A Philadelphia woman is suing Comcast, alleging that the hometown cable company not only spent nine months hassling her with debt collection calls but that the bill in question had already been paid. [More]

debt collection

CFPB Launches Monthly Reports To Showcase Financial Difficulties In Specific Areas Of The U.S.

Have you ever wondered if people on the other side of the country run into the same difficulties dealing with financial institutions as you do? Well, wonder no more, as the Consumer Financial Protection Bureau announced today that it will provide a peek into the overall state of consumer complaints in the U.S. and how individuals in certain areas deal with companies providing financial products and services through a new monthly series. First up: Milwaukee, WI, and debt collection. [More]

Chase Credit Card Settlement Halts Collections On 528,000 Accounts

Earlier today, we told you of reports that JPMorgan Chase had agreed to pay at least $125 million to close the books on state and federal investigations into its credit card collections practices. Now that the details of the deal have been made public, we know exactly how much the bank will pay and how many credit card accounts are affected. [More]

![JPMorgan Chase To Pay $136M To Close Credit Card Debt Collection Probes [UPDATED]](../../../../consumermediallc.files.wordpress.com/2014/09/chasecard.png)

JPMorgan Chase To Pay $136M To Close Credit Card Debt Collection Probes [UPDATED]

UPDATE: The Consumer Financial Protection Bureau has released the details of the settlement, which put the total value at $136 million, $106 million of which will go to the 47 states (and Washington, D.C.) involved in the investigations. [More]

PayPal Tweaking User Agreement To Remove Mandatory Robocalls

PayPal’s new user agreement — the one that gives the company even more latitude to make obnoxious prerecorded marketing calls to “any telephone number that you have provided us or that we have otherwise obtained” — is set to kick in this week, but following an FCC warning that this policy might be in violation of federal law, and a letter from multiple senators asking PayPal to rethink its new terms, the company has agreed to make changes that “clear up any confusion.” [More]

CFPB Asks Google, Bing & Yahoo To Help Stop Student Loan Debt Scams That Imply Affiliation With Feds

The Internet is teeming with scammers, fraudsters, and hustlers determined to part consumers from their money, and as a $1.2 trillion venture, student loans often present an attractive avenue for these ne’er-do-wells. In order to better protect individuals from such schemes, the Consumer Financial Protection Bureau is enlisting the help of the country’s major search engines. [More]

CFPB Sues Auto Lender For Aggressive Debt Collection Tactics Against Servicemembers

By now it should come as no surprise that lenders shelling out thousands of dollars to help consumers make purchases for things like houses and cars often use lies and threats in attempts to recoup those funds. And while those tactics might result in some payments, they will also likely draw the ire of federal regulators. [More]

PayPal’s New Terms Of Service Mean More Robocalls, Spam Texts For Users

PayPal’s terms of service already include a clause giving the company permission to make prerecorded marketing robocalls to the number you provide them, and to send texts to that number if it’s for a mobile phone. But starting in July, PayPal is giving itself a lot more authority for bothering you — and not just on the phone number you have on record. [More]

FTC Puts A Stop To Three Debt Collection Operations Using Threatening Text Messages, Robocalls

For the most part, we can’t say many glowing things about the debt collection industry that has, in the past, been known for using a litany of abusive and deceptive practices to pry money from consumers. Three such companies will no longer be bothering people after the Federal Trade Commission temporarily shut down the operations for engaging in nearly all of the hallmarks of shady collectors: threatening lawsuits or arrest, impersonating law enforcement and government officials and illegally contacting supposed debtors. [More]

Jury Hits Debt Collector With $83 Million Verdict Over Bogus $1,130 Debt

A jury in Missouri recently awarded $251,000 in damages to a local woman who was wrongfully sued by a debt collector — more than 222 times the amount she’d been sued over — but that’s nothing compared to the additional $82.99 million in punitive damages assessed against the collection company. [More]

Robocalling Phantom Debt Collector Accused Of Harassing, Defrauding Consumers

People hate debt collectors, perhaps as much as, if not more than, they despise robocalls from telemarketers. And phantom debt collectors — those who attempt to collect debts that aren’t owed to them, if at all — are among the worst of the bunch. So when you combine the automated recorded messages of robocalls with the incessant harassment of phantom debt collectors, you create a particularly loathsome Frankenstein’s monster. [More]

“Bad Check” Debt Collector Deceptively Used Prosecutors’ Letterhead To Intimidate Consumers Into Paying High Fees

