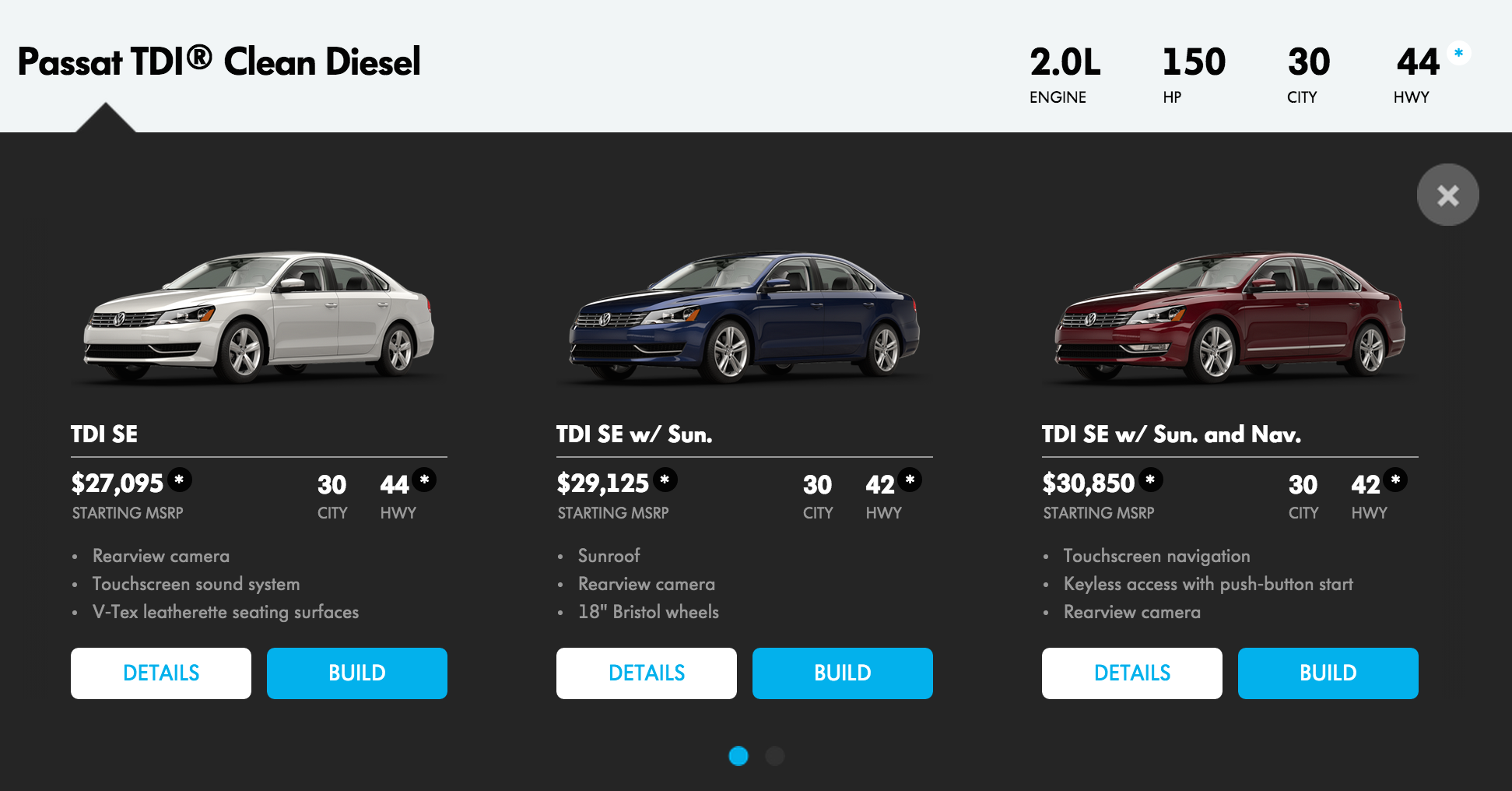

Just a day after the Department of Justice filed a potential multibillion-dollar civil lawsuit against Volkswagen for installing so-called “defeat devices” in vehicles to skirt federal emissions standards, a new report says that the German automaker has run into difficulties finding a fix for the nearly 500,000 affected “clean diesel” cars in the U.S. [More]

department of justice

U.S. Files Civil Lawsuit Against Volkswagen Over Emissions Scandal

It may be a new year, but that doesn’t mean Volkswagen can wash its hands of the ongoing diesel emissions scandal affecting 11 million vehicles. Today, the U.S. Dept. of Justice filed a civil lawsuit against the carmaker over its use of “defeat devices” to cheat on emissions tests.

