Between credit cards, online payment services, and good ol’ cash, many consumers have sequestered their checkbooks into cupboards and drawers that seldom see the light of day. Still, not everyone has left their checkbooks to waste away; many consumers use the notebooks from time to time, whether it be paying a bill, rent, or other expenses where plastic or cash aren’t options. [More]

financial

45% Of Americans Carry At Least $25,000 In Debt

If you owe creditors less than $5,000 (not including a mortgage) you’re in a rather small group of Americans with minimal debt. According to a new survey, nearly half the country owes at least $25,000 — and spends as much as half of their monthly income paying down their debt. [More]

Ruby Tuesday Seeking Buyer, Merger Partner After Continued Declining Sales

Last summer, Ruby Tuesday revealed plans to close nearly 100 underperforming stores as part of the chain’s “Fresh Start Initiative” that aimed to turn around slumping sales. Those efforts apparently haven’t been as successful as the restaurant brand would have liked, and now it’s looking to sell itself instead. [More]

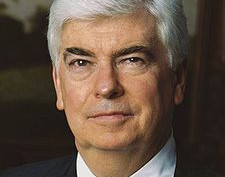

Consumer Financial Protection Agency On The Chopping Block

According to the Wall Street Journal, Senator Chris Dodd, a Democrat from Connecticut, has offered to abandon the Consumer Financial Protection Agency (CFPA) proposal in exchange for Republican support on other legislation. Nobody is saying anything official right now, but the WSJ reports that “the offer is conditional on the creation of a stronger consumer protection division within another federal agency.” [More]

Government Helped CIT Limp Along Long Enough To Keep From Ruining Christmas

According to SpendMatters, one big reason the government burned through $2.3 billion in TARP funds for CIT even though it was buckling under debt was to try to avoid ruining everybody’s Christmas this year.

Consumer Financial Protection Agency Gets Watered Down

There’s been so much resistance to the proposed Consumer Financial Protection Agency that Rep. Barney Frank, the chairman of the House Financial Services Committee, has proposed a less powerful version of the agency in an attempt to get it passed. Here’s what’s changed:

Obama To Call For Financial Watchdog Agency

Tomorrow, President Obama is expected to call for the creation of a new watchdog agency that would help protect consumers from abusive credit card, mortgage, banking practices. The banking industry is not happy about the idea, reports CNN. But hey, they’re just looking out for us: “It’s bad for consumers,” a banking industry lobbyist told the network. Oh, well, never mind then, and pass me some more delicious subprime!

Chrysler Financial Accused Of Turning Down Government Loan To Avoid Executive Bonus Restrictions

The Washington Post has just published a story accusing executives at Chrysler Financial of turning down a $750 million government loan because they “didn’t want to abide by new federal limits on pay,” and instead opted for more expensive private sector financing, “adding to the burdens of the already fragile automaker and its financing company.” Chrysler Financial denies the charge.

Lehman Brothers CEO Got Punched In The Face

Dick “It Wasn’t My Fault” Fuld, the CEO of bankrupt investment bank Lehman Brothers, (seen here being heckled after testifying on Capitol Hill) was apparently punched in the face while working out in Lehman gym on the Sunday following the bankruptcy, according to CNBC’s Vicki Ward.

../..//2008/10/01/in-one-brain-melting-two-minute-clip/

In one brain-melting two-minute clip, watch all the media frenzy, punditry, and cable-news excitement of the financial meltdown, courtesy of CNN’s own Rick “The Twitter Board Is Blowing Up!” Sanchez. [YouTube]

Citigroup Buys Wachovia

Part of Wachovia will remain independent — including its massive brokerage business which ballooned after it purchased AG Edwards in 2007, as well as its Evergreen investment management division.

Advanta Raises Your 8% Credit Card To 20% Because The Economy Is Bad

I have had an Advanta Credit Card for a little over a year now. My interest rate prior to a few days ago was 8%. My credit rating is very good, and I have always made my payments on time. As I was looking over my bill for September I noticed a fee of $75 dollars. A few clicks later I found that my interest rate had been raised to 20%.

10 Tips For Lowering Your Taxes

This list of ten tips to reduce taxes was published nearly a year ago, but they’re still relevant, and we thought now would be a good time to share them before Kiplinger releases its new “10 Ways” list later this month. Among the tips: make sure you load up your retirement accounts and flexible spending accounts, and remember that the government gives you a 2 ½ month grace period on reimbursing yourself from an over-funded flex account.

Find Out Your Nest Egg Score

A.G. Edwards has a short online quiz that determines your “nest egg score” based on criteria like how long before you plan to retire, how aggressively you invest, and where you live. It’s not meant to provide an in-depth portfolio review, just a quick sketch of where you stand—you’ll get a score very similar to a credit score, along with a comparative national average and a list of tips on how to improve your score.

../..//2007/10/04/if-youre-a-customer/

If you’re a customer of a small bank or credit union with limited access to fee-free ATMs, consider asking your financial institution to look into joining pre-existing, surcharge-free ATM networks like MoneyPass or Allpoint.

Borrowing From—And Loaning To—Friends And Family

Ah, what an awkward situation—over the phone, or whispered at your desk, or asked face to face over beers at your weekly hangout. What’s the best way to respond when someone you love (or at least like to some degree) wants to borrow money? And what if you’re the one in need? Betterbudgeting.com offers some advice on when to loan and when to figure out whether you’re just enabling a bad habit.

Website Offers 411 For Financial Questions

In July, federal regulators launched a new website, HelpWithMyBank.gov, to answer your basic bank-related questions, as well as to provide an easy way to lodge complaints about any of the 1,800 offending financial institutions that fall under its purview. (Yes, that includes Chase and BofA.)

The Secret To Being An Impulsive Shopper: Forget The Guilt

Are you an impulsive shopper? Odds are you don’t hang on to the guilt of “succumbing to temptation” the way more prudent shoppers do, says a new university study. The study found that thrill-seeking shoppers and careful shoppers alike feel guilty when they splurge on unnecessary goods, but over time thrill-seekers forget the guilt and only remember the high.