Layaway is back this year. What’s that? It’s where you buy an item at a store, but don’t pay for it completely right away. The store puts the purchase item aside for you. You then make regular payments and once they add up to the full price tag, you get your item. Imagine that, saving up and only buying something once you can afford to pay for it in cash. Layaway plans used to be more popular but were overtaken by the ease and instant gratification of credit cards. Unlike credit cards, you don’t pay any interest, although sometimes there is a base fee. Now that credit lines are being cut and thrift is the new black, layaway is making a comeback. Kmart is featuring it in their Christmas ads, and Oprah talked about it on her show recently.

debt

Video: How Credit Cards Become Bonds

We’ve heard lots about how mortgages get turned into tradeable securities, but they’re not the only thing. No no no, there was far too much Chinese money not able to earn anything on T-bonds for us to let them lie. Credit cards can become asset-backed bonds too. Marketplace’s Paddy Hirsch is back with his whiteboard and dry-erase markers to explain how it works. Video inside.

Banks Want To Forgive Credit Card Debt — But The Government Says No

The next wave of the credit crisis — the skyrocketing defaults on credit cards — is coming in and odd alliances are being formed. The Consumer Federation of America, along with the Financial Services Roundtable ( a self-described “major player on Capitol Hill and with the regulators” which represents the securities, investment, insurance and banking industries) has requested a “special program that would allow as much as 40 percent of credit card debt to be forgiven for consumers who don’t qualify for existing repayment plans.”

Use Prosper.com Loan To Get Lower, Fixed, Interest Rate

Blogging Away Debt wrote about the 7 things she did recently to cut her finance charges from $400/month to zero, and one interesting one was using a loan from peer-to-peer lending site Prosper.com to get a break on interest rates:

5 Inspirational Posts For Living Debt-Free

Whether you’re trying to get out, or stay out, of debt, these five posts are a good way to get inspired to stick with your goals:

- Reader Pays Off $14,330 In 20 Months With Our Tips

- How I Talk Myself Out Of Buying Stuff

- How To Get Out Of Debt

- Paying Cash-Only, Family Spends $1,800 Less

- How To Go 30 Years Without A Credit Card

(Photo: .A.A)

Debt Collector Bullying Me To Sign Affidavit Saying I Can Pay More Than I Can

Sarah has $40k+ in student debt that went into default after she got sick and had to spend a lot of money on medical care. She’s been paying it off, but one of the companies that owns one of her loans, NCO Financial, has told her that unless she signs a legal document that says she can pay $260 a month, they’re going to place her account back in collections and start harassing her even more than they are now (they’re already calling her daily at home and work)…

Economy: "Consumers Have Thrown In The Towel"

Consumer spending is down and credit card defaults are up!

Credit Blemished Over Imaginary Credit Card

The NES collection agency is coming after Nancy for a debt on an account number she’s never owned. She’s trying to beseech BoA billing for a resolution and to fix her credit history. That may be completely the wrong way to go about it. Here’s her story:

Attention: Credit Card Companies Have Realized That You Are Broke

The New York Times has an article detailing what promises to be the next fun financial crisis — credit card debt! Apparently, credit card companies have only just now realized that you people are broke! Whoops.

Collector Threatens Jailtime Over Dead Debt

Reader R. kinda messed up his credit years ago. He’s a good boy now and his credit score is 700+, but now RSI Claims Process Services is hassling him about a 12-year-old credit card debt. They scared him into thinking they’re going to send him to jail and managed to squeeze a $100 “good-faith” payment out of him, but now he’s got second thoughts. And with good reason: the statute of limitations on the debt has well passed and threatening to send a debtor to jail is a violation of Federal law. Here’s his story and our advice…

AMEX Says You Closed Your Account While In Coma

According to the credit report, AMEX says Dan’s father-in-law closed a credit card he had with them while he was in a coma. Now Amex is using that to come after the mother-in-law for $15,000. Read the rest of the story, inside…

Debt Relief Firm Defrauds Debtor

Dave was $23,000 in the debt hole. He had a wife, a 6-month old daughter, a Masters in Advertising, and a dead-end waitering job. Then he heard an ad on the radio for a “debt relief law firm” that promised to solve all his problems. “Looking back, it was so stupid to agree to any of this,” writes Dave. “I still beat myself up about it and we were lucky to find out everything was falling apart when we did.” Here’s what went wrong:

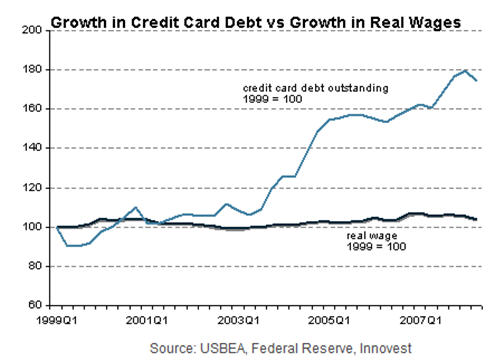

Hold On To Your Hats And Sunglasses, Here Comes The Credit Card Meltdown

We hope you’re enjoying our current economic roller coaster because it’s likely to continue — According to a new report from research firm Innovest Strategic Value Advisors, titled “Credit Cards at the Tipping Point,” the fun has only just begun. As the credit crunch begins to affect consumers, they’re going to have more difficulty paying their credit card bills. The report suggests that credit card companies’ misleading practices and cavalier extension of credit may come back to bite them. Who should be worried? Capital One.

How Can We Save Our Debt-Swamped Government?

The United States is $10.2 trillion in debt. Like countless Americans, our government has spent beyond its means and needs help getting back on its feet. We recently received a panicked email from White House Budget Director Jim Nussle…

Chicago Sheriff Halts Foreclosure Evictions, Won't Toss Innocent Renters

Cook County Sheriff Tom Dart said he understood he was flouting the law in refusing to have deputies carry out the rising number of eviction requests, but mortgage holders must be accountable.

I Told Off The Debt Collector

Some punkass debt collector called trying to get a hold of some lady he thinks my girlfriend knows. Here’s roughly how the conversation went. Keep in mind I had just put a bunch of peanuts in my mouth…

Our National Debt Has Outgrown The 'National Debt Clock' In NYC

Now that we’ve hit double-digit trillions, the “National Debt” clock that’s been running constantly since 1989 in New York City’s midtown can no longer properly display the total. Brian Williams says they’ve had to temporarily adjust the display while they build a new one, slated to go up next year. We’re not sure anyone should be spending money on a fancy new hi-tech clock right now—maybe they should just hang a big chalk board, and hire an unemployed investment banker to write the new debt each day. See the video below.

12 Signs You're Addicted To Debt

The headlines are screaming that America is more addicted to debt than crack. Then there are people out there who actually have a psycophysical need to spend spend spend. Are you one of them? Is your partner or friend? These are the 12 warning signs to watch out for…