Workers at a Target store in Valley Stream, N.Y. voted against unionization, but the union has vowed to try again, alleging the retailer illegally intimidated workers. [More]

economy

Wells Fargo Is Next Bank To Dump Reverse-Mortgages

Wells Fargo is the next bank to announce that they are pulling out of the market of selling reverse-mortgages, a loan typically sold to to seniors that converts their home equity into a stream of monthly payments. The lender gets paid when the home is sold at the borrower’s death or when they move. Without reliably rising home values, it’s not a very profitable proposition for lenders. [More]

Top 10 Dying US Industries Revealed

If you work in one of these fields, it might be time to start buffing your resume and taking night classes. [More]

Credit Card Reform Worked: Prices Not Increased, Just Clearer

Ignore all the haters. Credit card reform in 2009 did its job, making credit cards less confusing and safer for consumers. According to a new study from the Center for Responsible Lending, contrary to popular misconception, the reforms didn’t increase prices for credit cards, it just made the real costs clearer. Banks couldn’t tuck costs in hidden fees and sneaky practices, they had to put them on the sign out front. [More]

Why Unemployment Rising To 9.1% Is Good News

The newly released US jobs report shows the unemployment rate rising to 9.1% for May, the highest it’s been all year. On the face of it that looks like a faltering recovery. But hidden in this raw number is good news. [More]

When Should You Strategically Default?

Homeowners who owe more on their house than it’s worth face a dilemma. Should I stay or should I go now? Suze Orman tells CBS Sacramento’s Call Kurtis that those folks need to take a hard look at the value of their homes and make a tough decision. “If you own a home that is 50% underwater, 70% underwater, it will never ever, ever come back to where you purchased it.” she said. [More]

McDonald's Hires 62,000 At Job Event, Turns Down 938,000

McDonald’s reports that it has hired 62,000 people who applied during its April 19 nationwide job event. If that sounds like a lot of people who want to work at McDonald’s, get a load of this number. They say they got over a million applications, meaning they turned down over 938,000 wanna-be burger flippers. [More]

Bin Laden's Death Greeted By Falling Oil Prices, Market Gains

Looks like the death of Osama Bin Laden this Sunday took some “fear factor” out of markets, which greeted the news favorably. Pressure at the pump could be relieved a bit with oil falling 0.7% to $113.23. Gains were seen across several markets, with the Dow Jones up .5%, the S&P up 5 points and the Nasdaq moving forward 7 points. However the surge could evaporate easily, even by end of day, as the euphoria wears off. And if Bin Laden’s death leads to retaliatory attacks, you can be sure those gains will be erased, and then some. [More]

Walmart CEO: Our Customers Are Running Out Of Cash

Walmart CEO Mike Duke says the company is continuing to slash prices, but the chain’s quest to remain the cheapest big-box store may not matter to many of its customers, who are running out of money faster than usual, thanks to higher gas prices and the sluggish economy. [More]

When The Economy Gets Worse, People Shake Babies More

When the going gets tough, the weak get going on their babies. A new study finds a rise in “shaken baby syndrome” correlates with economic downturns. At one hospital, the number of babies that were hospitalized for what is known as “non-accidental head trauma” doubled during th recession. [More]

Regulators Hatch Plan To Pay Back Victims Of Bad And Illegal Foreclosures

It’s no secret that foreclosures in America have been a royal mess. Missing paperwork, faked documents, turbo-charged courts that just rubberstamp foreclosure orders, robosigners, the list goes on. Along the way, a number of homeowners have gotten foreclosed on improperly and, in some cases, even illegally. So regulators are putting together a plan for grand-scale recompense. They’ve laid down decrees that servicers have to start following the law, for really reals this time, banks need to hire outside firms to review their foreclosure actions between 2009 and 2010, and then pay back their victims. [More]

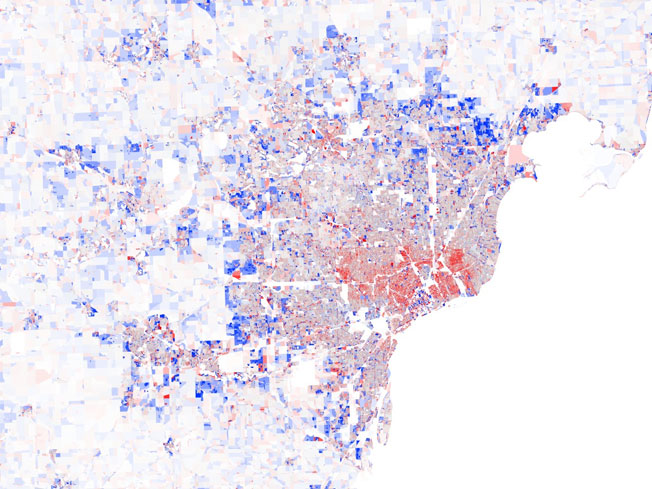

These Sweet Population Maps Make White Flight Look Pretty

Here’s a series of really nice-looking maps Datapointed made to visualize the 2000-2010 US Census data released this year. The bluer an area, the more people it gained. The redder an area, the more it lost. In the series of maps across America you’ll see urban centers surrounded by a blossom of red, ringed by a halo of blue. It’s the classic “flight to the suburbs” playing out. But one interesting development is the core of cobalt at the heart of these cities where downtown addresses have become in-demand again. Even beleaguered Detroit, as seen in this graph, is showing glimmers of a comeback in its most central neighbs. [More]

Is The 30-Year Mortgage On Death Row?

Plans are in the works to dismantle Fannie Mae and Freddie Mac, and that could mean that what many Americans had assumed came fourth after “life, liberty and the pursuit of happiness,” the 30-year mortgage, could be on the outs. [More]

Report: Retailers Plan To Expand Faster Than Last Year

The stock market and gross domestic product may say the recession is over, but as long as the unemployment rate hovers near double-digits, it’s tough to believe things are going well. A report on the retail industry reveals businesses are set to improve the job market with strong expansion plans this year. [More]

Survey: More Americans Will Blow Their Tax Refunds This Year

A retail trade industry survey finds more Americans plan to put the “fun” in “tax refund” this year. [More]

Intel Says It Will Add Thousands Of Workers This Year

It’s a buyer’s market for any corporation looking to stock up on talent. Intel is one of all too few businesses taking advantage of increasingly desperate job seekers, announcing it will add 4,000 workers in the U.S. this year. [More]

Even Nice Cities Not Safe From Housing Meltdown Anymore

NYT reports that the real estate crashdown isn’t just limited to Potemkin-village style build-n-flip hotspots like Vegas and and Florida. That’s just where it started. The giant needle of bubble popping is plunging through Seattle, where prices are down 30% from last year, and is making swift work of Minneapolis and Atlanta. One expert predicts prices could drop another 5 or 7% nationwide. Get out the dramamine, it’s double-dip time. [More]