According to a new survey by Lending Tree, 20% of Americans fear that they will never escape their credit card and other non-mortgage related debt and will be stuck with it for the rest of their lives. That’s depressing. Elizabeth Warren at Credit Slips says:”Lending Tree tries to put a happy face on some of the data (most people “perceive themselves as some day being debt free”), but I didn’t feel any better when I read it.” Yeah, we don’t feel any better either.

debt

Tomorrow Begins Today

Today, I mailed off my last final exam and finished my undergraduate degree requirements. “Luckily,” I was able to finish through online correspondence courses with my university, something I’ve slowly been chipping away at for the last three years. Yes, that’s three years after my intended graduation date.

Credit Card Fees, Penalties, On The Rise

A nationwide study by non-prof group Consumer Action found rising trends for credit card rates and fees. Compared to 2005

Confessions Of A Former Payday Loan Center Manager

Here’s a video confession from the former manager of a Virginia payday loan center.

Let Judge Judy Take Care Of Debt Collectors

Is this a good method for dealing with harassing debt collectors? We have no idea. Did it amuse us? Yep. —MEGHANN MARCO

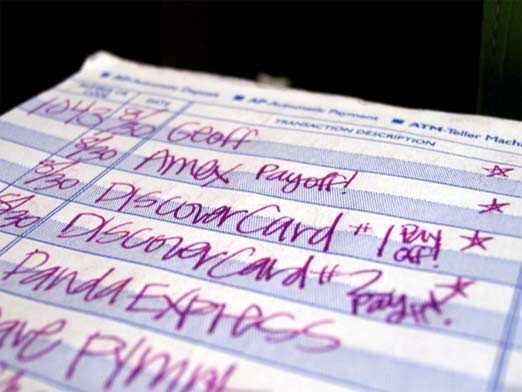

Is There Life After Debt?

Throwing off all the debt shackles remains an illusory proposition for many. But after the initial exhilaration wears off, the financially manumitted can find themselves feeling like they’re standing alone in a trackless prairie, asking themselves, what do I do now?

Make Debt Collectors Prove They Own What They Say You Owe

We’ve mentioned how if you’re being pursued by a debt collector, you need to make them prove that you owe the debt. Alabama Consumer Law Blog notes the other half, that you need to make them prove that it is they they actually own the debt, what is called having “standing.”

Watch Out If Your Credit Card Gets Sold To SST Card Services, Cause They're A Total Freakin' Scam

Consumer complaints are mounting against SST Card Services for deceptive and unlawful billing practices.

How To Sell On eBay

No Credit Needed made over $1000 in 2005 selling baby clothes on eBay as a way to get out of debt. He’s sharing 15 tips he learned, but fear not, childless readers, most apply to selling any kind of item at the online auction site. For one,

Debt Collectors Use Pocket Service Laws For No-Courts-Required, Insta-Garnishment!

In Minnesota, debt collectors can send a garnishment request directly to your bank and start snatching your dollars without even having through a court of a law.

Hasbro And Visa Pervert LIFE Board Game To Train Children In Racking Up Credit Card Debt

As if credit card-related debt wasn’t a big enough problem in the U.S., Hasbro and Visa want to fuel the fire. Hasbro is launching a new edition of The Game of Life called Twists and Turns that will replace play money with a Visa-branded card. Matt Collins, Hasbro’s vice president of marketing, said of the switch, “When we started to design a completely new edition of the popular game, we knew it was also time to reflect the way people choose to pay and be paid – and replacing cash with Visa was an obvious choice.”

Things Debt Collectors Can't Do

Seattle P-I has a good article about what debt collectors can and can’t do. For instance, they can’t:

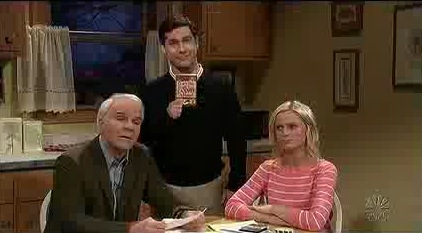

SNL Skit: Don't Buy Stuff You Can't Afford

SNL offers a revolutionary debt and money-management program. Chris Parnell teaches Steve Martin and Amy Poehler the secret to financial success. It’s all detailed in a new book called, “Don’t Buy Stuff You Can’t Afford.” Every debtor in America should read it.

Loanshark & Debt Collector Horror Show Roundup

“I make threats of arrest, property seizure, wage garnishment, and sometimes (usually if it’s a woman) I will threaten bodily harm if there is no payment….”

Financial Tips From CBS/The Nation: "Get a Loan From the Mafia."

“[I]f you need money to pay your medical bills or get your car fixed, get a loan from the Mafia. You’ll get a lower interest rate and better terms.”

AFFIL: A Day Late and a Dollar Short?

The message from the Americans for Fairness in Lending (AFFIL) is clear: Your home, your family, and your life are all in the crosshairs of predatory lenders across the nation. One look at their marketing material leaves no doubt in your mind that the consequences are dire unless we take action. Now AFFIL, along with a number of partner organizations including the Center for Responsible Lending, the NAACP, and the Consumers Union, have unveiled a new publicity awareness campaign designed to bring their message into your living rooms.

Why Don't Banks Offer Padayesque Loans, Just With Lower Interest?

Credit Slips digests a recent article in the Journal of Economic Perspectives on Payday Loans. The article’s answer to why banks don’t offer low-cost, short-term, unsecured loans is that banks find fees, like from bounced checks, more profitable. Bob Lawless disagrees, offering this alternative explanation: