It’s probably safe to assume that consumers stuck in the payday loan debt-trap have enough financial issues without being deceived by a company promising to make their debts disappear. There may be one less unsavory debt relief company around after the Federal Trade Commission sued to stop an operation that targeted millions of consumers. [More]

federal trade commission

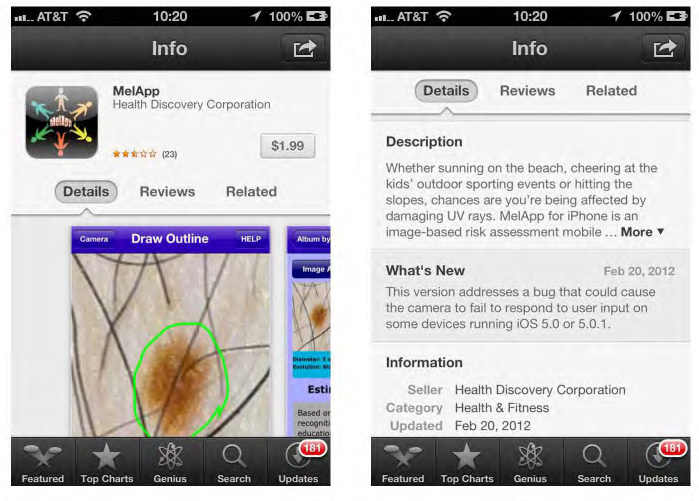

Feds Warn: These Melanoma Detection Apps Aren’t Supported By Scientific Evidence

Early detection of cancer can help save lives and make treatment easier, so the idea of mobile app that can spot possible skin might seem like a godsend… if there were any science to back it up. [More]

FTC: No Scientific Proof That Mosquito Shield Bands Actually Work

Mint oil smells very nice, but the marketing materials for Viatek’s Mosquito Shield Bands claimed that the plant substance can do more than perfume the air. Their plastic bands were supposed to use the oil to create a 5-foot mosquito-free zone around the wearer. Do they work? No, the Federal Trade Commission says. Not really. [More]

FTC Challenges Sysco Acquisition Of US Foods

Sysco’s in-person meetings with the Federal Trade Commission didn’t have the desired effect. The foodservice supply giant wanted approval for its planned acquisition of competitor U.S. Foods, but the FTC thinks that Sysco wants to gobble up too much of the market. The commissioners voted 3-2 to block the merger. [More]

Sysco Meets With FTC Over Foodservice Voltron Proposal

Way back in 2013, we shared the news that Sysco, the country’s biggest supplier to restaurants and other food-service facilities, wanted to acquire its next-biggest competitor, US Foods. Yet the Federal Trade Commission still hasn’t come to a decision about that proposal. FTC officials don’t agree on the question of whether Sysco plans to sell enough of its business to make sure the restaurant supply business stays competitive. [More]

FTC Orders Sweepstakes Promoter To Pay $9.5M For Deceiving Consumers…Again

Just like some people have a habit of entering as many sweepstakes as possible, some scammers can’t break their addiction to promoting bogus sweepstakes. Just ask the woman who now must pay $9.5 million because she continued pushing fake sweepstakes even after being caught by the feds. [More]

Mortgage Relief Pitchmen Settle FTC Charges Of Deceiving Consumers, Collecting Illegal Fees

When seeking to refinance or modify a home loan, consumer advocates urge consumers to seek assistance from professionals that have no financial stake in the outcome. However, that doesn’t appear to be the case for a group of pitchmen who have agreed to settle Federal Trade Commission charges they conned consumers into paying hefty fees for worthless mortgage relief services. [More]

Appeals Court Sides With FTC In POM Wonderful False Advertising Case

The Federal Trade Commission hasn’t let the bee out of its bonnet over health claims made by POM Wonderful that it says amount to deceptive advertising, having kept on the company’s case since 2010. Now, eight months after POM made its case before a federal appeals court that it’s not being misleading about the things its juice can do, the court is siding with the FTC. [More]

Feds Take Action Against Pair Of Deceptive Auto Title Lenders

When it comes to short-term, high-interest loans, payday lenders may get most of the headlines, but auto title loans can be just as perilous for borrowers, especially when the lenders use deceptive marketing. This morning, the Federal Trade Commission announced its first ever legal actions involving title loan operations that misled borrowers. [More]

FTC Requires Safeway, Albertsons To Sell 168 Stores Before Completing $9.2B Merger

