../../../..//2007/09/28/buoyed-by-the-fed-rate/

Buoyed by the Fed rate cut and hope for another, indexes near July’s record levels. [NYT]

Thanks for visiting Consumerist.com. As of October 2017, Consumerist is no longer producing new content, but feel free to browse through our archives. Here you can find 12 years worth of articles on everything from how to avoid dodgy scams to writing an effective complaint letter. Check out some of our greatest hits below, explore the categories listed on the left-hand side of the page, or head to CR.org for ratings, reviews, and consumer news.

../../../..//2007/09/28/buoyed-by-the-fed-rate/

Buoyed by the Fed rate cut and hope for another, indexes near July’s record levels. [NYT]

../../../..//2007/09/20/on-monday-we-reported-that/

On Monday, we reported that TD Ameritrade knew since May 2007 about data breaches that resulted in thousands of its customers getting penny stock spam, but it turns out the breach could have happened as early as November 2005. [Network World]

Been looking over your portfolio and noticing a bit of this, some of that, and a touch of whatever else you could find? Us too. If your portfolio looks more like a stamp collection — filled with one of everything — then consider simplifying your strategy. It will not only make your money easier to manage, but will also benefit your bottom line, according to CNN Money. They suggest a simple, two-part strategy for maximizing your investment returns…

USAToday is reporting that US stock funds, once the darling of investors, aren’t drawing dollars like they used to.

Does higher customer satisfaction lead to better stock performance?

../../../..//2007/09/05/historically-september-is-the-worst/

Historically, September is the worst month for the S&P 500. Now we don’t feel so bad about our portfolio. [All Financial Matters]

Walmart share price falls after Merril-Lynch downgrades stocks to “sell” from “neutral.” In a note to clients, a Merril analyst cited shrinking profit margins as a concern for the retailer. This would be the first time in 2007 the stock has been marked as sell.

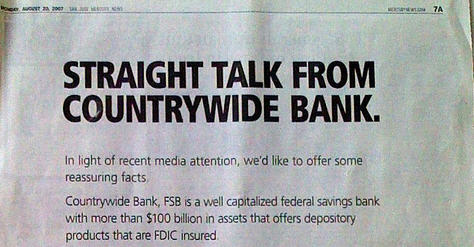

The New York Times has a very interesting article about the business practices that resulted in Countrywide’s dramatic spiral into the dirt. Recently, the nation’s largest mortgage lender had to tap $11.5 billion in emergency credit and was the beneficiary of a $2 billion investment bailout from Bank of America.

Leo at Zen Habits has listed 10 ideas for living without a credit card or any debt.

Meet the subprime mortgage meltdown’s other victim, a millionaire mortgage investor who has been forced to put his yacht up for sale—for $23.5 million.

The lump sum payout is, for most winners, the best choice. You know the tax consequences, you know the lump sum payout and you often have the opportunity to invest the proceeds to earn more than you could with the guaranteed return from the annuity payments.

Good to know. Now we just have to concentrate on the numbers… the numbers…

../../../..//2007/07/20/warren-buffet-likes-index-funds/

Warren Buffet likes index funds. [Bankrate]

As far as our novice eyes can tell, this transaction chart, found at thewallstreetbully, demonstrates the concept we posted last week of buying low and selling high within a single investment over time.

Money has a new column written by an anonymous financial planner (and you know how much we love that sort of sh*t), who says that if your financial planner is honest, he or she will tell you how you’re making them money.

We’ve been reading this weekend’s New York Times mutual funds report sitting on our kitchen table a little bit at a time for breakfast and something we saw in, “Don’t Pay Tax Twice On Your Fund Gains” changed how we thought about the old adage of “Buy Low, Sell High.”

We were discussing expanding our mutual fund portfolio (not hard, as it only contains ONE fund right now) with our step-father and mentioned adding in some international and European funds.

Want to know the one tip that will make you a successful investor? No, this isn’t a sales pitch for some get-rich-quick stock trading program. It’s a bit of good investing advice from Business Week on the factor that most separates excellent investors from average Joes.

![]()

Part of ![]()

Founded in 2005, Consumerist® is an independent source of consumer news and information published by Consumer Reports.