Every once in a while government agencies team up to take down unscrupulous operations that prey on financially vulnerable consumers. Such was the case this week when the Consumer Financial Protection Bureau and the Federal Trade Commission took action against a mortgage servicer that engaged in a assortment of deceptive practices often resulting in consumers losing their homes. [More]

federal trade commission

FTC Temporarily Halts Deceptive Practices Of Mortgage Relief Operation

The Federal Trade Commission continued its crackdown of deceptive mortgage relief companies this week as a federal court granted the agency’s request to temporarily halt a Los Angeles-based company that charged consumers excessive upfront fees for services they never performed. [More]

Dollar Tree, Family Dollar Expected To Close 340 Stores For Merger Approval

When Family Dollar accepted Dollar Tree’s proposal for a merger in January, the two companies estimated the deal would require the closing of no more than 300 stores. As federal regulators get closer to putting their stamp of approval on the dollar store marriage, they’re adding a few more stores to the chopping block. [More]

Company That Marketed Weight-Loss Products With Fake News Sites Must Return $11.9M To Consumers

UPDATE: The Federal Trade Commission has revised the judgement amount that LeadClick Media must return to consumers. The company must provide $11.9 million in redress, down from the previous judgement of $16 million. The $4.1 million previously ordered to be surrendered by CoreLogic was actually part of the total $11.9 million that the company was ordered to pay, an FTC representative tells Consumerist. The headline and text below have been updated to accurately reflect this revised figure.

The Federal Trade Commission’s crackdown on deceptive weight-loss marketers continued today, as the agency announced an affiliate marketing network and its parent company must return $11.9 million to consumers who were lured into purchasing a range of weight-loss products through fake news websites. [More]

FTC Shuts Down Credit Repair Business Masquerading As The Federal Trade Commission

Fraudsters have been known to scam unsuspecting consumers by claiming to be agents with the federal government. So, in a bit of poetic justice, the Federal Trade Commission had a hand in shutting down a business calling itself the “FTC Credit Solutions.” [More]

BMW Settles FTC Charges That It Required Consumers To Use Specific Parts, Service Centers Or Lose Warranties

Under federal law, car manufactures are prohibited from threatening to revoke vehicle warranties based on where a consumer chooses to have their vehicle fixed. Apparently, a division of BMW didn’t follow that rule and now must change its practices to resolve charges from federal regulators. [More]

FTC Report Alleges Google Used Anti-Competitive Practices Prior To 2013

When conducting a search on Google, consumers have a reasonable expectation that results will show a variety of options related to their inquiry. But a recently disclosed report shows that wasn’t always the case. [More]

FTC Orders Company That Swindled Tens Of Millions From Seniors To Pay $10M Judgment

We’ve said it too many times to count at this point, but scammers who take advantage of senior citizens are the worst. Today, the Federal Trade Commission made sure there was one less scammer out there by permanently barring the mastermind behind a multi-million dollar fraud from all future telemarketing activities. [More]

Marketer Of Snuggies, Perfect Brownie Pans, Others Must Pay $8M For Allegedly Deceiving Consumers

The marketer of popular “as-seen-on-TV” products such as Snuggies, Magic Mesh door covers and Perfect Brownie Pans must pay $8 million to resolve federal and state charges it deceived consumers with promises of buy-one-get-one-free promotions and then charged exorbitant fees for processing and handling, nearly doubling the cost of the products. [More]

‘Microsoft Tech Support’ Phone Scammer Threatens To Cut Man Into Little Pieces & Throw Them Into River

We already know that scammers use a variety of unsavory tactics when trying to take advantage of consumers; from impersonating federal agents to threatening jail time. But an alleged fraudster of the so-called “Microsoft Tech Support” scam took things to a decidedly nastier level when his hustle began to unravel. [More]

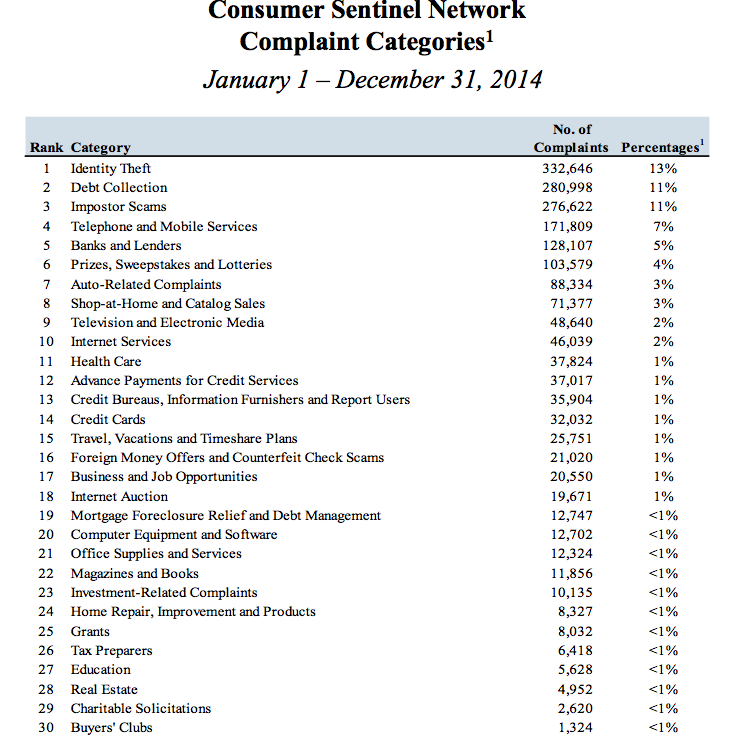

Consumers Lost $1.7B To Scams In 2014, Imposter Crimes On The Rise

For the 15th consecutive year, identity theft topped the Federal Trade Commission’s list of top consumer complaints. But its reign could be coming to an end following a significant increase in the number of scams in which con artists impersonating government agents and law enforcement personnel part consumers from their money.

[More]

Feds & NY Attorney General Team Up To Sue Abusive Debt Collectors

Just like one of those action movies where a federal agent gets paired up with a small-town sheriff who knows all the bad guys in the area, the Federal Trade Commission has brought its crackdown on abusive debt collectors to New York and partnered with the Empire State’s attorney general to shut down a pair of unsavory operators. [More]

Privacy Advocates Call For Investigation Into Samsung Smart TVs

Samsung’s Smart TVs have come under scrutiny recently after people learned the company’s privacy policy hinted that things we say within earshot of our televisions may be recorded and uploaded to third-party transcription services. While executives for the company have worked to calm people’s fears, a privacy group is now asked federal regulators to take a look into the matter. [More]

SCOTUS: Dentists Can’t Bar Other Businesses From Offering Teeth-Whitening Services

When you want to get your pearly whites professionally polished to their pearliest and whitest, going to the dentist doesn’t have to be the only option, the Supreme Court of the United States ruled today. The justices had looked at a case brought by the Federal Trade Commission against a North Carolina state board dominated by dentists that the agency said had unlawfully excluded non-dentists from teeth-whitening services. [More]