Arlene got behind on her mortgage payments and had been trying for 6 months to contact her lender, Washington Mutual, to see if they could work out a deal. All she found was disconnections, non-returned phone calls, contradictory information, and no answers. After reading my article in Reader’s Digest about ways to get customer satisfaction she sent me an email. She was ready to try the “town crier” method, where you stand outside the business passing out copies of your complaint letter, but we gave her some executive contact info to try first before wasting any money at Kinko’s. Arlene says that thanks to the phone numbers we gave her, “They are going to suspend the foreclosure for 60 days and work with me on the payments for a set period of time which is all I ever wanted them to do.” Once again, the almighty power of executive customer service has been revealed. Arlene’s original email, inside…

foreclosures

../../../..//2008/03/28/new-trend-organized-bus-tours/

New trend: organized bus tours of foreclosed properties for potential buyers. [AP]

Foreclosures Hit An All Time High As Many Homeowners Simply Give Up

The Mortgage Bankers Association says that foreclosures have hit an all-time high as more and more borrowers with adjustable rate mortgages walk away from their homes before their payments increase.

Exciting New Service Helps You Walk Away From Your Mortgage!

You will immediately know the exact amount of days you have to live in your house payment free. We stay on top of your walk away plan and keep you up to date with weekly progress emails. We also will notify you if the lender is taking longer than expected subsequently giving you more time in your home payment free.

It’s like a spoof, except real!

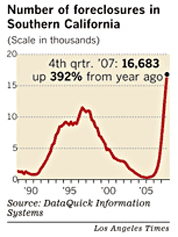

California Foreclosures Hit New Quarterly Record: 16,683

The number of homeowners losing their house to foreclosure shot to a new record of 31,676 in the last quarter of 2007, Los Angeles Times reports. Research firm DataQuick says that 41% of homeowners currently in default can keep their homes if they bring their payments current, refinance, or sell their home, down from 71% the year prior. Hey, at least it’s sunny.

../../../..//2008/01/15/banks-lost-the-paperwork-and/

Banks lost the paperwork and checks of a Maryland taxi driver who never missed a mortgage payment, and now, his his fourth appeal and stands to still lose his house to foreclosure. His lawyers have vowed to file more appeals. [Baltimore Sun]

Will The Foreclosure Tsunami Lead To An Arson Boom?

Faced with foreclosure on her Russellville, Indiana home, Christina Snyder allegedly concocted the kind of plan that now has insurance executives on edge.

Protesters Taunt Goldman Sachs Employees By Singing "Frosty The Goldman" Outside Company Christmas Party

Last week a clutch of protesters sang parodic carols outside the Goldman Sachs Christmas party at the hoity-toity BLVD club to protest the companies involvement with subprime mortgages.

../../../..//2007/12/31/smart-money-has-some-new/

Smart Money has some new scams to watch out for, in particular, con artists trying to take advantage of people in foreclosure. [Smart Money]

../../../..//2007/12/20/woman-loses-house-to-foreclosure/

Woman loses house to foreclosure because her lender underestimated her escrow. [South Florida Sun Sentinel]

Foreclosures Up 68% From Last Year

Foreclosure tracking firm RealtyTrac has announced November’s foreclosure numbers and, while foreclosure activity is down 10% from last month’s number, the news isn’t happy. Foreclosures are up 68% from November 2006, with 201,950 foreclosure filings—up from 120,334 this time last year. Also worth mentioning, last year’s numbers weren’t exactly low—they were up 68% from 2005.

As Foreclosures Increase, Renters Suffer

Stephen O’Brien wants to buy a foreclosed apartment building on Warwick Street in Roxbury. He wants to keep the ground-floor tenant, James Evans, 77, who is partially blind and living on Social Security.

Freddie Mac's Fraud Video Warns Borrowers

Freddie Mac produced this video to educate borrowers who face foreclosure about a fraud scheme where “a con artist will seek out a public notice of foreclosure and approach the potential victim with documents and the promise of sorting out the debt,” thereby tricking the homeowner into signing over the deed to the house.

../../../..//2007/12/12/if-youre-facing-foreclosure-you/

If you’re facing foreclosure, you can call 888-995-HOPE and get free advice from non-profit counselors about how to save your house or at least minimize the damage.

../../../..//2007/12/03/washington-mutual-forecloses-on-man/

Washington Mutual forecloses on man who made every single mortgage payment, but the banks somehow misplaced his check and papers so oops we’re going to foreclose on you anyway. [Baltimore Sun]

../../../..//2007/11/26/woman-pays-debt-on-foreclosed/

Woman pays debt on foreclosed home, only to have it sold out from under her anyway. [Newsday]

32 More Foreclosures Dismissed For Lack Of Documentation

In Ohio, judges have dismissed 32 more foreclosures due to insufficient documentation. This is no white-knight that’s going to save homeowners at risk for foreclosure. One law prof told us that whenever we go through a glut of foreclosures, judges start clamping down and begin requiring the plaintiffs to have all their papers in order. It’s all just a matter of getting the note from the loan originators, who usually hold on to all the proper paperwork.

What To Do When Rental Gets Foreclosed?

2 weeks ago both my wife and I got a summons, that let us know that our landlord was being sued by the bank he financed the house through, for not paying his mortgage since July of this year…