Volkswagen recently agreed to pay $15 billion to settle some of the allegations involving the carmaker’s use of so-called “defeat devices” to cheat on emissions tests in diesel cars, but a new report says federal criminal charges could be in the offing for VW. [More]

department of justice

For-Profit Educator Bridegepoint Education Under Investigation Over Federal Funding

Bridgepoint Education, the operator of for-profit colleges Ashford University and the University of the Rockies, added its name to the long list of higher education companies to find themselves on the receiving end of a federal investigation, as the Department of Justice has opened a probe into the organization’s federal student aid funding. [More]

Former Macy’s Employee Pleads Guilty To $3.5M Mail Fraud, Kickback Scheme

A Florida man could spend up to 30 years in prison after pleading guilty to taking part in a million-dollar, years-long shipping and kickback scheme involving his former employer Macy’s. [More]

Yuengling To Pay Nearly $10M To Settle Pollution Allegations

Facing federal allegations of violating the Clean Water Act, D.G. Yeungling and Son, the country’s oldest brewing company, has agreed to pay nearly $3 million in penalties and invest $7 million for improvements to its two breweries in Pennsylvania.

[More]

Accused Of Violating Clean Air Act, Trader Joe’s To Spend $2M To Cut Greenhouse Gas Emissions

Trader Joe’s will spend $2 million over the next three years to reduce the amount of greenhouse gases leaked from the refrigeration systems at its 453 stores nationwide in order to resolve federal allegations that the company violated the Clean Air Act. [More]

Fortune Teller Admits Stealing Millions From Clients For Lifting Curses

Whether or not you believe in dark curses or not, you shouldn’t be paying someone your hard-earned cash to lift them. The Department of Justice says the former owner of a fortune teller business in Virginia pled guilty in federal court to committing mail fraud and laundering more than $1 million she stole from her victims, after telling them she was clairvoyant and could see into the past and the future.

[More]

Feds Investigating Lending Club’s Loan Sales

A week after Lending Club’s CEO abruptly left the company, the peer-to-peer lending service disclosed that it had received a federal grand jury subpoena and warned investors it could soon face legal action. [More]

Former Wells Fargo Employee Claims Bank Defrauded Government Of $1.4B In Foreclosure Funding

There has been no shortage of lawsuits filed against Wells Fargo in recent years, from accusations the bank pushed mortgages on borrowers who couldn’t repay them to claims the company pressed employees to engage in fraudulent conduct with regard to customer accounts. Now, a recently unsealed whistleblower lawsuit melds together those issues, claiming the bank encouraged employees to withhold information from customers that could potentially lead to foreclosure proceedings. [More]

Daimler Reviewing U.S. Emissions Certification Process

Shortly after it was revealed that Volkswagen equipped 11 million diesel-engine vehicles worldwide with emissions-cheating “defeat devices,” rumors began swirling that similar irregularities were present in Daimler vehicles. While the carmaker hasn’t been accused of wrongdoing by regulators, it announced today that it would review its emissions certification process and investigate possibly issues. [More]

Goldman Sachs To Pay $5B To Settle Charges Of Selling Troubled Mortgages Ahead Of The Financial Crisis

Federal and state prosecutors are closing yet another chapter in its investigation related to banks’ roles in the financial crisis. To that end, Goldman Sachs has agreed to pay $5.06 billion to settle claims it misled mortgage bond investors during the period leading up to the crisis. [More]

Feds Sue To Halt Illegal Solar Panel Telemarketing Operation

It’s not against the law to tell people they might be able to save money by slapping some solar panels on their roofs. What is illegal is using millions of unauthorized calls to people on the Do Not Call list to sell those solar panels.

[More]

Whistleblower Lawsuit Claims University Of Phoenix Defrauded The Federal Government

You can now add the University of Phoenix and its parent company, Apollo Education Group, to the list of for-profit educators who find themselves on the defendant end of a whistleblower lawsuit. A former Phoenix employee is accusing the company of submitting false student aid information in order to receive federal funding it was not entitled to. [More]

Federal Court Enters Injunction Against Grower Of Listeria-Laden Sprouts

Back in 2014, we began asking whether everyone should just quit eating raw sprouts, and the sprout industry hasn’t done much to prove that we should since then. One of those companies that was part of the 2014 recalls apparently hasn’t cleaned up its metaphorical act and its literal sprouting facility, and the Food and Drug Administration went through the federal courts system went through the federal courts to stop them from sprouting until the company meets certain conditions. [More]

Timeshare Telemarketing Scam Bilked $25M From Consumers

Three Florida men pleaded guilty recently to assisting in an elaborate telemarketing operation that defrauded $25 million from timeshare owners in the U.S. and Canada. [More]

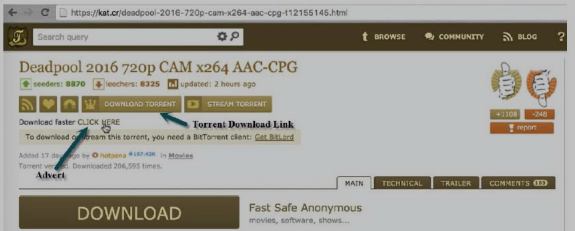

Feds Arrest Heads Of Two Massive Online Payday Loan Operations

Back in June 2014, Consumerist showed readers what might have been the scammiest payday loan we’d ever seen. Today, federal authorities arrested the man behind the company, AMG Services — along with his lawyer and another, unrelated, payday lender — for allegedly running online payday lending operations that exploited more than 5 million consumers. [More]

HSBC Must Pay $470M For Alleged Abusive Loan Practices

Thousands of homeowners who lost their homes or had their loans modified will receive a portion of a $470 million federal-state settlement with mortgage lender and servicer HSBC to settle allegations the bank engaged in origination, servicing, and foreclosure abuses. [More]

Toyota Must Pay $22M For Charging Higher Interest To Non-White Borrowers

Under the Equal Credit Opportunity Act, creditors are prohibited from discriminating against loan applicants based on race or national origin. But that was a rule Toyota’s financing unit allegedly violated, resulting in thousands of African-American, Asian and Pacific Islander borrowers paying higher interest rates than their white counterparts. Now, in an effort to resolve charges filed by the Consumer Financial Protection Bureau, Toyota Motor Credit Corporation must pay $21.9 million to wronged consumers. [More]