We loathe these Visa commercials. They show commerce going along like clockwork. People paying with their tap-and-go Visa card. Getting their donuts. Until one guy pay with cash. Everything screeches to a halt. He gets looks from the cashier and other customers.

debt

../../../..//2007/07/11/a-56-year-old-elementary-school-teachers/

A 56-year-old elementary school teacher’s story about how he got in— and out — of $61,000 in debt. [MySanAntonio via Blogging Away Debt]

12 Signs Of A Debt Addict

Do you have a problem with compulsive spending? Debtor’s Anonymous, yes, there is such a group, has 12 warning signs to watch out for.

../../../..//2007/07/10/the-7-myths-of-college/

The 7 myths of college financial aid (p.s. WSJ is free online today) [WSJ via AllFinancialMatters] (Photo: elle_rigby)

../../../..//2007/07/06/this-is-pretty-much-the/

This is pretty much the quintessence of how many people get stuck in debt (it was certainly true for us): “…we were spending more than we made because we thought we would make more money later to pay it off.”

../../../..//2007/07/06/networthiq-is-a-kinda-neat/

NetworthIQ is a kinda neat online service where you enter all your assets and debits by category and it gives you an aggregate personal finance “IQ” number to track over time. [via Poorer Than You]

../../../..//2007/07/04/the-richest-man-in-babylon/

The Richest Man In Babylon is an excellent personal finance primer told through a series of easy-to-understand parables.

../../../..//2007/07/03/if-you-want-to-successfully/

If you want to successfully challenge a charge a debt collector says you owe, you’ll want to understand the doctrine of “account stated.”

12 Steps For Digging Yourself Out Of Debt

If you’re in debt and you don’t want to be, (and who wants to be?) you might want to take a look at Zen Habits 12-Step Get Out of Debt Program.

Which Credit Card Best For A Beginner, Best For An Intermediate Seriously Thinking About His Options?

“I had this thought a few days ago, I have 2 credit cards (that I keep paid off, woo!) and my woman who just graduated college is thinking about getting one. Now the question I had was, I got my cards without too much thought involved as to what would be the best option for me, they are OK cards, maybe the best, but i don’t know this. When I read your “10 commandments of credit“, I realized that consumerist would be the perfect place to ask the question: what credit card is best for a first time CC? Are there other cards that are more fitting for someone with more established credit history? What is the consumerist card of choice?!”

../../../..//2007/07/02/debt-collector-denied-unemployment-benefits/

Debt collector denied unemployment benefits because he was abusive towards debtors… the same conduct that had gotten him promoted to a supervisor position within the company.

Consumerist's 10 Commandments of Credit

Keeping a balance on a credit card is a sin in the eyes of the Consumerist. If you have a balance, make it your priority to pay it off as quickly as possible.

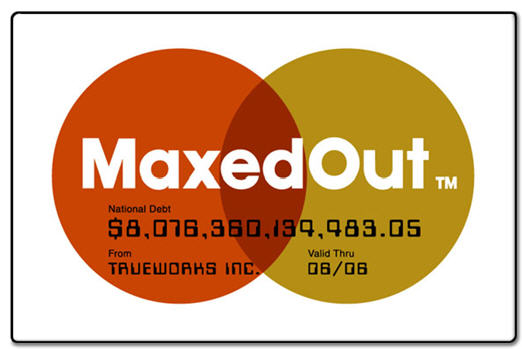

Personal Finance Bloggers Say "Maxed Out" Has Non Sufficient Funds

We’re not the only ones irked by the Maxed Out documentary.

H&R Block Subprime Lending Division Loses $676.8 Million

The company reported losing $85.5 million, or 26 cents per share, during the February-April period, which is when the nation’s largest tax preparer sees the majority of its revenue. By comparison, the company earned $587.5 million, or $1.79, during the same period a year ago.

H&R Block says it will sell its subprime lending operation to a private equity firm.

Payday Lenders Funded By Bank Of America, Chase, WellsFargo, U.S. Bancorp, Wachovia

Seven big payday loan chains are extensively bankrolled by brand name banks. Bank Of America, Chase, WellsFargo, U.S. Bancorp, and Wachovia all extend tens to hundreds of million dollars in lines of credit to these predatory lenders who charge several hundred percent interest on cash advances, often made to the poor and uneducated.

Maxed Out: Take It For What It's Worth

We just finished watching Maxed Out, the recent documentary about the viperous evils of the credit industry. We agree with the basic premise: Underinformed debtors are getting taking advantage of. And the stories are horrific, with three different people driven to suicide because of debt. The doc does a good job of outlining the links from debtor, to bank, to debt collector, to government representatives. It’s a nasty apparatus.

Daughter Stuck with Comatose Mom's Debt?

For those of you who enjoyed today’s post on the woman who committed suicide after her husband was threatened with debtor’s prison, here’s another one up your bleak alley.