Nick received an automated call from some scammy outfit this morning that told him his debit card had been deactivated. The scam looks simple enough, but it’s probably worth looking at as a reminder to others. [More]

debit cards

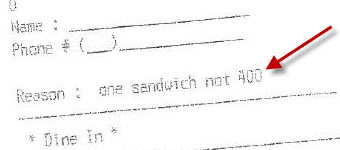

Subway Charged Me $2273 For $5 Footlong

For quite some time, Subway has been advertising their array of $5 footlong sandwiches. But Consumerist reader Josh stumbled across that rarest of fast food treats — Subway’s $2273.40 sub. Unfortunately for Josh, now he can’t seem to get his money back. [More]

What Changes Should You Expect From The CARD Act?

After several months of waiting (during which, banks have had plenty of time to jack up your interest rates and cut your credit limits), the Credit CARD Act of 2009 has finally kicked in. If you haven’t been following the news, here’s a quick run-down of what’s changed and what hasn’t. [More]

Wachovia Flooded Me With So Many Overdraft Fees I Don't Know Whether To Sink Or Swim

Jared thought he had enough money in his Wachovia checking account to cover a mini-spending spree, but he found out soon after that he’d racked up big-time overdraft fees. Now he’s not sure whether or not he should pay Wachovia the money he owes or just cut and run and start over with a new account somewhere else. [More]

Why People Stop Using Credit Cards

In yesterday’s Money section, USA Today talked to some consumers who refuse to carry credit cards, and looked at the hidden costs. One 24-year-old says they make her uncomfortable; a guy working at a gas station to pay for college says he doesn’t want to get accosted by endless junk mailings once his name enters the pool of potential customers. Then there’s the bankruptcy lawyer who canceled his cards on principle 8 years ago, after seeing how lenders behaved when their customers suffered financial setbacks: [More]

ING Apologizes For Screwup, Gets Me New Debit Card

Responding quickly to Noah’s gripe about ING Direct canceling his debit card without his permission, the bank called him and sent him a new debit card. [More]

Best Buy Bans Visa Contactless Payment Over High Fees

If you buy something with your Visa card at Best Buy, you’ll have to go the old fashioned route, comparatively speaking, and swipe it. Visa demands that contactless payments have to be signed, which is more profitable for Visa but not for Best Buy. Visa refused to change their policy, so Best Buy says it will no longer allow customers to pay that way, reports StorefrontBacktalk. Mastercard doesn’t ban PINs on contactless payments and will continue to be an option. [More]

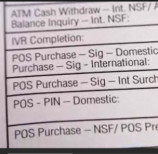

Sign The Slip Or Enter Your PIN? The Difference Is Fees

The NYT has an interesting article about what does on behind the scenes when you make a purchase at a retailer with your VISA debit card. You typically have two choices — you can enter your PIN or choose to sign. When you sign the retailer has to pay higher fees to VISA. [More]

28-Year-Old Pleads Guilty To Stealing Over 130 Million Credit And Debit Card Numbers

Albert Gonzelez pleaded guilty today to “conspiracy to engage in wire fraud for his role in stealing more than 130 million credit and debit card numbers from Heartland Payment Systems,” reports Boston.com. [More]

Best Buy Overcharges For Out-Of-Stock GPS, Won't Cancel Order

Daniel is the latest Consumerist reader to experience problems with ordering an item from Best Buy’s website. He writes that a retail sales associate who was either misinformed or dishonest led him to order GPS units as Christmas presents. Daniel’s debit card was charged before the items were delivered, which isn’t supposed to happen. Then Best Buy charged him the wrong price and lost his order, which really isn’t supposed to happen. [More]

How Cons Steal Your ATM Card

The Real Hustle shows two methods fraudsters can use to jack your ATM card and PIN. The first is the skimming method most of us are familiar with. The second is a lo-tech distraction-based method that, while interesting, seems a little higher risk than most card thieves are willing to put up with. [More]

Citibank Closes Overdraft Protection Due To Lack Of Overdrafts

We all know that banks offer overdraft protection because it makes them money, not because they want to be kind to customers. Still, it seems weird–or maybe just brutally honest–that Citibank would cancel Corrie’s overdraft protection service simply because she’d managed to avoid any overdrafts since she opened her accounts. [More]

Toys R Us Double Charges Black Friday Shoppers

Reader Ken emails to let us know that Toys R Us is experiencing a double billing issue stemming from some sort of glitch on Black Friday. He says a friend just told him she was double charged, and that when she contacted Toys R Us, they told her it was a national problem. [More]

You Can Buy Used ATMs On Craigslist

Even if you always look for skimmers and hidden cameras when you use an ATM, you still might be a victim of identity theft if the ATM is later sold on eBay or Craigslist. [More]

Don't Let Maintenance Fees Ruin Your Automatic Savings Program

If you participate in an automatic savings program like Bank of America‘s Keep the Change service, where debit card purchases are rounded up and the difference is deposited into your savings account, keep an eye on maintenance fees. James says he was hit with a $5 charge last month because he hadn’t met the minimum monthly deposit requirement of $25: “It turns out that I wasn’t even accruing $5 worth of change per month, so I was losing more money due to the maintenance fee than I was saving via Keep the Change!”

Revealing The Hidden Cost Of PrePaid Debit Cards

With credit cards harder to come by and more annoying to use, the prepaid debit card market is projected to explode from $8.7 billion loaded on the cards to $119 billion in 2012, but a good chunk of that is going to be eaten up by hidden fees and gotchas. This sexy graphic visualization shows how.

Prepaid Debit Cards Are Money Sucking Black Holes In Your Pocket

Be very careful about activating any sort of over-the-counter prepaid debit card, reports the New York Times. They looked at a handful of prepaids currently on the market and discovered ridiculously high hidden fees—the first two months of use can cost you up to $80.

Overdraft Fees Up 35% In Past Two Years

As a nation, we pay more each year in overdraft fees than we do for books, cereal, or fresh vegetables, says the Center for Responsible Lending (CRL)—and considering how outrageously expensive cereal is, they must be talking about a huge sum. They are: “Banks and credit unions collected nearly $24 billion in overdraft fees last year, an increase of 35 percent from just two years earlier.”