In a move meant to ease uncertainty in the markets, the Federal Reserve pledged to keep interest rates low for the next two years. The Fed’s target rates, which banks use to set loan rates, have been close to zero since 2008, and previously said they would stay there for “an extended period.” The two-year designation is a sign that the Fed expects the economy to remain in troubled waters until at least 2013. [More]

federal reserve

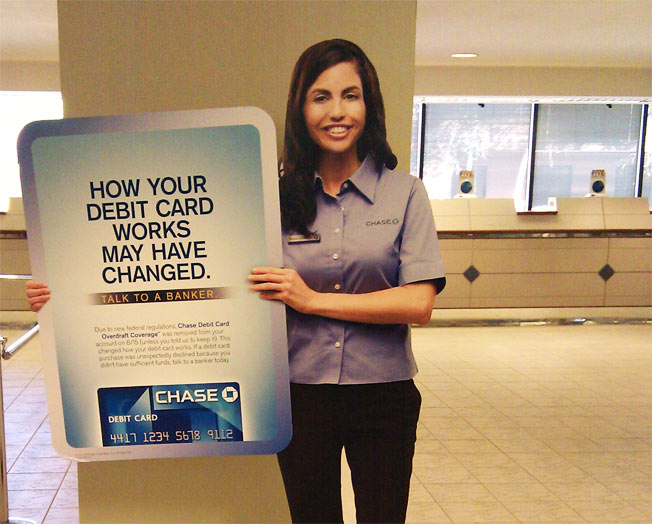

Long-Awaited Fed Ruling Caps Swipe Fees At 21 Cents

The Federal Reserve unveiled its ruling today on the fees banks can charge merchants for processing debit cards at 21 cents a swipe. The cap is far less restrictive than the 12 cent ceiling set by the Dodd-Frank bill, but is still less than the current 44 cent average. It’s uncertain how this will affect the consumer. [More]

Fed: Economic Recovery Not Happening As Quickly As Expected

While some of us have managed to go back to our pre-bust ways of eating gold-dusted diamonds and speculating on real estate, the Federal Reserve said today that the overall economic recovery hasn’t moved as swiftly as it had previously expected. [More]

Banks Back In Business Of Lending Money, People Back To Borrowing

The New York Federal Reserve just issued its latest quarterly Household Debt & Credit report — which looks at the state of mortgages, home equity borrowing, auto loans and credit cars — and, for the first time in a few years, there are a number of not-so-bad things to say about things. [More]

Goldman Actually Borrowed From Fed Discount Window 5 Times, Contradicting Bank Claims

Looks like Goldman has been a more frequent visitor to the Federal trough than they’ve been letting on. Despite testifying before Congress that they had only accessed the Federal Reserve’s discount window, which lets banks borrow cash from the government quickly and on favorable terms, just once, Bloomberg reports that recently released data shows they actually took at least five overnight loans from the Fed between September 2008 and 2010. [More]

Why Banks Threatening To Limit Debit Card Swipes To $50 Is Horrible, And Hooey

As I mentioned on Friday, because the banks are pissed off, pretty soon you might not be able to pay for a restaurant meal or pay for groceries on your debit card. The banks are considering putting a $50-$100 cap on how much you can buy per transaction with a debit card. First, I think they’re bluffing. But, if they really followed through on it, this would seriously disrupt commerce across America. Let me paint you a picture of hypothetical supermarket checkout line. [More]

Banks Might Limit Amount You Can Buy On Debit Card

Grumbling over proposed limits to debit card swipe fees, banks are hinting they’re considering putting a cap on how much you can buy with a debit card. It could even be something like $50 or $100, forcing consumers to either pay with credit card or cash. [More]

Fed Might Rethink Capping Debit Card Swipe Fees

The Fed told Congress yesterday that it might rethink the plan to cap debit card swipe fees at 12 cents per swipe. One of the hopes is that merchants would be able to pass on the reduced costs to consumers in the form of lower prices. Lawmakers piled on in the hearing, saying that it would “batter banks still reeling from the 2008 financial crisis.” How banks can both be posting soaring profits and still be “battered” and reeling is an accounting trick way over my head. [More]

Bernake Says Unemployment To Stay "Elevated"

Federal Reserve Chairman Ben S. Bernanke testified before the House Budget Committee today that he expects unemployment to “remain elevated” “for some time.” So if you were putting your job search on the back burner, thinking, “oh, I’ll just try harder when the economy gets better,” it might be time to reevaluate that strategy. [More]

Govt Misprints Ton Of New $100s

A printing error on the fancy new $100 bills means that nearly a billion are in storage until the government figures out how many to destroy. The paper got creased during printing, leaving a portion of Franklin’s face uninked. It’s a $110 billion boo-boo! [More]

Animated Pig Bunnies Explain Quantitative Easing

Still don’t understand quantitative easing? Is it really just “printing money” or something more subtle? These animated xtranormal pig bunnies seem to have a grasp, at least judging by the millions of hits this movie of them explaining it has gotten. “The only thing deflating is the Fed’s credibility,” says one pig bunny to the other. [More]

Fed Clamps Down On Credit Card Loopholes

To shut down “fee harvesters” and other crafty tricks credit cards cooked up to escape the CARD act, the Federal Reserve has proposed three ways to tighten and clarify the rules. [More]

Um, Just What The Heck Is Quantitative Easing And Why Are We Doing It?

There’s been a lot of talk over the last few days about “quantitative easing,” but if you’re wondering what it is and why it matters — you’re not alone. Long story short — it’s a way for the Fed to create money out of thin air. [More]

Do We Need A Little Inflation To Get The Economy Moving?

Inflation is good, at the right time, and in moderate amounts. Like adding just a smidge during a recession when there’s a lot of people in debt. Knowing that prices will rise, some consumers and businesses are prodded to crack open their pocketbooks. The value of debts drop, easing the burden on strapped borrowers. Having used up a lot of options already, the Fed could slightly raise its inflation target and let prices slowly rise over the next few years, but they’re unlikely to announce anything remotely close to that in their meeting this week. Namely because people really really really hate inflation. Why is that? [More]

Fed Votes To Buy Up Treasuries, Keep Mortgage Rates Low

The Fed voted Tuesday to reinvest expiring mortgage-backed securities by putting the money into longer-term Treasuries. That, and the decision to keep rates at 0 to 1/4 percent, should keep mortgage rates low. Here’s the full statement following their coffee klatsch: [More]

Study: American Express Has Most Obtuse Penalty APR Polices

If you’re gonna get kicked in the pants, wouldn’t you at least like to know why? Well, American Express is the least clear in how they communicate their penalty interest rate policies, a new Card Hub survey finds. [More]

Hunt Down Your Credit Card Contract Online

Hey, you can now look up your credit card contract online. There’s a searchable database over at the Federal Reserve that lets you check them out in both text and PDF form. [More]

Credit Cards Limits Reduced Based On What You Bought, Where You Bought It

New insight into how the credit card companies have been secretly judging us all has emerged in a new Federal Reserve report. From Nov ’06-Nov ’09, some credit card companies admit to using more than just the usual income, credit and repayment history to evaluate if they should reduce your line of credit or raise rates. Yep, they’re looking at where you shop. [More]