, you will have to give up your username and password to your various financial services to let Mint scrape the data. The new brokerage features are hardly mind-blowing, but by having investment-tracking now Mint can basically be your entire financial dashboard, you just can’t touch all the levers yet. Sexy screenshots, inside…

../../../..//2008/05/02/personal-finance-management-site-mintcom/

Personal finance management site Mint.com is launching a beta for its new investment tracking system on May 6th. [Mint]

../../../..//2008/04/29/the-33-biggest-corporate-implosions/

The 33 biggest corporate implosions of all time. We like that they included The South Sea Company, whose stock price collapsed after reaching an artificially inflated peak in the 1720. It was called the “South Sea Bubble” and its collapse sent many investors, who had purchased the stock on credit, into bankruptcy. [HR World]

Real Estate Speculation: From A Trailer Park To Foreclosure On 4 Homes

The Minneapolis Star-Tribune has a fascinating article about real estate speculation in Minnesota. The article focuses on Bradley and Sarah Collin, a couple with three children who were living in a trailer park when they were suckered by a local “property management company” that (illegally) paid the couple $20,000 cash to buy 4 houses in a new subdivision.

../../../..//2008/04/17/what-recession-hedge-fund-managers/

What recession? Hedge fund managers are still making billions a year. [Reuters]

Dateline Investigates Shady Annuity Salesmen Targeting Seniors

Dateline did a hidden camera investigation into the world of shady annuity salesmen targeting seniors and playing on their emotions to lock their life savings away in funds they may never live to receive the benefit from, or pay stiff penalties, not disclosed in the sales pitch, for early withdrawal. In this clip, Dateline producers attended “Annuity University,” a two-day session run by Tyrone Clark to teach them how to sell to elders. He settled with the state of Massachusetts after he published a sales pamphlet that told salespeople to treat seniors “like they were selling to a twelve year old” and to hit their “fear, anger, and greed buttons” to make the sale. He also sells questionable self-promotional tools and services. In one of them, a fake radio guy will call up the salesperson and interview them like they’re a financial expert on the radio. The session is recorded and the salesman gets CDs to pass out, so they can pass themselves off as legitimate financial advisers. Video, inside…