Last March Albertsons supermarket owners Cerberus Capital Management and AB Acquisition LLC announced that they would acquire the Safeway chain of stores in a merger valued at more than $9 billion, but as with most deals of such magnitude, the new coupling between the second- and fifth-largest grocers in the United States had to pass regulatory muster before they could proceed down the aisle. Today, the chains announced they would sell 168 stores in eight states in order to make their matrimonial dreams a reality. [More]

Marketers Of Green Coffee Bean Weight-Loss Products Must Refund $9M

By now we should all be fairly familiar with the saga of Dr. Oz, the supposed “miracle” weight-loss benefits of green coffee bean extract, and the Federal Trade Commission’s mission to put a stop to the craze by shutting down marketers and online sellers that created fake news sites, fake reporters and relied on bogus studies to sell the product. The Commission’s work continued Monday when one such company agreed to pay $9 million in consumer redress to settle charges of deceptively marketing the products. [More]

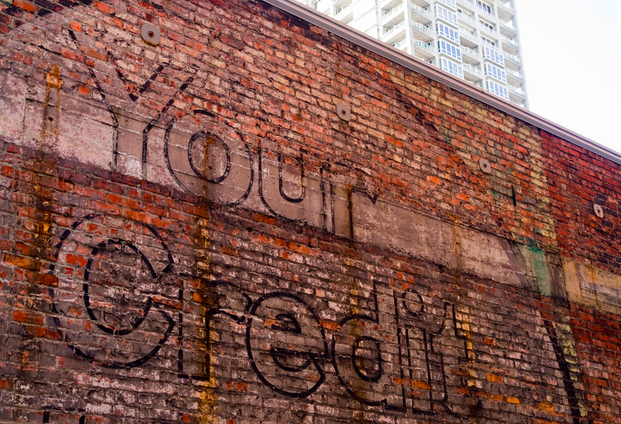

FTC: Credit Report Errors Continuing To Linger Years After Being Found

Two years ago, a Federal Trade Commission study found a surprisingly large percentage of consumers had discovered, and had corrected, errors on their credit reports. There were also several people who believed there were errors with their reports but had not yet reached a resolution. A new follow-up study from the FTC finds that nearly 70% of these disputes from 2012 are still unresolved. [More]

Dish Found Liable For Tens Of Millions Of Calls In Violation Of Federal Telemarketing Rules

More than five years after being sued by the Federal Trade Commission for years of allegedly illegal telemarketing calls, Dish Network has been held liable by a federal court in Illinois for tens of millions of calls made in violation of the Telemarketing Sales Rule (TSR) beginning as far back as 2007.

[More]

Online Payday Lending Companies To Pay $21 Million To Settle Deception Charges, Must Waive $285M In Loans

It’s no secret that payday lending companies charge high interest rates and a butt-load of fees for their small dollar, short-term loans. Payday lending companies break federal laws by not being upfront about the often highly inflated fees they charge. The FTC today jumped in to block two online payday lending companies from preying on consumers with the highest fine ever levied against a payday lender. [More]

Family Dollar Urges Shareholders To Take Dollar Tree Deal, Call Proposal A “Virtual Certainty”

Just weeks after Family Dollar appeared to show a change of heart in the months-long dollar store soap opera, officials with the company are once again pushing for approval of a deal with smaller rival Dollar Tree despite a heftier bid by Dollar General. [More]

Yelp Says That The FTC Investigation Of Yelp Is Complete

The Federal Trade Commission has received a lot of complaints about Yelp––more than 2,000 from 2008 through last spring. These led to what Yelp calls “a deep inquiry into our business practices” by the FTC, which has lasted almost a year. Today, Yelp announced that the feds have closed their investigation, and won’t be taking any action against Yelp regarding its business practices. [More]

FTC, State Of Florida Shut Down Deceptive Online Directory Companies, Order $1.7M In Redress

For a small business owner trying to reach customers, advertising in an online directory might sound like a good idea. But there are also scammers out there looking to take advantage of these businesses by charging them for directory listings that never materialize. Just ask the victims of two “directory” operators that allegedly bilked millions of dollars from small businesses. [More]

T-Mobile Agrees To Pay $112.5M To Settle FTC Mobile-Cramming Lawsuit

Rounding out a week punctuated by new accusations of mobile carriers overcharging consumers using a practice known as “bill-cramming,” one past lawsuit is being put to rest. T-Mobile agreed today to shell-out at least $112.5 million to settle a Federal Trade Commission lawsuit that the “Un-carrier” tacked-on unwanted third-party charges to customer’s bills. [More]