Late last year, Consumerist reported on a string of debt collectors paying to use prosecutors’ letterheads as a way to intimidate consumers into paying their debts. While the company facing the wrath of the Consumer Financial Protection Bureau today didn’t exactly pay to use the letterhead, they allegedly used the documents in a deceptive manner to get consumers to enroll in costly financial education programs. [More]

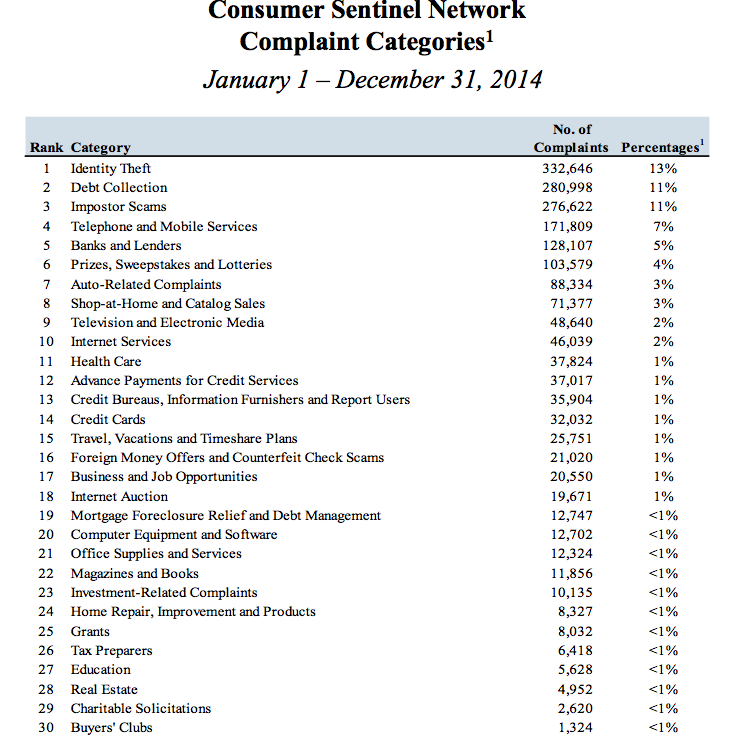

Consumers Lost $1.7B To Scams In 2014, Imposter Crimes On The Rise

For the 15th consecutive year, identity theft topped the Federal Trade Commission’s list of top consumer complaints. But its reign could be coming to an end following a significant increase in the number of scams in which con artists impersonating government agents and law enforcement personnel part consumers from their money.

[More]

Feds & NY Attorney General Team Up To Sue Abusive Debt Collectors

Just like one of those action movies where a federal agent gets paired up with a small-town sheriff who knows all the bad guys in the area, the Federal Trade Commission has brought its crackdown on abusive debt collectors to New York and partnered with the Empire State’s attorney general to shut down a pair of unsavory operators. [More]

Is It Time For Regulators To Stab Zombie Debt Through The Brain?

What a lot of people don’t know — and what debt collectors rarely mention — is that most unpaid debt has an expiration date after which you can’t be sued for repayment. And even fewer consumers are aware that this dead debt can be sparked back to life by making a payment after it’s already passed on to the debt afterlife. A new report calls on federal regulators to make sure that debt doesn’t rise from the dead in zombie form. [More]

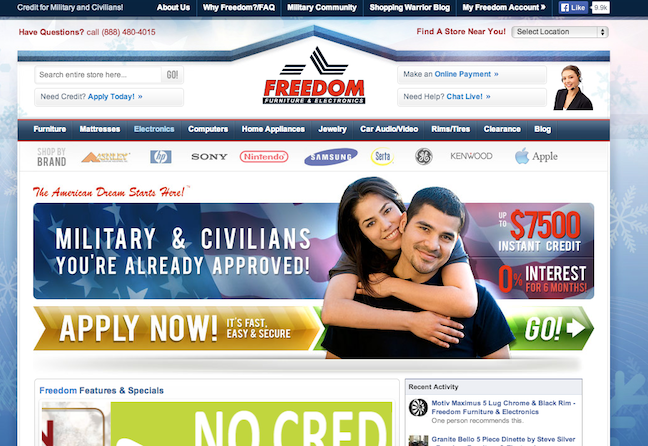

CFPB: Retailer Allegedly Using Illegal Debt Collection Practices Against Servicemembers Must Refund $2.5M

The Consumer Financial Protection Bureau continues its fight against companies that continuously take advantage of members of the military, despite protections afforded to them under federal laws. Regulators’ latest victory? A settlement demanding over $2.5 million in consumer relief from three companies that allegedly used illegal tactics to pilfer money from servicemembers and their families. [More]