There’s big ramifications to a federal court’s dismissal of 14 foreclosure cases because the bank couldn’t prove that they owned the mortgage note, reports NYT.

foreclosures

../../../..//2007/11/14/8-foreclosure-dos-and-donts/

8 foreclosure do’s and don’ts. Some could save you your house. [Bankrate]

Update: Dubious Fees For Homeowners Facing Foreclosure

Last week we talked about a NYT article about a bankruptcy professor who has been looking at fees loan services are charging and how she found many of them to be dubious and/or inexplicable. For example, by looking at all the defaulted loans being paid off under chapter 13 bankruptcy, she found millions of dollars of difference between what the debtor thought they owed and what the loan service said was owed. Some of that was due to the insertion of questionable fees, like “fax fees” and “demand fees.” There was a front-page NYT article on it, and now you can download the paper that started it all, Misbehavior and Mistake in Bankruptcy Mortgage Claims (PDF).

Dubious Fees For Homeowners Facing Foreclosure

The New York Times today took a look at the work of Katherine M. Porter, associate professor of law at the University of Iowa, and bankruptcy specialist. She’s been taking a closer look at the fees that some loan servicers are charging homeowners who are in foreclosure. She’s determined that some of the fees are “questionable.”

WaMu's Net Income Down A Whopping 72%

The “housing correction” is turning out to be “more dramatic and more rapid” than Kerry Killenger, WaMu’s chairman and chief executive had expected.

../../../..//2007/10/10/a-increase-in-spammers-trying/

A increase in spammers trying to capitalize on the housing crisis can mean only one thing: spammers can read newspapers. [Symantec]

Fight Foreclosure Roundup

October is here, which can only mean one thing: $50 billion in option-ARM mortgages ratcheting up to higher interest rates. Here’s four posts of ours that can help affected homeowners see their way clear:

Tales From The Foreclosure Frontlines: The Little House That Couldn't

“My wife and I went through a foreclosure and bankruptcy here in Ohio (where we lead the nation in foreclosures). The long story short – we bought a house for $32,000 in 1995, but couldn’t afford to fix it up. Just kids at the time (I was 20, she was 22), we were expecting our son and found a fix’er upper. We took out a subprime second mortgage to do the much needed repairs ourselves. The neighborhood was going to hell and after seven years we wanted to get out, but we had no real equity…”

The Case Of The Man Who Should Have Known Better

Back in 2005, my wife and I bought our first condo. We live in the Central Coast of California, in San Luis Obispo, where the property values were skyrocketing, and were not supported by the wage base, similar to Monterey and Santa Barbara. It was the top of the market and I knew it, but we had a very slick mortgage broker who got us qualified (it wasn’t a no-doc loan, but it was a 100% finance, 80/20 with a first and a second, the first was a 6.5% 2/28 ARM, the second a 9% fixed.) We were assured at the time and up to as recently as this Summer, that we would have no problem re-fi-ing that loan (and even paying off our lower-interest student loans by taking some cash out in the process=wtf???) by the same broker. Of course that didn’t happen…

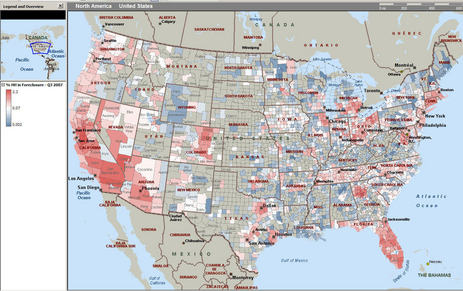

Foreclosures Up 115% From Last Year

Foreclosures “zoomed” in August, up 115% from last year and 36% from July according to the newest numbers from RealtyTrac. This is the beginning of one of three remaining waves that will hit the market in the next year. This wave is expected to peak in October as 2 million 2/28 ARMs reset to market rates and an estimated 600,000 homeowners can no longer afford their payments.

../../../..//2007/09/10/the-step-by-step-process-of-130000/

The step-by-step process of $130,000 gross yearly income housing bubble poster couple getting foreclosed, a case study. [Dr. Housing Bubble Blog]

House Bought At Foreclosure Found Filled With Dead Cats And Dogs And Feces

Speculators beware: Foreclosure sales are great buying opportunities, except that you only get to inspect the house after the old owners move out, and that’s when you discover the over two dozen dead cats and dogs, over 100 live cats, and feces six to ten inches high covering the basement.

Jordan Fogal Responds To Your Comments About The Rotten Lemon Tremont Homes Sold Her

Two: We did not understand the true ramifications of arbitration, or it’s unfairness. No one who has not been caught in this snare does. We did not know that almost always big business wins. We thought it was like, OK kids lets sit down and not argue and fix this situation. We did not know the system was rigged. We did not understand the builders were repeat clients and the arbitrators meal tickets. No one understands arbitration companies are just the middle men. You still have to put on a trial and have all the costs associated: witnesses, subpoenas, expert testimony you even have to pay for the room to hold the arbitration in… We would not have had to pay a judge as we did an arbitrator or room rent or the astronomical fees charged by arbitration companies. Our arbitration fees alone were $9300. dollars. That does not include going to the kangaroo court where the rules of law no longer apply behind close doors. That was nearly $30,000 dollars…

Tremont Homes Sells Rotten Lemon, Provokes Victimized Homebuyer Into Five-Year Consumer Crusade

“We always wondered what life would be like in our sixties, our credit is ruined; we have stored, sold, and given away years of our memories; and for the last three years we have been holed up in a third story apartment.

../../../..//2007/07/04/homeowners-in-mortgage-trouble-need/

Homeowners in mortgage trouble need beware “equity stripping,” a scam where someone else takes over your deed, borrows as much as they can against the house, pockets the cash, and runs, leaving you to probably still lose your house.

GoogleMaps Mashup Of Minneapolis Foreclosures

A googlemaps mashup of 2007 foreclosures to-date in Minneapolis area puts the acceleration in failed mortgages into a different perspective.

4 Things To Try Before Foreclosure

Usually one has somewhat of an advance notice that they’re going to miss a mortgage payment, so before that happens and the bank comes to take your house away, Kiplinger’s advises calling up your lender and discussing one of these four options: