Another factor to consider when choosing a mutual fund are its 12b-1 fees, which are basically money the fund managers take out to pay for running and marketing the fund.

investing

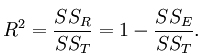

What Is R-Squared?

We’re trying to learn more about mutual funds, which we find quite frightening, so let’s start by breaking down some terms, like R-squared, a measure of volatility. Here’s what Vanguard says:

../../../..//2007/07/05/inflation-eats-up-most-of/

Inflation eats up most of the appeal of zero-coupon bonds.

../../../..//2007/07/03/starting-2008-kids-making-more/

Starting 2008, kids making more money off investments are subject to higher taxes.

Pending Home Resales Drop To Lowest Level Since September 2001

Pending sales of existing homes dropped for the third straight month as troubles in the mortgage industry continue to disrupt the housing market. Figures released today show a 3.5% drop in May, following April’s drop of 3.2% and March’s drop of 4.5%.

30 Free Personal Finance eBooks

Mint has collated a collection of thirty free ebooks on personal finance and money management. The selection ranges from budgets to credit cards to mortgages to general consumer advice. Each one is in PDF format. Check ’em out and get your learn on.

7 Common Mental Money Mistakes

WSJ round up seven mind games people play that can have them short-changing their personal finances.

IRS: 10 Reasons To Put Off Saving For Retirement

Maybe I won’t live long enough to retire. Life is so uncertain. Why should I miss out on the high life now when I might not even need to have money put aside for my old age? (If married, change pronouns in this reason to the plural.)

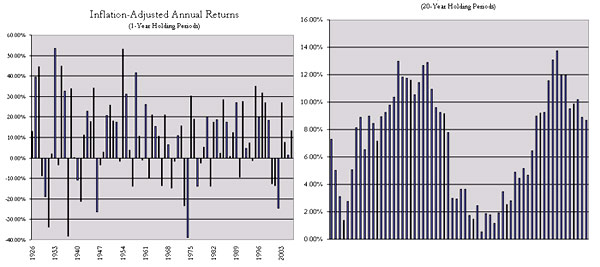

Don't Want To Lose Money In The Stock Market? Buy And Hold For 20 Years

The longer you hold stocks, the better your inflation adjusted returns are, AllFinancialMatters demonstrates. For instance, compare the S&P 500 Annual Real Returns from 1926-2006 with a 1-year holding period vs a 20-year in the picture above.

What Are "Expense Ratios?"

For the new investor considering mutual funds, one important comparison basis is their expense ratio.

How To Pick A Financial Planner

Let’s say you’re the kind that can make money but don’t know what to do with it once it’s yours. Or perhaps you know a bit about personal finance but need some help on the more complicated matters associated with managing your money. Or maybe you don’t want a thing to do with handling your finances — you simply want to turn them over to someone else. In all of these cases (and several others you can likely imagine), you may be in the market for a financial adviser. But the world of financial planners is full of sharks, say CNNMoney and USAToday:

In most states, anyone can call themselves a financial adviser, even if they don’t have any training.

So how do you pick a financial planner who knows what she’s doing and who won’t rip you off by only working to turn your money into her money? A couple thoughts…

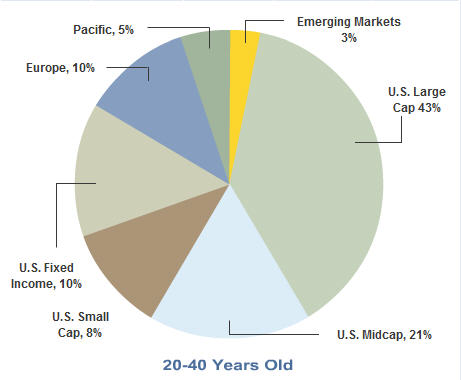

You Have Assets, Time To Allocate Them

Bankrate has some nifty pie charts that show you how you should be allocating your retirement investments at different age groups. How you allocate your assets determines the risk in your portfolio. Of course, you don’t have to take these suggestions, your level of risk should reflect your tolerance for it. —MEGHANN MARCO

Comparing Index ETFs and Mutual Funds

We understand that investing in index exchange trade funds (ETF) can be a good option for beginning investors, but what if you’re also looking at mutual funds, and you want to compare purchase costs between the two?

What Is Dollar-Cost Averaging And Why Is It Bunk?

