A recent Huffington Post article wondered if talking about personal finance was “the final taboo.” Talking about money can feel as revealing as a strip-tease with none of the fun, but for something as complex and individual as your financial future, a one-way conversation with the internet or personal finance columnists isn’t enough.

finances

The Five Universal Financial Truths

Saving can be boiled down to a few universal financial truths. The sooner you know and internalize them, the sooner you can start enjoying a responsible, sustainable lifestyle.

At Least Someone's Getting A Raise: Minimum Wage Rises To $7.25

Great news, laid-off Wall Streeters, minimum wage work just a got bit more lucrative! As of yesterday, the new minimum wage is $7.25 per hour.

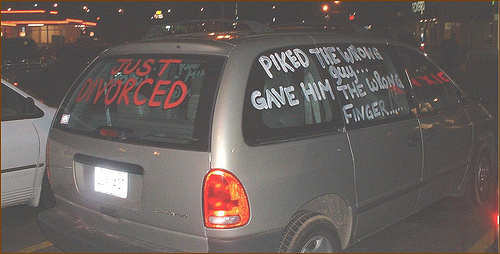

Protect Your Personal Finances In A Divorce

Sources around the country say that the divorce rate is down nationwide, though it’s usually higher during economic recessions. One theory as to why: the economy is bad, but people are marrying later and cohabiting more frequently than past generations.

Four Financial Tools All New Parents Need

The baby’s on the way! You’ve got a crib, toys, and a rapidly approaching delivery date. So what else you do need? Kiplinger shares the four must-have financial tools that no new parent should go without…

../../../..//2009/06/20/here-are-5-personal-finance/

Here are 5 personal finance podcasts to subscribe to, download, and argue with during your commute or workout. [Automatic Finances] (Photo: uhuru1701)

Give Yourself A Financial Stress Test

Why let banks have all the fun? Run the numbers on your own personal finances, suggests a certified financial planner in the Dallas Morning News, and see whether or not you’re prepared for disruptions like a layoff or sudden interest rate increase.

Ready To Make A Budget? Here's How To Prepare

So you want to write a budget, but you’re not sure where to start? No Credit Needed has a list of ten simple but necessary steps to take before drafting your first spending plan. Most consumers will already have knocked off the basics like putting their checking and savings accounts in order, but everyone can take advantage of tips like tracking your spending for a full month and making sure you have a detailed list of your irregular expenses. Once you’ve done your homework, check out our guide to writing a beginner’s budget and start mapping out your financial future.

How Does The Chrysler Bankruptcy Impact Your Mutual Fund?

What impact does the Chrysler bankruptcy have on regular investors who hold bond funds? Most likely little to none, it turns out. Consumer Reports points out that most mutual funds have been avoiding Chrylser, GM, and Ford debt for years now—and if your fund does include Chrysler, it’s probably a tiny portion of your overall investment.

Is It Cheaper To Make Or To Buy? Six Foods Tested

Jennifer Reese decided to make six common food items and then determine whether it was better to go the homemade route or to buy from the store. We briefly considered making our own crackers last month in a fit of anger over how expensive generic saltines have become, so we’re glad someone did the research for us.

Reader Finds Card Skimmer On Bank ATM

Dan says over the weekend he discovered a card skimmer attached to the ATM at his local WaMu branch. He pulled it off and took photos of it.

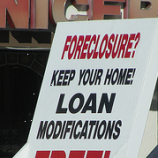

Report: Loan Modifications To Date Haven't Been That Effective

Fewer than half of loan modifications made at the end of last year actually reduced borrowers’ payments by more than 10 percent… [while] nearly one in four loan modifications in the fourth quarter actually resulted in increased monthly payments.

Banks Seeking To Value Assets Higher Than Market Value

Banks are pushing for a change to banking rules that would allow them to ignore mark to market accounting for assets in markets that they deem “inactive.” In other words, if a bank is loaded with worthless assets but decides that the market for those assets is frozen, they can value those assets higher than the market would. Or to simplify it even more, they can create value out of toxic assets. And it looks like now the Financial Accounting Standards Board, which so far has been against this rule change, is caving in.

Your Credit Card Limit Can Be Reduced Below Your Current Balance

We’ve seen how available balances can disappear when lenders cut credit card limits, but SmartMoney points out that lenders can cut your limit below your current balance, causing all sorts of problems. They’ll send you a notice, of course, but you may not receive it for several weeks. Your best bet is to set up your own alert system. A web-based financial service (like Mint) will send you an email or SMS alert if your available balance drops below a specified threshold.

Banks Didn't Pay Into FDIC Coffers From 1996 To 2006

For 10 years—including the boom times banks enjoyed in the first half of this decade—the FDIC was prevented from collecting fees from 95% of financial institutions, which it would have used to further build up its safety net in the event it would someday have to bail out a bunch of stupid losers who confused banking with alchemy.

Single Men Trade Stocks Too Much

Nick Kapur at The Motley Fool says that men trade stocks more frequently than women. This is not a good thing; the result of all this hyperactivity and overconfidence is lower earnings on your investment. He writes, “Worse still (for unmarried guys like me) is that single men trade a whopping 67% more than single women, earning them annual net returns of 2.3% less! The authors cite increased trading costs, taxes, and a greater tendency to speculate as reasons for this underperformance.”

How To Find Reputable Credit Counseling

If you’re having problems with your credit and need some help, consider calling a legitimate credit counseling agency for assistance. Here’s how you find a reputable one that won’t scam you.

Three Tips To Keep The Recession From Depressing Your Relationship

Money can ruin relationships, but by talking honestly about finances with your significant other, you just might emerge from this depressing recession as a couple. Even if your finances are deteriorating, there are a few ways to keep your money problems from rotting your relationship.