Rising unemployment is exacerbating the already critical foreclosure crisis, because sadly, while you can return your Hyundai if you lose your income — you’re kinda stuck with that 4 bedroom ranch with the in-ground pool.

foreclosures

1 In 8 US Households Either Late Or In Foreclosure

Here’s your daily depressing mortgage news — as employers shed jobs mortgage delinquencies are rising — intensifying and spreading the mortgage crisis.

See The Bank Failure And Foreclosure Rates In Your State

CNN Money has put together a couple of quick interactive maps of the U.S. that let you see the bank failure rates and foreclosure rates for each state. According to these two maps, Wyoming is the place to be.

What Happens To This Stuff Left In A Foreclosed House?

What happens to all the stuff left inside a foreclosed house when the ex-owners jet? The bank contracts these guys to haul it all away to the dump in what is called a “trash out.” Here’s a short video following a crew of junk chuckers. It’s amazing what people leave behind, including photos and computers.

Congresswoman Marcy Kaptur Urges Squatting In Foreclosed Homes

Last week I was watching Lou Dobbs while scrubbing my dentures and complaining about joint pain (two of those things are true, sadly), and I saw a segment on Ohio congresswoman Marcy Kaptur, who is encouraging homeowners to stay put in their foreclosed houses. She argues that many of the loans made during the subprime fiasco may not be legit, and that you should seek legal counseling and demand a mortgage audit from the bank before leaving. Kaptur admits her advice doesn’t trump the sheriff knocking at your door with an eviction notice, but a real estate lawyer told the Toledo Blade that otherwise she has a point.

Citibank, Senate Agree On "Cramdown" Bill To Prevent Foreclosures

Ever heard of a cramdown? It’s when a bankrupcty court splits a home loan into two parts: a secured loan that’s equal to the current value of the home, and an unsecured loan that covers the rest of the outstanding debt. The secured loan is paid, and the unsecured isn’t. It can result in lower monthly payments (if the new loan amount is amortized over the course of the loan), but the important part is that it helps guarantee that a significant part of the loan will still be paid off.

The Recession Spares Nothing, Not Even Puppies

Ever feel like the poor state of the economy is impacting every area of life? Well, it is! A few examples popping up in some surprising places, like animal shelters…

Fannie And Freddie To Announce More Sweeping Loan Modifications

Fannie Mae and Freddie Mac are expected to announce today plans for accelerating and expanding mortgage loan modifications for distressed homeowners. The new guidelines will apply to specific kinds of past due loans and try to bring their debt to income ratio down to 38%. Washington will also prod other big banks to do the same. “It could apply to a broad range of borrowers,” reports WSJ. Expect the full details at a 2pm eastern Federal Housing Finance Agency press conference.

The Town With The Most Screwed Housing Market In America

Nearly 90% of the homeowners in Mountain House, CA owe more on their mortgages than their house is worth. The average homeowner is down by $122,000. What are they doing to cut back? No more dinners at Applebee’s, buying 1 DVD a month instead of 50, canceling remodeling projects, and playing board games at home instead of going out to the movies, “But not Monopoly,” reports NYT, “with its real estate theme, it reminds them too much of real life.” One man is even cutting back on his scub and flying hobbies, and waiting until after Christmas to buy a high-def television. Wow. I think you’re going to have to dig a little deeper…

After Losing His Home, Man Trashes House, Spray Paints Message To Bank

Here’s an odd story from the Bay Area. A man who says his house was “sold without his knowledge” to a bank after he signed a “deal” to prevent foreclosure has trashed the property — spray painting a message to the new owner.

Chicago Sheriff Halts Foreclosure Evictions, Won't Toss Innocent Renters

Cook County Sheriff Tom Dart said he understood he was flouting the law in refusing to have deputies carry out the rising number of eviction requests, but mortgage holders must be accountable.

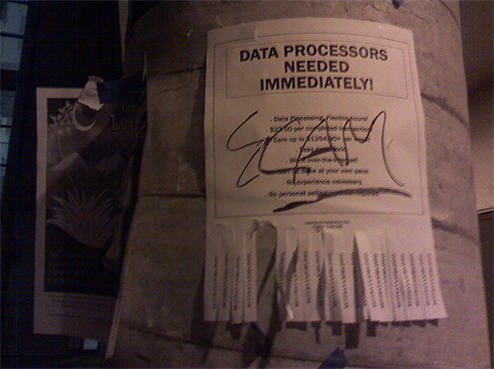

5 Scams To Watch Out For During A Recession

The LA Times says that recessions are boom times for scammers looking to take advantage of desperate people. They’ve listed 5 common scams that do well in a poor economy. They include bankrupcy scams, foreclosure scams, and fake home-based businesses.

Houses For $1: "My 14-Year-Old Son Could Buy a Block of Detroit Property"

Things are looking pretty bleak in parts of Detroit these days. In fact, you can get a house for $1. Yes, that’s right. A house.

Extreme Makeover Home Edition Leaves Homeowners In Perdition

Some of the winners of ABC’s Extreme Makeover Home Edition (EMHE) got a boobie prize. The Free Money Finance blog has found a few examples of EMHE recipients now in foreclosure, because after the workmen, camera crews, and glitz left, they were left with more house than they can afford. In one case, the town is hosting dinner raffles to help keep the family afloat. Here’s an extreme makeover for you: how about giving the people a house that fits their budget? I guess that doesn’t sell as many Twinkies.

JPMorgan Chase Accidentally Breaks Into Your House And Steals Everything You Own

Bobo and Joy Dickson bought a house had been headed for foreclosure, but JPMorgan Chase apparently didn’t get the message that the former owners had moved out and the new owners were in residence. So, naturally, they hired a firm to drill the Dickson’s locks and take everything they owned, including their food. Now JPMorgan Chase is “taking it seriously.”

"We Used To Sell Homes In A Day, Now 50% Of Our Sales Are Foreclosures"

Bank repossessions (that’s when not even the bank can sell your house) are up 48% from a year ago, as falling house prices trapped borrowers in mortgages they couldn’t afford, says Bloomberg.