An Oregon couple signed up for $77.99 Verizon-Qwest bundle that included phone, internet and TV service, and were surprised to see the actual bill come to $158.49.

hidden fees

National Car Rental Nixes Visa Discount With 'Concession Recovery Fee'

An anonymous reader thought he would use his Visa Signature card to snag a $37 discount on his National car rental, but found that the rental company took back $36.99 of the savings with a “concession recovery fee.”

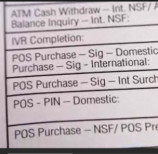

Prepaid Debit Cards Are Money Sucking Black Holes In Your Pocket

Be very careful about activating any sort of over-the-counter prepaid debit card, reports the New York Times. They looked at a handful of prepaids currently on the market and discovered ridiculously high hidden fees—the first two months of use can cost you up to $80.

$10 XSport Fitness Upgrade Really Costs $20

Cache asked about the $10 “Super Power Pass” add-on at his local XSport Fitness club today—the sign in the window says “work out where you want, when you want with a Super Power Pass for just $10 more*,” and lists “Chicago – New York – Washington” across the top. We don’t know what’s linked via that asterisk, because the fine print on the ad is so small that it’s unreadable in the photo Cache took, but as you might expect there’s no such thing as a $10 add-on that lets you use any XSport Fitness.

Wachovia Sends Out Its Own "Free Credit Report!" Offer To Customers

Tom just received a great offer from his bank. He can receive a free credit report just by peeling off this sticker and affixing it to another part of the same page. That’s right, a free motherloving credit report! Who doesn’t want one of those? Free, you say? Sign me up!

CARD Act Will Also Prevent Gift Cards From Expiring For Five Years

One unexpected benefit of the CARD Act, if it passes the Senate vote, is that Senator Charles Schumer of New York has included a provision that prevents abusive gift card practices.

Brookstone Clerk Tries To Sneak Warranty Into Sale

Clearly Brookstone doesn’t spend enough time training its employees to be dishonest, because this airport Brookstone clerk did a terrible job at trying to sneak a $4 warranty onto Nadav’s father’s purchase. She even admitted to the act when confronted.

Comcast Sends Customer "Free" Self-Install Kit, Then Adds $9.95 Shipping Charge To Monthly Bill

Hillary discovered that her money-saving free digital service self installation kit from Comcast wasn’t so free after all when she got her monthly bill. She says they removed the charge when she called to ask about it, which further reinforces our suspicion that this is a sneaky plan to pass the cost of the free kit back to subscribers. If you request a free self install kit from Comcast, watch your bill for extra charges.

Vonage Silently Adds "Optional" Feature, Refuses To Refund Your Money

We’re having a hard time figuring out how Vonage can justify pulling their “Visual Voicemail” scam on customers without even offering the option of a refund, but that’s exactly what they’re doing to Daniel. They quietly turned on the feature over a year ago. You’d think in a year of logging onto the website, an observant customer would catch that sort of thing—only Vonage makes it actually look like it’s not enabled on your control panel, all the better to sneak it past you. Here’s how they pulled it off with Daniel’s account.

GameStop Pays Its Employees In Hidden Fee "Cash Cards"

Remember our post on student loan debit cards? The cards are pitched as a great convenience, or less expensive to distribute than paper checks, or more secure, when in reality they’re germy with hidden fees that slowly nickel and dime your balance. Turns out, GameStop uses a similar system to pay its employees.

Tonik Insurance Sneaks 20% Premium Increase On Customer After Approval

Tonik is the rad, x-treme! lifestyle health insurance for young people who can’t afford regular insurance—sort of the Poochie of health insurance, except it’s not going to go away. Aasma wrote to us to let us know that when she signed up for it over the weekend, she got a nasty surprise after she submitted her credit card information.

Circuit City Says Rogue Firedog Was Wrong, Refunds $40 'Repair' Fee

Last week we wrote about a Circuit City customer who was charged $40 without warning for “repairs” to a brand new computer. We received several explanations from Circuit City insiders, both in the comments and through email, that the repair was mandatory—Acer and Circuit City had agreed that instead of pulling the PCs, the retailer’s Firedog techs would flash the BIOS in-store upon purchase. What was unclear was how or why this would fall under the Firedog “Quickstart” service, which is optional and includes things like removing shortcuts from your desktop and setting up your background. (Seriously, check it out here.) Yesterday we received the following interesting email from Circuit City HQ.

Circuit City Firedog Charges $40 To 'Fix' Computer You Just Bought

Update: Circuit City says the repair should have been free. Here’s their response. Travis writes that a friend of his just bought a new computer from Circuit City, and after turning down all of the Firedog’s “it won’t work unless you also buy this” offers, he noticed a $40 fee on his receipt. Turns out the associate claims he had to flash the computer’s BIOS or Vista wouldn’t work. Travis writes, “Regardless of the fact that Vista booted up just fine with out the update, he was more disturbed with the fact that Circuit City would sell him a computer that they knew didn’t work, or so they say.” So does Circuit City sell computers that don’t work without a preliminary repair, or do they lie in order to generate extra fees?

U.S. Airlines Now Charging As Much As $400 To Carry Surfboards

Airlines and surfers must be involved in some secret war, because how else can you explain why airlines are targeting them so savagely right now? Sure, snacks cost us $9, bags are $50 each, and seat belts will probably soon be auctioned off during the preflight check—but if you’re a surfer, you can expect to pay up to $200 each way to bring along your board, pretty much blowing out the budget of any surfer who isn’t Patrick Swayze.

M&T Bank Makes An Offer You Can Definitely Refuse

Here’s a novel way for a bank to increase revenue: offer your customers a “perk” where they can skip a payment on their loan for a neat $25 fee! Of course, interest still accrues, your total repayment amount increases slightly, and one month is added to your repayment period. No thanks. You can see the actual letter and details below.

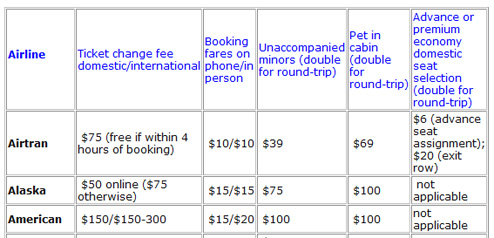

Accurately Compare Airline Fees With Handy Charts

Finding a competitively priced airline ticket is tricky enough without each airline having its own myriad of fees and individual policies. Fortunately, the Airfarewatchdog blog lists most of the fees for the major airlines in one place. Combine it with their checked bag fee chart, and now you know all the fees. This makes meaningful comparison much easier. Otherwise, you might have to go through the entire ticket purchase process before you could figure out your total including fees. They are also “the only site that lists low airfares on all airlines, including Southwest. And [they] include special fares that you can only buy on the airline’s own sites.”

Customer Gets Slapped With "Excessive Activity" Fee For Messing With Savings Account Too Much

Qwest Sells Woman "Cheaper" Package That Costs More, Has Unmentioned 2-Year Commitment, And Requires New Modem

Matt’s mom, a longtime Qwest customer, called up the company to switch her long distance over from AT&T. The CSR suggested she switch over to a bundled package that would save her $11 a month and offer faster Internet connection speeds. What the CSR didn’t mention was that the new package required a 2-year commitment, that it wouldn’t work with her current DSL modem, and that it actually came out to about $3 more per month.