Keith just found out the hard way that if you try to pay off your late fee with Wells Fargo, you can’t just add it on to the regular payment. You have to call them up and tell them where to apply it. [More]

fees

You Have To Call Up Wells Fargo To Ask For Your Extra Payment To Be Applied To The Late Fee

DOT Investigates Airlines For Not Disclosing Fees On Their Websites

Starting August 23rd, airlines were supposed to start being more upfront on their websites about the fees they charge you. Guess what? They didn’t. [More]

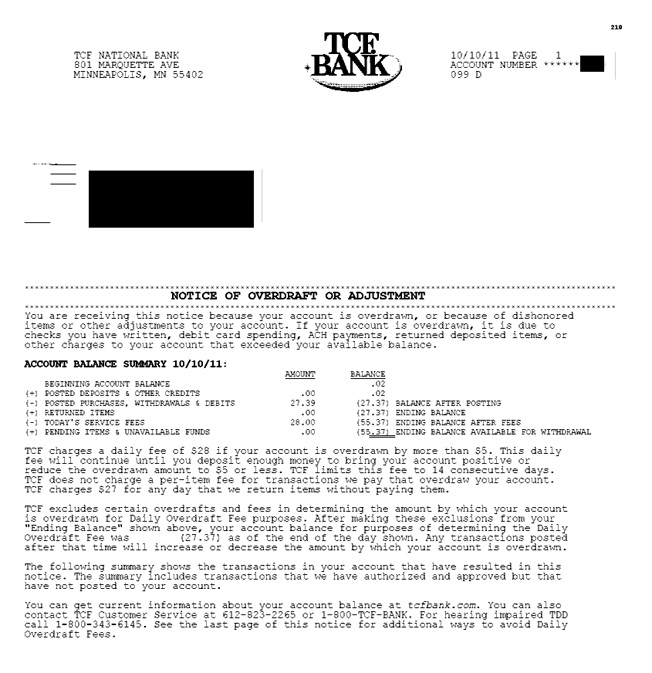

TCF Bank Adds New $28 Daily Overdrawn Balance Fee

Reader Jeff used to intentionally overdraw his bank account in order to have enough money to feed his family and gas the car. At $35 a pop, that’s a pretty cheap loan. But now that’s not going to be a viable option because TCF Bank has started to assess him a daily fee of $28 if his account is overdrawn by $5 or more. [More]

Behold The Amazing Disappearing Prepaid Debit Card

It seemed like a good idea at the time. When Jim’s wife received a bonus at her job in the form of a prepaid debit card from the First National Bank of Omaha, they chose to put it away for an emergency. What they didn’t realize is that prepaid debit cards combine all of the arbitrary fees of banks with all of the general crappiness of a gift card, only worse. Much worse. By the time the couple went to use the card, the entire balance had been gobbled up by fees. Fees levied for not using the card. [More]

Non-Credit Union Alternatives To Banks With Monthly Debit Card Fees

While often the default response online to people looking for something other than a big retail bank to stash their cash is to shout, “Credit union! Credit union!”, they’re not the only game in town. [More]

Bankers Association Defends Checking Rate Hikes: "We Don't Expect To Pay Nothing To Ride The Train"

Bankers are sure trotting out the appealing straight talk to defend the recent increase in rates on various consumer banking services. First it was Bank of America CEO Brian Moynihan telling folks that adding a $5 monthly fee for debit cards was okay because they “have the right to make a profit.” Now an American Bankers Association has an interesting turn of phrase to defend the jackup in checking account costs, most recently done by Citibank. [More]

Bank Of America CEO Defends $5 Fee Hike: We Have "Right To Make A Profit"

Bank of America has taken a lot of flack over the bank’s decision to levy a $5 monthly fee on debit card holders. Now the CEO is firing right back. [More]

Citi Jacks Up Monthly Fees And Minimum Balance Requirements For Checking Accounts

While Bank of America is inflaming consumers’ anger by saying it will soon start charging some debit card customers a monthly fee, the people at Citibank have been busy figuring out just how much to inflate the monthly fees and balance minimums for many of their checking account customers. [More]

Citibank Jacks Up Monthly Fees On Checking Accounts

Citibank sent customers a letter informing them that starting in December, they’re raising monthly fees on checking accounts, in some cases by double. [More]

DirecTV Promises No Extra Fees, Then Charges $10 Monthly Fee

After a recent move, Vincent signed up with DirecTV for his television-beaming needs. A sales representative quoted him a price, then assured him that no, there would be no extra fees on top of that. No one will be surprised at what happened next: a $10 per month HD fee appeared on his monthly bill. The person who originally signed him up refunded the fee and called it an “error.” But it didn’t go away with his next bill. Or ever. [More]

It Could Now Cost You Over $400 To Check A Bag On Some Flights

Fees for checked bags vary wildly, from absolutely nothing to arm-and-a-leg-and-an-ear. And according to a new round-up of fees from the various carriers, you might need to throw another limb in there if you’re checking an oversize bag on your international flight. [More]

What New Fees Have You Seen Popping Up On Your Bank Statements?

