Consumerist’s Tip For Criminals #872: If you rob a guy, don’t then use his stolen credit card to have pizza delivered to your home, because the driver dropping off your pie might just be a police officer in disguise. [More]

ID theft

Don’t Use That Stolen Debit Card In Front Of Woman You Stole It From

We’ve heard numerous stories over the years of someone having their debit card stolen and then watching online in horror as their account was drained while waiting for someone at the bank to pick up the phone. But here’s a story of a woman who was able to nab the thief of her debit card — because he tried to buy $200 worth of toys with it right in front of her. [More]

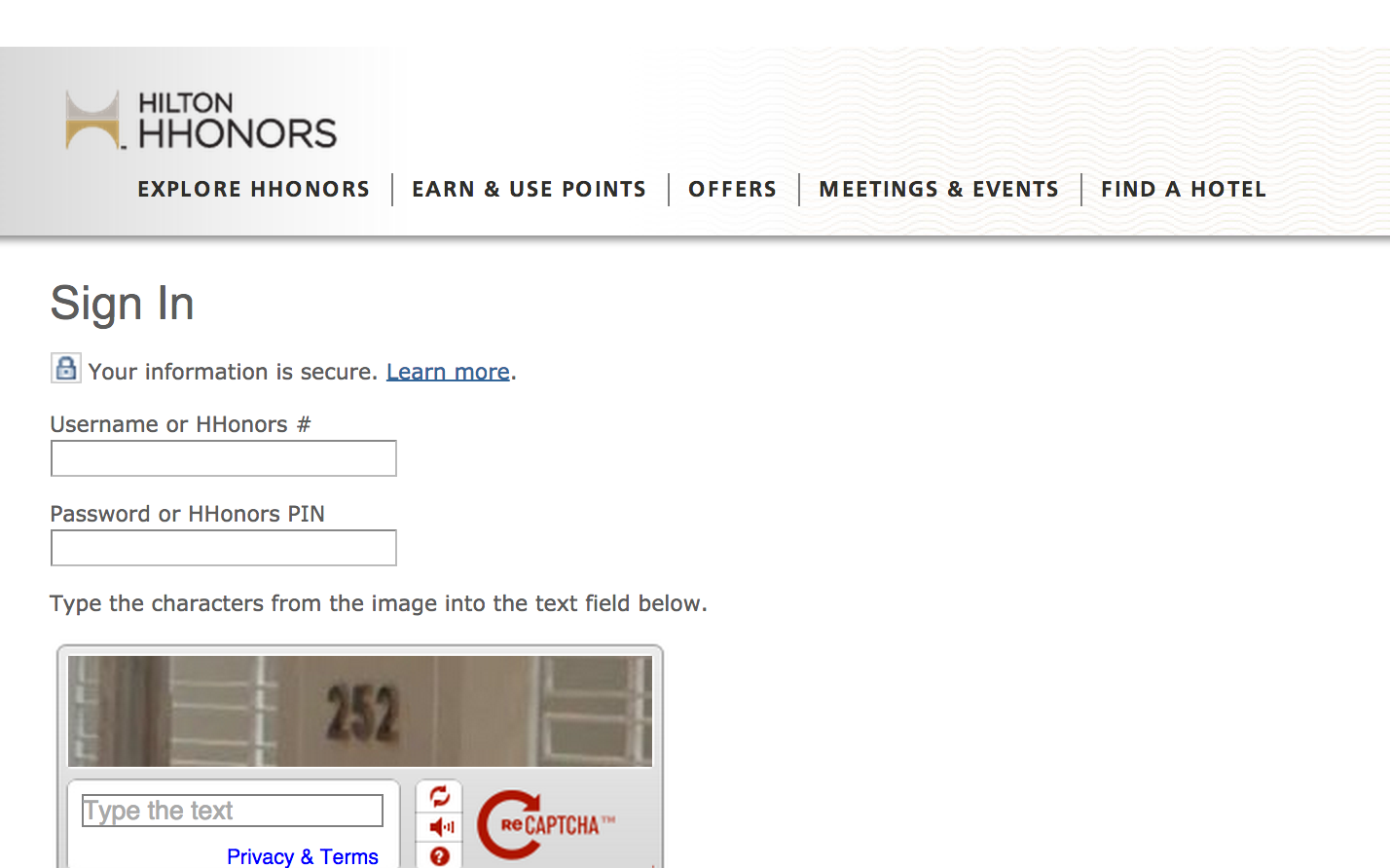

Hackers Now Stealing Your Loyalty Rewards & Points

While we hear almost daily reports of retailers having their payment systems hacked and customer records stolen, it looks like cybercriminals are increasingly realizing they can turn a profit by stealing assets many consumers treat as an afterthought — loyalty rewards. [More]

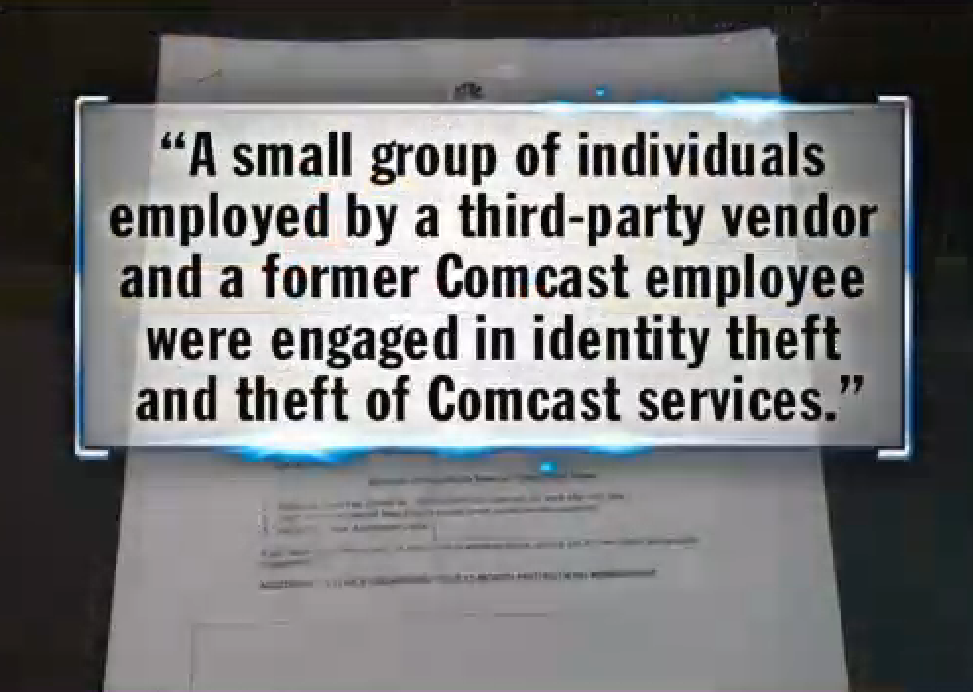

Comcast Sat By As ID Thieves Set Up Multiple Accounts, Ran Up Thousands In Charges

A local news report in Nashville about a local man whose ID was stolen and used to open up two bogus Comcast accounts hundreds of miles away in Louisiana has uncovered numerous additional complaints from consumers in the area who say they have also been sent to collections for fake Comcast accounts opened in the same city. [More]

Chase Data Breach Hit 76M Households, 7M Businesses; Account Info Not Stolen

Remember that coordinated hack attack against JPMorgan Chase and other banks from August? Chase now says information — but apparently no payment data — on some 76 million households and 7 million small businesses was compromised. [More]

ID Thieves Don’t Need PINs To Withdraw Cash From Debit Cards Stolen From Home Depot

When Home Depot confirmed the potentially massive data breach of its in-store payment systems in the U.S. and Canada, it tried to quell some concerns by saying there was no evidence that PIN info for debit cards had been compromised in the attack. But it looks like enough other information was stolen in the hack that a clever ID thief wouldn’t need that PIN to drain the cash from a victim’s bank account. [More]

If You’re Going To Commit $175K In ID Theft, Don’t Do It Under Your Real Name

One would think that a scammer clever enough to steal a victim’s personal data and trick some of the nation’s largest banks into helping her steal $175,000 would have the forethought to hide her own identity. But that idea apparently didn’t occur to a North Carolina who also posted helpful photos of herself online to aid police in their search. [More]

MasterCard Extends Zero-Liability Policy To ATM & PIN Transactions

While both MasterCard and Visa have zero-liability policies for fraudulent transactions made by swiping a card or using the card number online or over the phone, that same level of protection has not been afforded to all cardholders for bogus ATM withdrawals or PIN-based purchases. However, MasterCard announced today that it is extending the zero-liability policy in the U.S. to include these two types of transactions. [More]

Washington State Sold Computers Loaded With Sensitive Personal Information

It’s not just retailers and manufacturers that carelessly sell used and refurbished electronics containing sensitive information left behind by a previous user. The state of Washington has sold or given away hundreds of surplus computers that contain things like Social Security numbers, medical records, tax forms and other confidential information. [More]

