UPDATE: Sued By Chase For $7k, In Debt For $40k+, I Think I’ll Declare Bankruptcy [More]

debt

2012 And The Debt Apocalypse: It's Comin'

The Mayan calendar ends in 2012, and supposedly those clever Mayans knew something we don’t. The NYT says that if the world does end in 2012 — it’ll spare us from a ridiculous junk bond debt avalanche. [More]

Where People Pay $30k A Year To Make $10 An Hour

The New York Times takes a look at one dubious beneficiary of the recession, the for-profit trade school. These places offer training in fields like health care, computers and food service …and enrollment is soaring. [More]

Woman Who Lost Home Over $68 Dental Bill Might Get Another Chance

Almost a year ago, Sonya Capri Ramos was in the news because she’d lost her home over a $68 dental bill. Last week, the Utah Court of Appeals gave her some hope that she might be able to get it back from the title company that bought it at auction for $1,550. [More]

Make Only Minimum Credit Card Payments, And Your Heirs Will Still Be Paying During The Robot Wars Of 3510

Cracked shares a cautionary tale of what will theoretically happen to a person who makes only the minimum payment on a credit card balance of about $10,000. Like all solid financial advice, it begins with an Amazon.com addiction and ends with the Earth being destroyed two thousand years in the future by a power-mad Bank of America. [More]

Don't Sign Your Soul Over To Student Loan Debt

Welcome to the American Dream. To follow that dream, you borrow heavily to get the education you need for your chosen career, in the mistaken belief that you will be able to get a better-paying job in that career once your education is completed, and repay the loans. Borrowing the money for education isn’t always an investment in yourself–often, it’s committing yourself to decades of commitment to a debt that is difficult to discharge or negotiate when you encounter a bad job market or other hard times. [More]

Why People Stop Using Credit Cards

In yesterday’s Money section, USA Today talked to some consumers who refuse to carry credit cards, and looked at the hidden costs. One 24-year-old says they make her uncomfortable; a guy working at a gas station to pay for college says he doesn’t want to get accosted by endless junk mailings once his name enters the pool of potential customers. Then there’s the bankruptcy lawyer who canceled his cards on principle 8 years ago, after seeing how lenders behaved when their customers suffered financial setbacks: [More]

Consumerists, How Do I Deal With Credit Card Companies Now That I've Lost My Job?

Newly unemployed, credit card debt-carrying Lilgaladriel wants some advice on how to deal with the credit card companies. He writes: [More]

The Debtor Debt Collectors Hate To Call

Craig Cunningham has made $20,000 from 18 lawsuits he’s filed against debt collectors for violating the Fair Debt Collection Practices Act (FDCPA). In fact, it’s something a part-time job/hobby for him. To ensnare his first FDCPA-violating collector, with voice recorder running, he called back the number they left on his answering machine, and asked: [More]

Watch Out For These Tricks After The CARD Act Kicks In Next Month

The credit card reform bill will go into effect at the end of February, but that doesn’t mean you should stop paying attention to what your credit card company does with your account. There are lots and lots of loopholes, notes WalletPop. For example, your card issuer can still raise rates on future purchases any time and for any reason. In addition, there’s no limit to the number of fees that can be invented and applied to your account. The only way to make sure you don’t get screwed by a profit-hungry card issuer is to read every single thing that’s mailed to you, and closely review your statement for evidence of any changes that you may have missed. [More]

AT&T Says I Owe Big Money From A Bill Six Years Ago

Richard says AT&T tracked him down to tell him he had an unpaid bill of $1,671.98, but it doesn’t owe the phone company the money because it sold the debt to an outside agency. He fears getting dinged on his credit history for a bill he believes he doesn’t owe. [More]

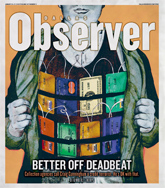

Make A Picture About Debt, Possibly Win $1000!

Bust out your Photoshops! Consumers Union Defend Your Dollars is running a contest to see who can make the best image that shows how debt can be dangerous. Users vote and the winner gets a a $1000 cash prize. You have a pretty good chance of winning too as they’ve only got like 17 entries and the contest ends on Jan 31. I know some of you folks like to make these sorts of things so why not give it a whirl? [More]

4 Reasons You're Dumb With Money

Science has proven that you are stupid with money. Four recent experiments give insight into the irrational ways you use your money that could be chopping down your bank account. My favorite one involves how credit cards make you end up spending more than they normally would: [More]

Company Introduces Bridal-Style Registry For Paying Off Bills

BillPayRegistry is a new website where customers can create a list of bills they need paid off, and then have friends and family members make “gift” payments via the website to be applied to said bills. The site takes 5.9% off the gift amount and sets aside the rest in a fund that the registrant can only apply to the accounts listed–there’s no way to cash out the funds, in other words. [More]

How To Make Sure Your Marriage Isn't Costing You Money

Liz Davidson at Forbes has an article about ways you and your spouse can fine-tune spending and investment patterns so that your marriage isn’t a financial drain. It’s easy enough to compare financial health before marriage (although lots of couples don’t do it, she notes), but even if your net income increases, your net worth could flatline or drop: [More]

Americans Falling Behind On Credit Card Payments Again

As a country, we were doing pretty well paying down our credit card debt for most of 2009, but according to Moody’s Investor Services, the number of people who are behind on their payments rose slightly in November. [More]

If Your Adult Child Dies, Do You Have To Pay His Credit Card Debt?

Reader Mat has a question. His uncle passed away a few days ago and his credit card company is telling his grandparents that if his bank account can’t pay the balance — they’ll have to. He’s wondering if this is true. [More]