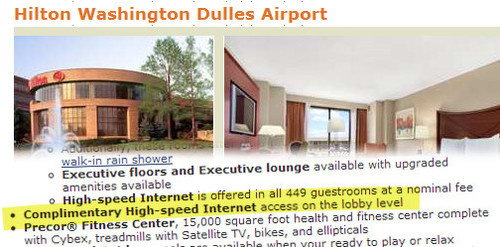

At Hilton Washington Dulles Airport hotel, everything is complimentary! That’s because to them “complimentary” actually means “for a price.” Last week, a linguistics professor tried to take advantage of their “Complimentary High-speed Internet access on the lobby level,” which is how they describe the service on their website. He quickly discovered that he’d have to agree to a $9.99 charge in order to get the free service.

fees

Capital One: Waive Your Rights, Get $10 Off Your Next Overlimit Fee!

Everett says Capital One called him up and made him an offer. If he opted out of at least one of the consumer credit protections enacted by the CARD act, Capital One would drop the overlimit fees from $39 to $29! Woo!

Airlines Could Start Charging Extra For Credit Cards

Could extra fees for using a credit card to pay become the airline industry’s hot new trend?

Wachovia's "Way2Save" Account Triggers Over $5,000 In Penalty Fees

Wachovia has a new financial product called Way2Save that automatically moves $1 from your checking account into a high interest personal savings account every time you make an electronic bill payment. Susan tried to maximize her contributions by making a lot of little bill payments, but Wachovia cut off access to her funds without notice and triggered an avalanche of penalty fees. Now she owes over $5,000 to her credit card companies, far more than she would likely have ever earned through Wachovia’s complicated savings program, and of course Wachovia is denying any responsibility.

No Visa Or MasterCard Gift Cards This Year, Please

If you want to spread some fiscally sound good cheer this year, consider asking your friends, relatives, and coworkers not to give gift cards backed by the major credit card companies. Why am I making such a sour suggestion? Because a new study from two consumer advocacy groups indicates that most of the population still doesn’t recognize what a money trap those little plastic cards can be.

Bank Of America Uses Temporary Hold To Trigger Overdraft Fee?

Bank of America got so fee crazy last week that it applied a $10 overdraft fee to Christopher’s account even though it wasn’t overdrafted. I went back and forth with Christopher to try to figure out what BoA could have done to trigger this, but as you can see from the screen cap below, he only had two debits on the day of the event.

24 Hour Fitness Sued For Charging Ex-Customers Fees

The gym chain made famous on NBC’s “Biggest Loser” is being sued for continuing to debit the bank accounts of customers who have canceled their memberships. The US Court of Appeals, Ninth Circuit, has given the green light to a class action lawsuit that says the chain is violating both the RICO Act and the Electronic Funds Transfer Act by keeping these zombie memberships active.

Bank Of America Will Introduce Annual Fees Next Year On Some Cards

Bank of America has announced that it plans on “testing” annual fees on some of its reward cards starting next year. The odds are good you won’t see this—a BoA spokeswoman says it will only be tested on 1 percent of accounts globally—but who knows? Maybe the BoA Fairy will smack you down.

Capital One Invents Its Own Christmas Creep, Raises Interest Rate On December 26th

When Wally first got his Capital One credit card, the interest rate was 12 percent. Then they raised it to 22.9 percent. Now they’re going to raise it again—the day after Christmas—to 25.9 percent.

Expect Airlines To Keep Hiking Ticket Prices As Holidays Approach

This year it’s a seller’s market when it comes to buying airline tickets, reports the New York Times, so if you must travel via plane, buy early and try to be as flexible as possible.

More Airlines Add $10 Travel Surcharge To More Holidays

Since consumers didn’t whine too much about the addition of $10 “just because” fees airlines imposed on busy travel days, they’ve added fees on more days. Goody for us!

The Consumer Financial Protection Agency And You

Legislation to create a Consumer Financial Protection Agency (CFPA) is making its way through Congress. Interested parties have spoken out (“It sucks!” “It’s awesome!“). Now the White House wants to know what you think.

Prepaid Debit Cards Are Money Sucking Black Holes In Your Pocket

Be very careful about activating any sort of over-the-counter prepaid debit card, reports the New York Times. They looked at a handful of prepaids currently on the market and discovered ridiculously high hidden fees—the first two months of use can cost you up to $80.

Consumerist: Better Than Your Dad (At Fighting Bank Of America)

Sometimes, your dad’s advice doesn’t apply anymore. Companies have realized that giving a damn is too expensive. That’s when it’s time to kick ass, Consumerist style. Craig writes:

Frontier Communications Has To Pay Back Early Termination Fees

If you signed up for Frontier Communications’ Price Protection Plan—a combo phone and broadband package—between January 2007 and September 2008, and you canceled the agreement and were charged an early termination fee (ETF), you may be getting some cash back.

Overdraft Fees Up 35% In Past Two Years

As a nation, we pay more each year in overdraft fees than we do for books, cereal, or fresh vegetables, says the Center for Responsible Lending (CRL)—and considering how outrageously expensive cereal is, they must be talking about a huge sum. They are: “Banks and credit unions collected nearly $24 billion in overdraft fees last year, an increase of 35 percent from just two years earlier.”

Your New Computer's Free Windows 7 Upgrade? Not So Free, Actually

Not many people really want a computer with Windows Vista. The sensible thing for customers who need a computer—but not right away—to do is wait until the launch of Windows 7 and then buy a computer with the much-awaited OS pre-installed. Vendors realize this, and are trying to get Vista-laden machines off their shelves with the promise of a free upgrade to Windows 7 when it comes out. A free upgrade that is not, in fact, free.