Americans took their cost of living raises and stuck them in their piggy banks, says the Commerce Department, pushing the savings rate to a 14-year high. Not long ago we had a savings rate of 0.1% — now it has skyrocketed to 5%.

income

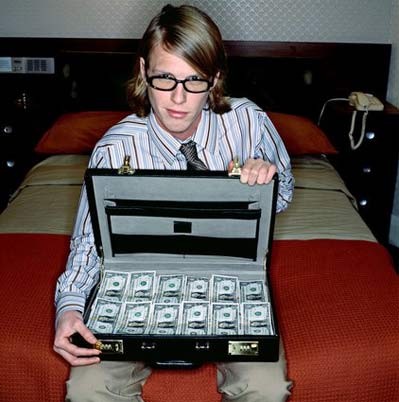

We All Need Extra Income

Hey, if you’ve got $28,000, you can use it to rent Steve Martin’s house for a week. [WSJ]

Gas Price Impact Map: Rural US Getting Slammed By $4 Gas

Suburban commuters may not enjoy paying an average of $4 a gallon for gas, but the rural US, where income levels are low and dependence on large vehicles is high, is getting hit the hardest says the New York Times.

5 Myths About The Upcoming Tax Rebate Stimulus Check

There are a lot of myths and rumors going around out there about the upcoming stimulus check. Tax Cat is in full debunk mode this morning. Careful of the claws, ladies and gentlemen. He gets touchy when tax season ends and he has to retire the glasses for another year and go back to ruining things in Chad’s apartment.

Estimated Hourly Wages For The Lowest Paying Jobs In The U.S.

The blog Political Calculations took data from the Congressional Budget Office, “which published a study of the lowest-wage workers in the U.S. from 1979 through 2005,” and looked at the occupations of the bottom 20% of earners in the U.S. Then it took a chart of the 10 full-time jobs with the lowest annual earnings as compiled by BizJournals.com and estimated the hourly wage based on 40-hour weeks. Conclusion: don’t plan on operating a Tilt-a-Whirl and retiring comfortably.

Tax Cat: Let's Learn About "Necessary And Ordinary Business Expenses"

If you have your own business, you can write off your expenses. This reduces you income, and lowers your tax bill. Sadly, you can’t just write off whatever you want.

IRS: Report Your Poker Winnings, Or Else

The IRS is clarifying the fact that yes, you do have to report your poker winnings as income, because apparently there has been some “confusion.” Ahem.

IRS Launches Special Website Section For People Facing Foreclosure

The IRS has launched a special section of its website aimed at helping people who are facing foreclosure navigate the tax issues that surround debt forgiveness.

America's 25 Best and Worst Paying Jobs

Forbes has put together a list of America’s Best and Worst Paying jobs. The best? Anesthesiologists with a mean annual wage of $184,340. The worst? Food prep and Fast food workers: $15,930.

Do I Need To Report This Income?

The IRS wants to eat all your money. They don’t care where you got it, even if its from bribes or selling drugs.