In 2015, nearly 40% of all federal student loan borrowers over the age of 65 were in default, thanks in part to issues they faced when it came to the servicing of their debts, including problems enrolling in income-driven repayment plans and accessing protections as co-signers. [More]

income

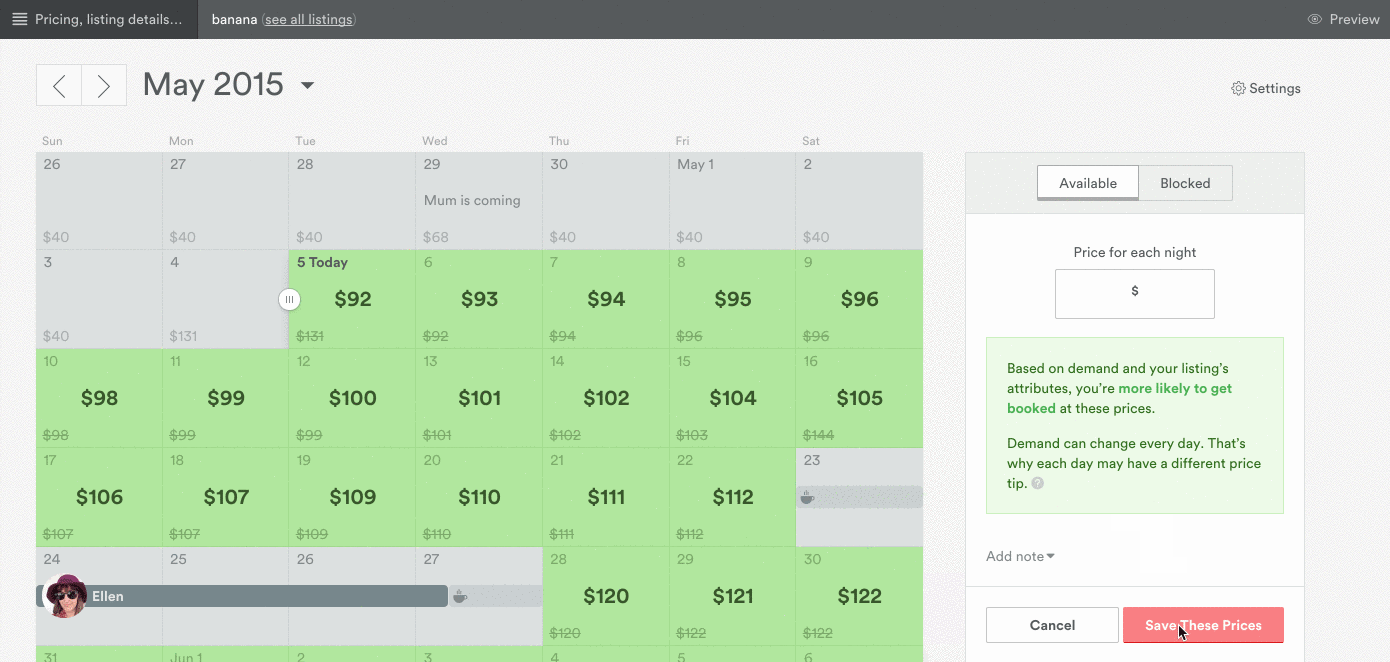

Airbnb Launches New Tool To Help Rental Owners Make More Money

Airbnb launched a new tool Thursday that aims to help owners of properties make the most money possible. Price Tips will create continuous suggestions for pricing based on metrics such as demand for rooms, local events and rental prices for hotels in the area. The company claims that owners who price their property within 5% of the suggested amount are four times as likley to attract a renter. [TechCrunch] [More]

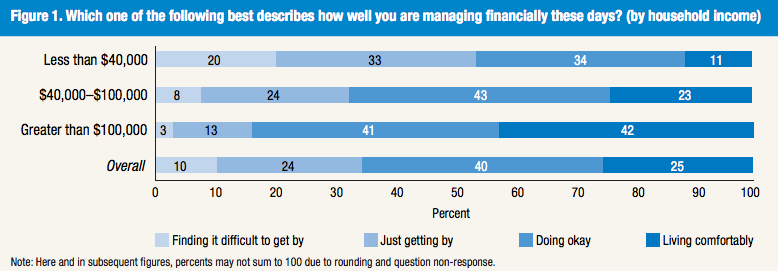

Fed Survey Finds Most Consumers Are Happy With Their Finances, Despite Lack Of Retirement Savings

As the economy continues to bounce back from the Great Recession, consumers have adopted a more optimistic outlook when it comes to their finances despite the fact that a third of the country has no savings put away for the future, according to a new survey from the Federal Reserve. [More]

Report: Taking For-Profit Colleges Nonprofit Can Generate Hefty Profits For Owners