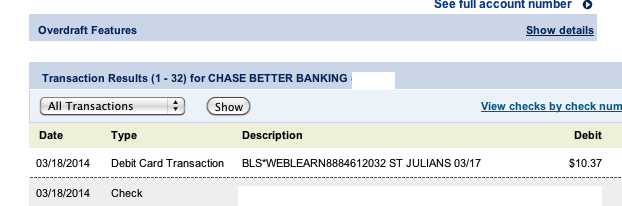

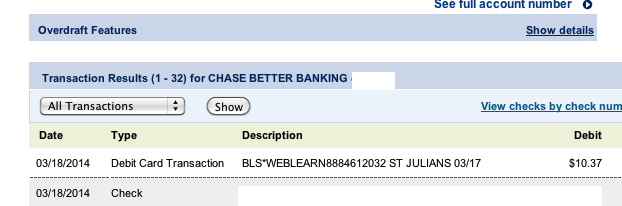

Fraudulent WEBLEARN Debit/Credit Card Charges Possibly Linked To Earlier “$9.84” Scam

We recently told you about a rash of low-value fraudulent charges attributed to a mysterious company called “WEBLEARN” popping up on credit and debit card statements. Since then, we’ve heard from hundreds of people who’ve been hit with these charges and while we still don’t know where the scammers got the purloined card numbers, the identity of the scammers is now less of a mystery. [More]

Check Your Debit, Credit Card Statements For “BLS WebLearn” Scam Transactions

A lot of times when someone gets a hold of someone’s credit or debit card info and decides to use it for illicit purposes, the ID thief makes as many charges as possible in a short period of time. But some scammers choose to chisel away at victims’ accounts in the hopes that the crime will go unnoticed. [More]

Home Depot Employees Arrested For Stealing Personal Information Of 300 Co-Workers

Of all the people at your workplace that you’d hope would not violate employees’ trust by stealing their personal information and using it for illicit gain, it would probably be the folks in corporate human resources. But you’d be wrong, at least in the case of the three Home Depot HR staffers who have been arrested for allegedly stealing co-workers’ information to open bogus credit card accounts. [More]

Sylvan Learning Center Needs Refresher Course In Customer Privacy

We live in a time when ID thieves need only a few pieces of information in order to steal someone’s identity and rob them blind. Most companies have learned to recognize this threat and now take measures to protect customers’ information. Judging by the dumpster full of hundreds of folders containing customers’ names, addresses, dates of birth, credit card info, and Social Security numbers, someone at the Sylvan Learning Center in Beaverton, OR, needs a refresher course on customer privacy. [More]

Airbnb Cancels Reservation Because You Don’t Want To Post A Video Of Yourself

One month ago, home-sharing service Airbnb began rolling out a program called Verified ID, which requires some U.S. users (and eventually people in other parts of the world) to go through a verification process that uses social media logins — either Facebook or LinkedIn — and offline proof of ID, like a scanned license or passport. But what if you don’t use Facebook or LinkedIn? [More]

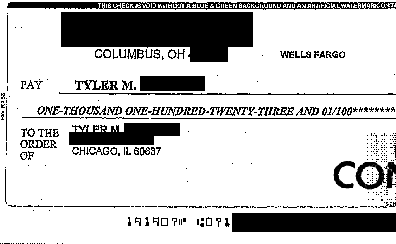

Wells Fargo Closes My Account After $32,000 Fraud, Allows Bogus Payment To Go Through On New Account

Imagine waking up one day to find your bank account has not only been compromised, but that more than $30,000 in fraudulent checks have been written on it. Then to make matters worse, once things seem to be resolved, another bogus charge is placed on an entirely new account. [More]

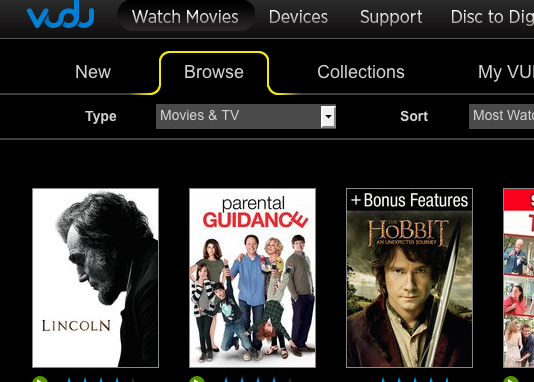

VUDU Alerts Customers To Theft Of Hard Drives Containing Personal User Info

In the last hour, several Consumerist readers have forwarded us e-mails they have received from the video-streaming folks at VUDU. The message alerts customers to a recent theft at the company offices and the potential that customers’ private information could be compromised. [More]

Grocery Store Chain Tied To 400+ Credit Card Fraud Reports Since Jan. 18

Customers of Arizona-based grocery store chain Basha’s should be checking their debit and credit card accounts. Authorities say that, just since Jan. 18, there have been more than 400 reported cases of fraudulent charges being made to accounts of people who had shopped at Basha’s. [More]

Bank Employee Explains Why It Takes So Dang Long To Process Debit Card Fraud Claims & Disputes… And Other Fun Stuff

We hear a lot from readers who say their debit cards were charged for services they didn’t receive — whether by fraud or by ineptitude on the part of a merchant — and who are now waiting for their bank to please put back the money that was wrongfully taken from them. [More]