Dollar cost averaging (DCA) is a method of investing whereby you spend a fixed amount on a stock per month, regardless of price.

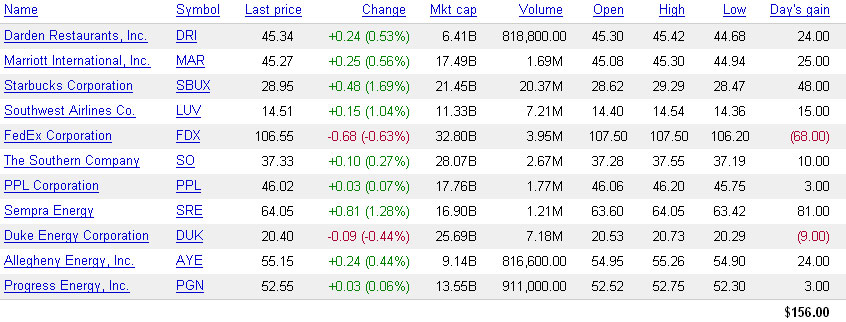

The Consumerist ACSI Fund v2.0

Based on your suggestions, we redid The Consumerist ACSI fund mock portfolio. We changed it from 100 shares to $1000 worth of each company, rounded down to whole shares. This way the highest stocks won’t have an undue influence on the portfolio’s performance.

The Consumerist ACSI Fund

We made a mock portfolio buying 100 shares of companies scoring high on the American Customer Satisfaction Index (ACSI).

Mo' Money, Mo' Problems

• What Do You Look For In An Online Bank Account? [Money, Matter, and More Musings] High interest rates, easy synchronization with other bank accounts, absolutely zero fees and seven other factors you should consider when selecting an online bank account.

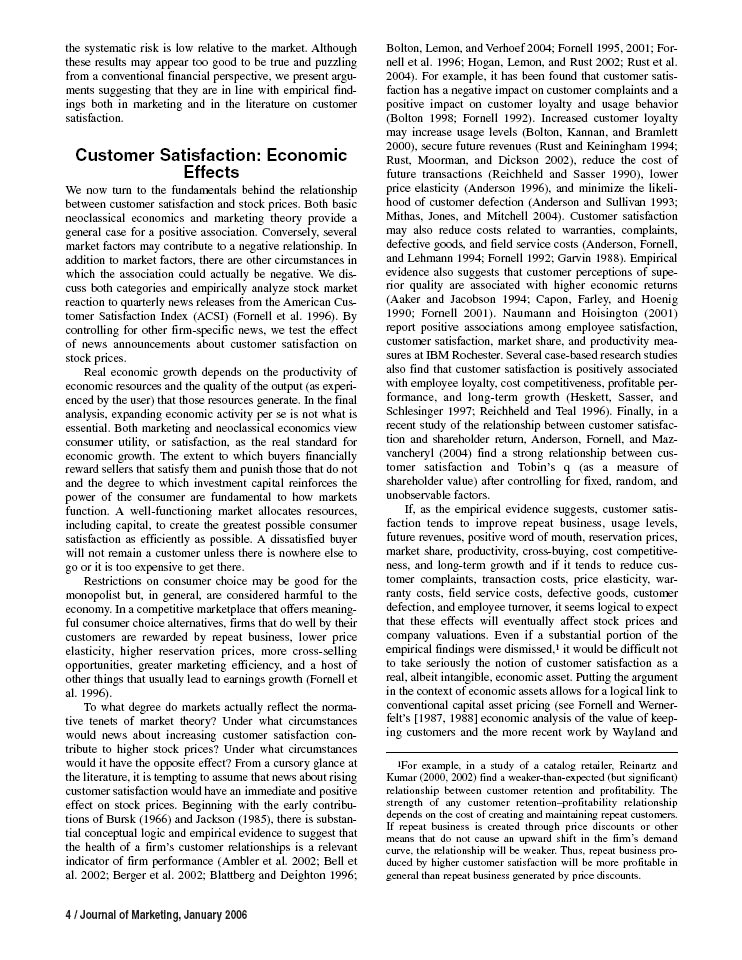

How To Beat The Stock Market: Buy Companies With High Customer Satisfaction Scores

Using a back-tested paper portfolio and an actual case, the authors of a study published in the Journal of Marketing found that companies at the top 20% of the the American Customer Satisfaction Index (ACSI) greatly outperformed the the stock market, generating a 40% return.