Earlier this year Education Credit Management Corporation bought 56 campuses from embattled for-profit chain Corinthian Colleges Inc. and took the schools to the nonprofit sector. While that conversion was initiated because of the ongoing collapse and financial problems facing CCI, other college chains have dropped the for-profit status seemingly to pick up hefty profits. [More]

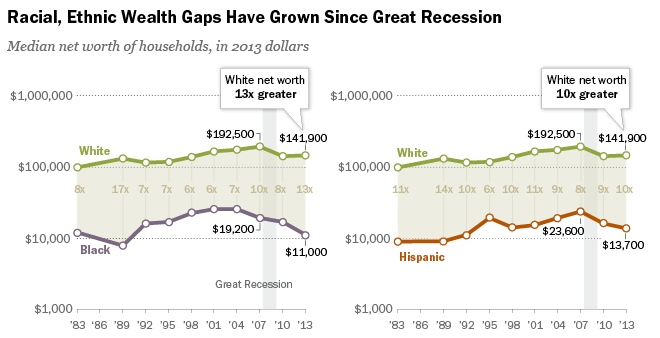

Report: Americans Are Poorer Since The Recession Ended, Wealth Inequality Continues To Increase

While it could be debated to no end whether or not the Great Recession is over, a new report points out that consumers are still worth less money than they were before the bottom fell out of the economy. [More]

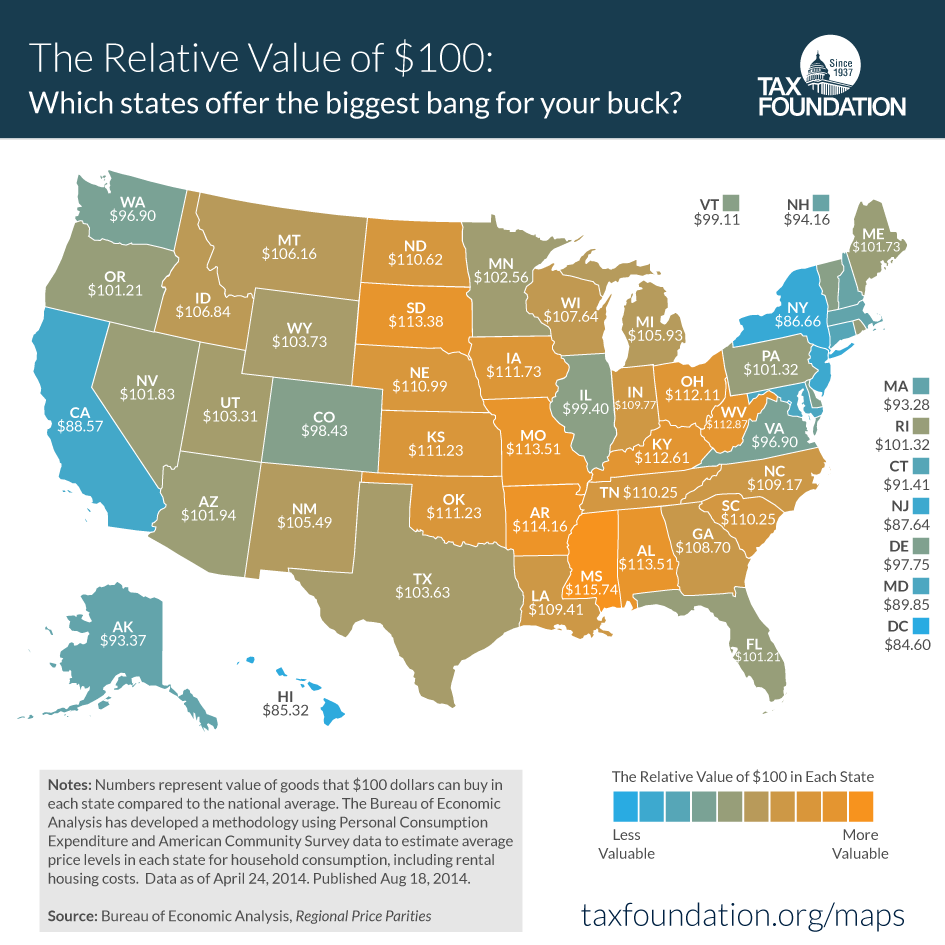

How Far Does $100 Go In Your State? Here’s A Map That Shows You

When people ask me why I moved from NYC back to Philadelphia a few years ago, I usually just show them my mortgage statement — or the fact that I can even afford a mortgage at all — as evidence of the lower cost of living. Now I have a map that shows how much further my money goes here in Pennsylvania than it did in New York… and which also makes me think that maybe I should move to Mississippi. [More]

