The Federal Trade Commission teamed up with two states to put an end to five unscrupulous debt collection operations that illegally deceived millions of Americans. The actions, made under the “Operation Collection Protection” initiative between federal, state and local law enforcement authorities, represent $6.5 million in relief for millions of consumers. [More]

debt collection

Provision In Highway Funding Bill Would Require The IRS To Use Private Debt Collectors

While federal regulators continually work to crack down on private debt collectors that utilize unsavory, illegal tactics to make consumers pay up, government agencies often contract these entities to collect a variety of debts. That practice could continue if a provision in the Highway Trust Fund Bill receives approval. [More]

JPMorgan To Pay $100M To Settle Unlawful Debt-Collection Allegations In California

Four months after JPMorgan Chase agreed to pay at least $136 million to close the books on state and federal investigations into its credit card collections practices, the company reached a $100 million settlement putting an end to a similar investigation in California. [More]

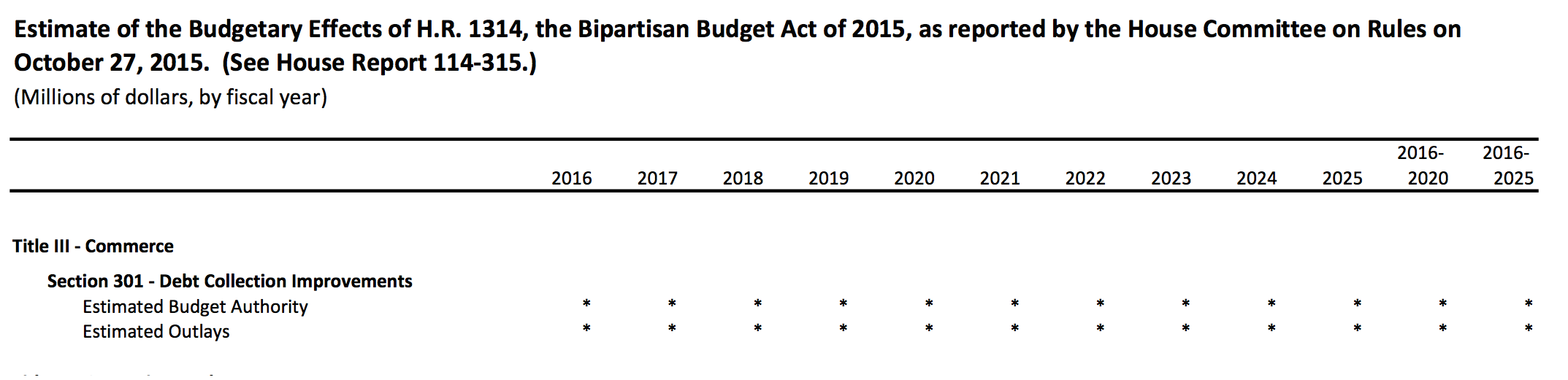

Government’s Own Budget Analysis Shows That Allowing Debt Collection Robocalls Is Pointless

In response to the news that the bipartisan budget deal currently before Congress includes a loophole that would allow the federal government to make debt-collection robocalls, some might say “Well, if it helps the government get back some of the money it’s due, then maybe it’s a necessary evil.” But the government’s own analysis of the budget proposal currently shows this clause as having no measurable impact on our federal finances. [More]

Auto Lender Must Pay $3.28M In Refunds, Penalties For Illegal Debt Collection Tactics Against Servicemembers

Four months after federal regulators filed a lawsuit against an Ohio-based auto loan company over allegations it violated consumer protection laws – including those protecting servicemembers – in order to collect debts, Security National Automotive Acceptance Company (SNAAC) will pay $3.28 million in refunds and fines to resolve the case. [More]

7 Things We Learned About How Debt Collection Lawsuits Affect Minority Neighborhoods

While some debt collectors have resorted to questionable and sometimes illegal practices, there are also legal routes to debt collection — like lawsuits and wage garnishment — that can nonetheless have a destructive effect, particularly in low-income, minority neighborhoods. [More]

Wells Fargo Reportedly Under Federal Investigation Related To Student Loan Servicing

According to a new report, Wells Fargo is the latest big-name bank to be scrutinized as part of the Consumer Financial Protection Bureau’s ongoing investigation into student loan servicing practices.

[More]

California Senate Passes Bill Allowing Consumers To Fight Unfair Default Judgments

We recently told you how potentially millions of Americans are stuck with someone else’s debt because of the large number of default judgments in favor of debt collectors. Yesterday, lawmakers in California approved a bill aimed at giving consumers in that state some ability to fight back.

[More]

The Country’s Two Largest Debt Buyers Must Refund Consumers $61M Over Illegal Collection Practices

Encore Capital Group and Portfolio Recovery Associates are two of the biggest names in the debt-buying game, and according to federal regulators they have often used deceptive and harmful tactics to collect their newly acquired debts. Now, as a result of these actions, the companies must refund consumers $61 million and pay $18 million in penalties. [More]

Countless Consumers Are Paying Off Someone Else’s Debt Because Of Default Judgments

Imagine receiving a phone call that 25% of your wages are going to be garnished because of a credit card account opened 14 years earlier that was never paid off. Making things worse, you know you didn’t have a credit card from the bank in question at that time, so it can’t possibly be your debt. This should be an easily remedied error, but not if a court has already granted a default judgment against you, making you responsible for paying back money that you didn’t owe and didn’t find out about until it was too late. [More]

