../../../..//2007/12/06/how-to-calculate-compound-growth/

How to calculate compound growth in Excel using the RATE function. [AllFinancialMatters]

Thanks for visiting Consumerist.com. As of October 2017, Consumerist is no longer producing new content, but feel free to browse through our archives. Here you can find 12 years worth of articles on everything from how to avoid dodgy scams to writing an effective complaint letter. Check out some of our greatest hits below, explore the categories listed on the left-hand side of the page, or head to CR.org for ratings, reviews, and consumer news.

../../../..//2007/12/06/how-to-calculate-compound-growth/

How to calculate compound growth in Excel using the RATE function. [AllFinancialMatters]

Yesterday Comcast lowered its growth expectations for 2008—not by much but down from 12% to 11% for the year. This morning at a media conference, Comcast’s CFO Michael Angelakis cited a “challenging economic and competitive environment,” with companies like Verizon and AT&T poaching its video customers to their new services. Oh, and also because nobody wants to be a Comcast customer unless it’s the only game in town.

../../../..//2007/11/28/stocks-jumped-after-the-fed/

Stocks jumped after the Fed hinted at further interest rate cuts. [AP]

../../../..//2007/11/28/thinking-of-selling-a-mutual/

Thinking of selling a mutual fund soon? You might get tax savings if you do it before the year-end distributions. [Kiplinger]

../../../..//2007/11/27/turbulence-consumer-confidence-drops-to/

Turbulence: Consumer confidence drops to 2-year low. Home prices drop the sharpest they’ve ever dropped. Stocks fall 10%.

Consumers can be cued to spend more through a series of simple “priming” questions. A study in the Journal of Consumer Research split subjects into two groups. One was asked a series of questions about the contents of their wallets: Did they have any library cards? Did they carry pictures or cash? How many other wallets did they own? The other was asked about their financial portfolio.

Okay, so Jack Hough’s column in SmartMoney this week is really just an extended ad for his new book. But in this case, the content of the book is something valuable that we think a lot of Consumerist readers will want to know about: how to identify reliable stock picking strategies.

Here’s 5 common myths people tell themselves that can end up bungling their retirement savings plan, cribbed from the Autumn issue of the Vanguard market report.

../../../..//2007/11/12/if-you-arent-willing-to/

“If you aren’t willing to own a stock for ten years, don’t even think about owning it for ten minutes.” – Warren Buffet. [via Money Crashers]

We didn’t know about this (possibly because we have enough interesting email to read without bothering with spam), but apparently the new cool thing is to send MP3 spam.

The sad news is that 1 in 3 lottery winners are in serious financial trouble or even bankrupt within 5 years. Why? The suddenly wealthy often never learn to manage their money.

A lot of financial advisors have suggested investing in gold lately, since the U.S. economy seems headed for the crapper and gold tends to increase in value as the dollar plummets. And a lot of people seem to be following that advice, because gold is up above $750 an ounce now, “its highest level since 1980,” says SmartMoney. But gold investments can change value quickly and can be even more difficult to predict than regular investments, so don’t go all Scrooge McDuck on the gold hoarding.

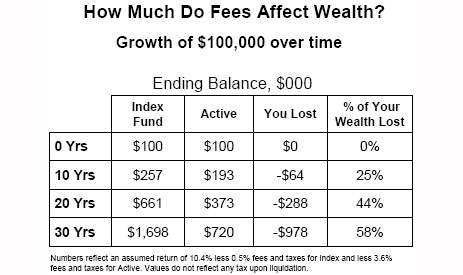

“Guide to Transparent Investing” is a 53 page PDF about how financial advisers are ripoffs and you can do all your investing by putting your money in index funds. The basic principles they promote are to figure out how long you want to invest for, pick a portfolio based on your timeline and risk tolerance, and put the money in index funds. Set it, forget it, and spend more time doing the important things in life, like gardening and getting your scuba diving certification.

Citigroup, Bank of America and JPMorgan Chase are joining forces to create a fund that will buy the debt from their mortgage-backed securities. The new group, assembled at the urging of the benevolent and mysterious Dr. Treasury Department, call themselves The Super Bank Friends. Their undying quest: fighting together to prevent the credit market from collapsing and creating a rift in the space-time continuum that would transport America back to 1929.

Wall Street’s relentless drive for short-term profit is ruining corporate America and the consumer experience, according to John Bogle, founder of the Vanguard Group. The overseer of one of the world’s largest mutual funds appeared on Bill Moyers Journal to discuss a New York Times investigation that revealed substandard care at nursing homes owned by investment firms. According to Bogle, the trend is not contained, and has dire long-term consequences:

The financial sector of our economy is the largest profit-making sector in America. Our financial services companies make more money than our energy companies — no mean profitable business in this day and age. Plus, our healthcare companies. They make almost twice as much as our technology companies, twice as much as our manufacturing companies. We’ve become a financial economy which has overwhelmed the productive economy to the detriment of investors and the detriment ultimately of our society.

The SEC doesn’t like stock spam. They’ve suspended trading in three companies as part of an anti-spam initiative, meant to deter e-mail campaigns that defraud investors.

Citibank is warning investors to expect a 60% drop in earnings due to “dislocations in the mortgage-backed securities and credit markets, and deterioration in the consumer credit environment.”

![]()

Part of ![]()

Founded in 2005, Consumerist® is an independent source of consumer news and information published by Consumer Reports.