AOL Still Has 2.4 Million Paying Subscribers

For most of our readers, AOL is is a distant memory: you probably still have an Instant Messenger account around somewhere, and your favorite aunt uses it for e-mail. Oh, and you think that they might own some sites you visit sometimes, like Joystiq and TechCrunch. However, even as it works hard at becoming a content company, AOL still earns a lot of money from selling Internet service to people, including dialup. [More]

Americans Spent Highest Percentage Of Income In 30 Years On Fuel In 2012

Even though Americans are cutting down on how often they hit up the gas pump, as a country we’re paying a higher percentage of our incomes on gasoline than we have in the last 30 years. The Energy Department said in a new report that U.S. households shelled out an average of $2,912 last year for gas, or about 4% of their pretax income. [More]

How To Adjust Your Budget To An Income Boost

Maybe it’s been so long since you’ve gotten a raise that you wouldn’t know what to do with the money when it hit you. Such a problem is a nice one to have, but still a problem. Act carelessly with your newfound income and you’ll hardly notice that you’ve got it. [More]

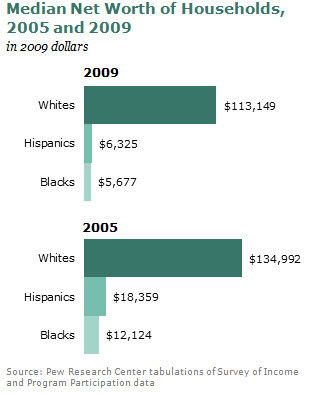

Wealth Gap Between Whites And Minorities Is Widest In 25 Years

The wealth gap between whites and Hispanics has increased to its widest in 25 years, according to new analysis of Census data by the Pew Research Center. We’re talking a 20-1 ratio between whites and blacks, and an 18-1 between whites and Hispanics. Like so many things, it comes down the the housing crisis. [More]

Oracle, Apple, Capital One CEOs Rank Among Decade's Top Earners

Being POTUS makes you age prematurely, and Lady Gaga is stuck in a 360 deal that takes a cut of everything she does. Screw that, I wanna be CEO. The Wall Street Journal has listed the top paid CEOs of the last decade, which is topped by Oracle CEO Larry Ellison at $1.84 billion. Steve Jobs comes in fourth with $749 million, and Capital One’s Richard Fairbank is fifth at $569 million. The WSJ also notes that “four of the top 25 CEOs worked at financial companies, two on Wall Street.” [More]

High-Volume Sellers On eBay, Craigslist Can Look Forward To New Tax Form For 2011

If you tend to move a lot of merchandise on eBay or Craigslist, you should know that the IRS wants a share of those earnings. If in 2011 you sell more than $20,000 worth of goods and have more than 200 transactions, then come early 2012 you’ll receive a shiny new flavor of 1099 form called a 1099-K, and you’ll have to pay up. If you’re an infrequent seller, where your eBay or Craigslist transactions more closely resemble a garage sale than a virtual storefront (and especially if you sell items at a loss), you probably don’t have to worry. [More]

24 Ways To Make Some Extra Money

If you’re between jobs, underemployed, or just have a lot of extra time on your hands now that you’ve give up expensive hobbies like smoking or shopping, here’s a list of 24 ways you can you earn some extra money. They’re not full time jobs, or sometimes even part-time jobs, but they’re a good starting point if you need some inspiration on how to bring in a little extra cash. [More]

How To Make Sure You Get Paid What You're Worth

Wired has put together a Wiki called a

Friday Is The Cutoff To Pay Estimated '09 Taxes Without Penalty

January 15th is the last day you can pay estimated taxes for 2009 without worrying about the IRS’s 4% interest penalty. For most people, you need to have paid 90% of what you owe for 2009 or have a good reason why you didn’t (e.g. casualty, retirement). Kiplinger notes that even if you can’t pay the full amount, pay whatever you can by January 15th to reduce the amount that’s penalized. [More]

Get Ready To Disclose A Lot More Information When Applying For Credit

The downside to responsible lending is that the lenders will need more information about you, says the WSJ. [More]

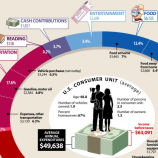

How The Average Consumer Spends His Paycheck

You already have a budget, you just probably haven’t seen it turned into a colorful graphic before. Here’s one that illustrates where all the money goes. Sadly, we spend about three times as much on tobacco as on reading, and yet almost nothing on strippers! (Unless that falls under “entertainment.”)

JoS A. Bank Will Refund Part Of Suit If You Lose Your Job

Work suits starting to look a little shabby? Wishing that that cool worn-in jeans look applied to trousers? One men’s clothier is sick and tired of men cutting back on buying suits because of the economy — so they’re promising to refund a portion of the money you spent on the suit if you lose your job.