10 States Investigating Movie Theater Chains Over Antitrust Violations

You know how it’s almost impossible to ever see one of those big blockbuster films showing at the little movie theater down the street? That issue is largely the result of exclusive agreements between large theater chains and film studios that effectively prevent independent rivals from showing certain films. While these deals might be great for the bigger companies, they aren’t so awesome for consumers. And so, 10 state attorneys general are looking into whether or not the contracts used by Regal Cinemas, AMC Entertainment, and Cinemark constitute antitrust violations. [More]

McDonald’s Will Pay $355K To Settle Claims That It Discriminated Against Immigrant Workers

McDonald’s has agreed to pay $355,000 in civil penalties as part of a settlement with the U.S. Justice Department, to resolve claims that the company discriminated against legal immigrants in the workplace. [More]

UPDATE: For-Profit Education Company EDMC Agrees To Pay $95.5M To Settle Fraud, Recruitment Violations

UPDATE: Education Management Corporation, the operator of for-profit college chains such as Brown Mackie College, Argosy University and the Art Institutes, will pay $95.5 million to settle claims it violated state and federal False Claims Act (FCA) provisions regarding its recruiting practices. [More]

DOJ Sues To Stop United And Delta From Swapping Slots At NYC-Area Airports

When two major companies decide to get along, it’s not quite so simple as exchanging friendship bracelets — each side usually sees some benefit. For example, airlines United and Delta want to get friendly, so they’ve agreed to swap slots at two New York City-area airports. One hitch, however, is that the United States Department of Justice isn’t a fan of the plan. [More]

More Trouble For ITT Education Services: Agency Restricts For-Profit’s Use Of Federal Student Aid

Just a month after for-profit college operator ITT Education Services announced it had become the focus of a federal fraud investigation, the Department of Education revealed it had placed restrictions on ITT Technical Institute’s use of federal grants and loans. [More]

Regulators Probing AB InBev Over Allegations Of Pushing Out Craft Brewers By Buying Distributors

Despite Anheuser-Busch InBev’s attempt in recent years to get drunk on craft beer by padding its portfolio with small brewers like Golden Road, Goose Island and Blue Point Brewery, among others, the beverage behemoth is in talks with federal regulators over allegations that its recent purchase of distributors is a calculated attempt to shut the door on increasingly popular craft brews. [More]

NJ-Based Bank Must Pay $33M To Settle Discriminatory Lending Charges

“Redlining” is the act of denying services, either directly or through selectively raising prices, to residents of a certain area based on race or ethnicity. Federal law prohibits creditors from this type of discrimination, but New Jersey-based Hudson City Savings Bank is now on the hook for a total of nearly $33 million for allegedly providing unequal access to credit in parts of four states. [More]

ITT Educational Services Target Of Federal Fraud Investigation

Things don’t appear to have gotten better for for-profit college operator ITT Educational Services since it announced in September 2014 that it was under increased scrutiny from federal regulators, as the owner of the ITT Technical Institute chain revealed on Monday that the Department of Justice is looking into whether the company defrauded the federal government. [More]

Report: Prosecutors, GM Reach $900M Agreement To Settle Criminal Charges Over Ignition Defect

Federal prosecutors are poised to settle a criminal investigation into General Motor’s mishandling of the ignition switch defect linked to more than 120 deaths and hundreds of injuries. [More]

Feds: Green Energy Ponzi Scheme Duped Consumers Out Of $54.5M

When someone makes a promise that seems too good to be true: like saying you’ll be “stinkin’, filthy rich” if you invest in their green energy technology, it’s a good idea to look into that proposition with a little more scrutiny. That kind of attractive, yet ultimately worthless deal cost consumers nearly $54.5 million, federal prosecutors say. [More]

Kmart Pays $1.4 Million To Settle Accusations Of Illegal Coupon Acceptance, Prescription Incentives

In most of the country, pharmacies can offer rewards points, coupons, or other inducements to get you to switch prescriptions to them. Not only is this illegal in certain states, it’s also illegal to offer these incentives to customers with health insurance through Medicaid. Kmart has settled allegations from a whistleblower that it did exactly that for customers with Medicaid, and accepted co-pay coupons for brand-name drugs for them. [More]

Man Charged With Operating Debt Collection Scheme That Targeted, Defrauded Spanish-Speaking Consumers

Deceiving consumers is a trademark for most unscrupulous operations attempting to collect debts that aren’t actually owed. Shady collectors have been known to lie about debts, misrepresent themselves as officers of the law, threaten lawsuits and, in the case of one operator, threaten Spanish-speaking residents with deportation. [More]

Sallie Mae Spinoff Navient Could Face CFPB Lawsuit Over Student Loans

In the short time since Navient – the nation’s largest student loan servicing company – spun off from Sallie Mae, the company has come under scrutiny for it allegedly unfair practices of overcharging and imposing excessive fees on consumers’ loans. While those practices resulted in a $97 million settlement with the Depts. of Education and Justice, and the Federal Deposit Insurance Corp, they could soon lead to a lawsuit from the Consumer Financial Protection Bureau. [More]