As we’ve reported numerous times during the last year, many banks have been planning to fight new financial regulations and swipe fee reforms by tacking on a host of new fees for everything from getting a paper statement to talking to a human being at the bank to closing an account. Now our corporate cousins at Consumer Reports want to hear from you about which ones have been creeping their way into your bank statements. [More]

AT&T CSR: We'll Probably Refund Your Minimum-Use Fees If You Ask

Yesterday, we wrote about a new “minimum use” fee AT&T was charging to landline customers without long-distance service plans. Per the official company line, the only way to get around the fee is to make the equivalent amount in long-distance calls or pay another fee to remove access to long-distance from your account. But a CSR from AT&T tells Consumerist that you can probably get the fees credited back to your account if you just ask. [More]

U.S. Airways CEO: We Don't Overcharge, We Pass On Costs

If any of you had some sort of pipe dream that there might be a day when airlines wouldn’t charge ancillary fees for services that used to be included in the ticket price, U.S. Airways CEO Doug Parker has made it clear the charges aren’t going anywhere because they benefit everyone in the long run. [More]

How Should Banks Notify Paperless Statement Customers Of Changes?

When a growing number of bank customers go paperless and statement-free, is notifying them of new fees or policy changes only on their statements enough? Becky doesn’t think so. She’s annoyed that Key Bank instituted a $9 per month fee on some accounts recently, but only announced it on the statements that, thanks to online banking, she has no reason to pay attention to. [More]

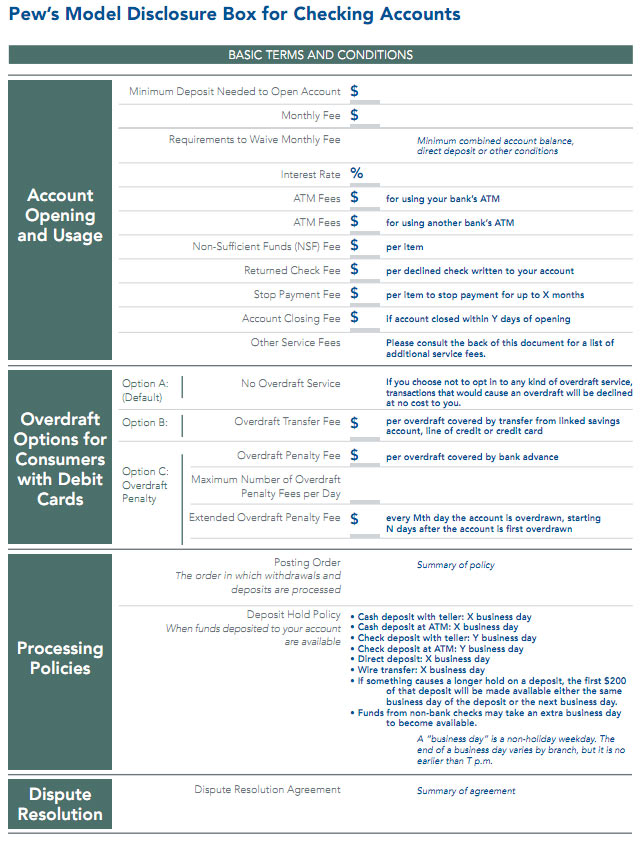

Wouldn't It Be Nice To Find Out Your Checking Fees With A One-Pager Like This?

Wouldn’t it be really cool if your checking account disclosure form looked like this nice one-pager the Pew Research Group mocked up? Naw, just kidding. We know you love reading paragraphs of tiny text that have the important clauses buried in the middle of longer sentences. Playing a scavenger hunt to find out what fees you have to pay is part of the fun of having a checking account! [More]

Bank Of New York Charges Some Big-Time Clients Fees For Making Cash Deposits

Some clients who are considering making large cash deposits to the Bank of New York Mellon will have to pay for the privilege of doing so. Responding to huge cash deposits from freaked-out customers who are fearful of losing their money in the market, the bank will charge 0.13 percent for accepting high-dollar deposits some accounts. [More]