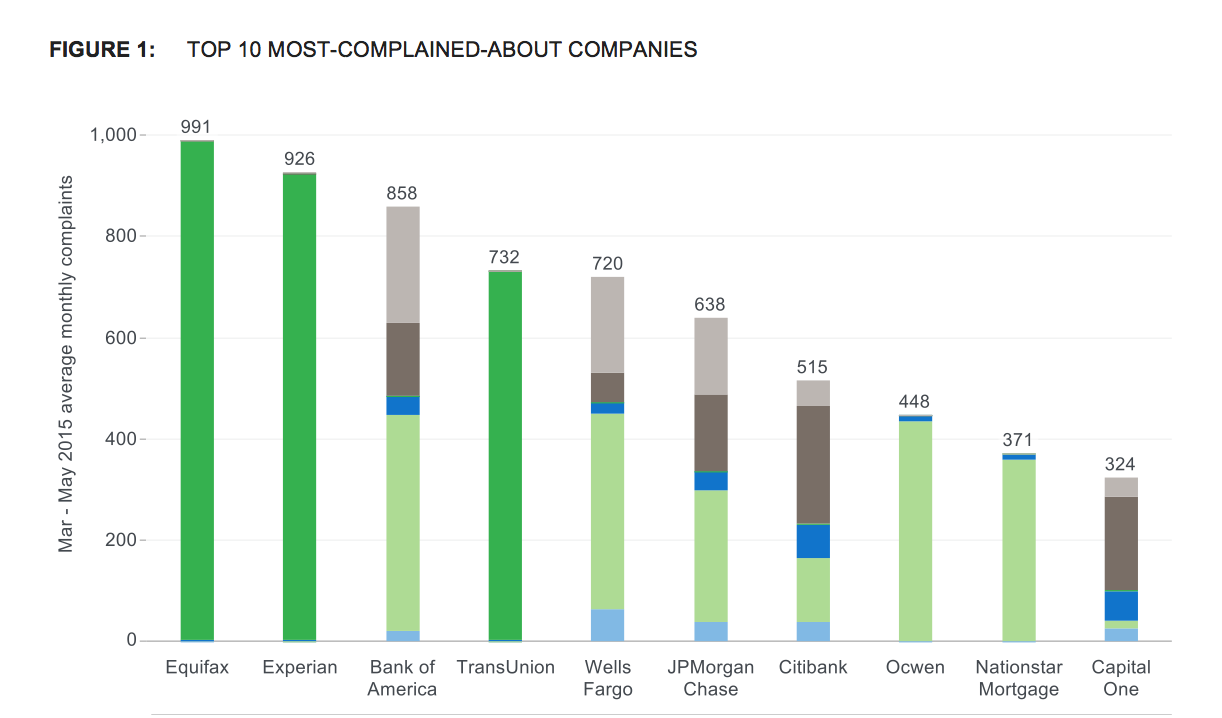

Credit Bureaus, Bank Of America, Wells Fargo Top List Of Most Complained-About Financial Companies

The Consumer Financial Protection Bureau has released its latest report on the various complaints the agency has received about banks, lenders, debt collectors, and other financial services. Amid a sudden increase in the number of complaints involving credit report errors, the country’s largest credit bureaus now dominate the top of the CFPB’s list of most complained-about companies. [More]

Sallie Mae Spinoff Navient Could Face CFPB Lawsuit Over Student Loans

In the short time since Navient – the nation’s largest student loan servicing company – spun off from Sallie Mae, the company has come under scrutiny for it allegedly unfair practices of overcharging and imposing excessive fees on consumers’ loans. While those practices resulted in a $97 million settlement with the Depts. of Education and Justice, and the Federal Deposit Insurance Corp, they could soon lead to a lawsuit from the Consumer Financial Protection Bureau. [More]

Florida Man Spends 17 Years Challenging Debt He Never Owed In The First Place

Imagine you wake up one day to find out that you suddenly owe nearly $100,000 on a house you’ve never owned, in a city where you’ve never resided. Should be easy enough to sort that out, right? Tell that to the Florida man who has spent the better part of two decades trying to convince creditors he didn’t buy property in Philadelphia when he was 12 years old. [More]

Regulators Sue To Shut Down Illegal Offshore Payday Loan Network

While most of us think of payday lenders as small-time storefront operations, there is also a complicated web of interconnected payday businesses operating outside the U.S. borders, but illegally issuing costly short-term loans to American borrowers. A newly filed lawsuit hopes to put an end to one such network. [More]

Citigroup Facing Federal Investigation Into Student Loan-Servicing Practices

Just last month federal regulators announced that an ongoing probe into potentially unscrupulous student loan-servicing practices resulted in nearly $18.5 million in refunds and fines from Discover Bank. Now, regulators appear to have Citigroup in their crosshairs, as the financial company announced it was party to an investigation. [More]

Discover Bank Must Pay $18.5 Million Over Illegal Student Loan Servicing Practices

As federal regulators continue to probe potentially unscrupulous student loan servicing practices, the Consumer Financial Protection Bureau has ordered Discover Bank and its affiliates to pay nearly $18.5 million in refunds and fines for, among other things, overstating amounts due on student loans and failing to notify borrowers of their rights. [More]

Citibank Must Pay $700M Over Illegal Marketing, Collection Practices

The Consumer Financial Protection Bureau ordered Citibank and one of its subsidiaries to pay $700 million in relief to more than 8.8 million consumers for engaging in a string of illegal credit card practices, including deceptively marketing and billing for debt protection and credit monitoring services, and misrepresenting fees related to debt collection actions. [More]