Chieftain Capital Management Inc., owns 2% of Comcast (about 60 million shares) and is unhappy with the way its investment has been performing. They’re calling the management tenure of CEO Brian “Bad Install” Roberts a “Comcastrophe,” a term that might just good enough to be Mr. Robert’s new official Consumerist nickname. Brian “Comcastrophe” Roberts. We like it.

investing

../../../..//2008/01/18/heres-10-top-questions-frequently/

Here’s 10 top questions frequently asked about starting a Roth IRA. Don’t have one? Why not? They’re a great no-brainer way to save for retirement. [Yahoo! Finance via Money Crashers]

../../../..//2008/01/18/in-the-first-cost-cutting-move/

In the first cost-cutting move by new Sprint CEO Dan Hesse, 4,000 jobs were cut. Its stock subsequently sunk 26% to a new 52-week low of $8.56. Wall Street is overreacting, we have this feeling in our heart of hearts that Hesse can turn things around. [Reuters]

Who Wasn't Investing In Subprime Mortgages?

The money transfer services provider’s stock lost half its value Jan. 15 after the company disclosed a plan to recapitalize its balance sheet that depends on its ability to shed its risky loan portfolio.

../../../..//2008/01/10/if-youre-looking-to-invest/

If you’re looking to invest in mutual funds and avoid capital gains tax, Vanguard Tax Managed International Fund (VTMGX) and Third Avenue Value Fund (TAVFX) are recommended as funds to look into, along with index funds and ETFs (exchange traded funds) in general. [WSJ]

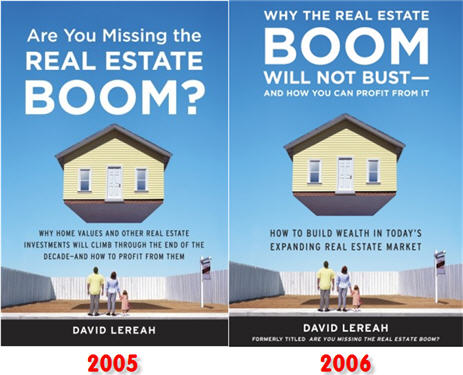

"Economist" Publishes "Why The Real Estate Boom Will Not Bust" Shortly Before Real Estate Boom Busts

David Lereah was the chief economist for that National Association of Realtors before he left to become an Executive Vice President of Move, INC. During his tenure as chief economist, he published several books. One of them, released in 2005, was titled Are You Missing The Real Estate Boom? Why Home Values And Other Real Estate Investments Will Climb Through The End Of The Decade—And How To Profit From Them. The cover depicted a nice enough looking family staring up at tiny little house that was hovering in the sky above their heads, out of reach, but still tantalizingly close. If only, if only they’d just read Mr. Lereah’s book!

How To Talk To Your Teen About Investing

In the list of most popular regrets, the “if only my parents had taught me that” one usually ranks pretty high, which is why we’re glad to have found this post titled “How to talk to your teenager about personal finance.”

Stockton, California Shows Us How Bad The Mortgage Meltdown Can Get

Steve Carrigan is in charge of economic development for Stockton. He says bank loans made it a party every day.

Record Decline In U.S. Home Prices

It was the largest drop in more than 16 years and marked the 10th consecutive month of price depreciation and 23 months of decelerating returns.

../../../..//2007/12/20/ouch-bear-stearns-loses-money/

Ouch. Bear Stearns loses money for the first time in 80 years. [NYT]

Sallie Mae CEO Ends Conference Call With "Let's Get The Fuck Out Of Here"

Dodging tough questions about the student loan company’s fiscal well-being and strategy in the midst of the credit crunch, not to mention his recent sale of 97% of his company stock, Sallie Mae’s CEO ended a conference call yesterday with investors by cursing, reports WSJ:

In an apparent reference to investors’ anger, he said: “I can assure you, you will be going through a metal detector.” He ended the conference call by saying “Let’s go. There’s no questions. Let’s get the [expletive] out of here.”

Retirement Investment Scams And How To Avoid Them

People who are about to retire often find themselves faced with a million different brokers who have a million different great ideas about what they should do with their savings. It can be overwhelming, but Kiplinger has a great article about shady investment scams and how to avoid them.

The Truth About Chinese-U.S. Trade

With all the hoopla in the media about all things Chinese—exports, Chinese investors in the United States, the U.S. trade deficit with China, and so on—we thought this myth-exploding article was worth the read. It’s aimed at investors, but relevant to anyone interested in the U.S. economy and how our relationship with China really works. For example, the U.S.’s foreign direct investment (FDI) in China so far this decade is only a third of what we’ve put into Ireland and Germany.

Bank Of America Plans To Lose An "Unknowable" Amount Of Money

Losses from the subprime meltdown are going to hurt Bank of America, but they won’t say how badly. They just want investors to be prepared when the 4th quarter numbers come in, says the NYT.

../../../..//2007/12/12/feds-add-40-bil-cash/

Feds add $40 bil cash for banks to borrow, stocks jump. [Business Week]

Highest-Yielding CDs With Reasonable Minimum Deposits

The fed rate cut means yields on money market accounts and online savings accounts are more than likely going to fall, making it a good time to look to switch money to certificates of deposit, as long as you don’t mind the illiquidity. Here are the best 3, 6 and 12-month CD rates right now with reasonable minimum deposit requirements.

../../../..//2007/12/12/stocks-fell-yesterday-as-investors/

Stocks fell yesterday as investors sold off after only a 1/4 point drop instead of the 1/2 point drop the market was priced for/hoping for. Pre-market trading indicates there could be a rally today. [AP]