A lot of times when someone gets a hold of someone’s credit or debit card info and decides to use it for illicit purposes, the ID thief makes as many charges as possible in a short period of time. But some scammers choose to chisel away at victims’ accounts in the hopes that the crime will go unnoticed. [More]

debit cards

Surprise! Here’s Your New US Bank Debit Card

A blank envelope arrived on Amanda’s doorstep. She almost tossed it aside, since it didn’t say “HEY! I’M IMPORTANT!” on it. She happened to feel a plastic card inside, though, so she opened it up. Inside was her new debit card. That’s good, isn’t it? Amanda doesn’t think so. [More]

Bank Of America’s New Debit Card Charges $5/Month For Something That Is Free On All Accounts

Bank of America is in the news because it’s testing a new debit card that won’t let customers overdraft. For that privilege, cardholders will pay a $4.95/month fee and they won’t be able to write paper checks. Thing is, anyone with a bank account can turn off overdraft protection without being required to pay a fee. [More]

After Target Breach, Banks Are Way Behind In Reissuing New Cards

The baddies behind the recent Target payment data breach are selling off card data at fire-sale prices and cranking out cards that can be used in the real world, some of the people whose card numbers were breached have a long wait to get their new cards issued. [More]

Banks Say Target Hack Has Cost Them $153 Million In Replacement Cards

It’s not just Target’s sales figures that are feeling the sting of the massive data breach that affected more than 100 million customers at the height of the holiday shopping season. According to a group representing the nation’s retail banks, financial institutions have had to spend more than $153 million to replace credit and debit cards in the last six weeks. [More]

Citi To Replace Debit Cards Linked To Target Hack

A month after Target first revealed that its in-store credit and debit card payment system had been breached, Citi has finally announced plans to replace all debit cards for customers whose account information was stolen in the hack. [More]

Target Confirms PIN Data Also Stolen In Credit/Debit Card Hack

After days of denying a report that hackers had stolen encrypted PIN data from some 40 million Target shoppers, the retailer has finally admitted that yes, this information was indeed collected during the 3-week-long data breach. [More]

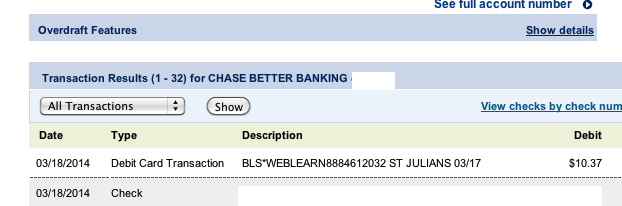

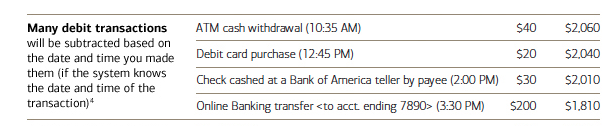

BOfA Stops Overdraft-Friendly Practice Of Re-Ordering Transactions From High To Low

As we’ve noted multiple times over the years, some banks love to lump all transactions made by a customer during a day or weekend together and then process them not in the order they were received, but from largest to smallest. For customers on the brink of overdrafting, this can result in numerous fees that may have been avoided if the charges had been processed chronologically. In a rare bit of positive Bank of America news, the bank has decided to stop this high-to-low transaction processing (for many debit purchases). [More]

Court Strikes Down Fed’s Debit Card Swipe-Fee Rules

One of the more contentious aspects of the recent financial reforms was a directive from Congress for the Federal Reserve to set a cap for swipe fees — the amount charged to retailers for each debit card transaction — in order to bring the fees in line with what it actually costs to process the transactions. This morning, a U.S. District Court judge ruled that the Fed disregarded the intention of the reforms by setting that cap much higher than it should have been. [More]

Banks Raking In Billions In Profits From Overdraft Fees

The notion behind an overdraft fee — in which a bank customer is charged a penalty for overdrafting his account — is twofold: To incentivize consumers to pay attention to how much money is in their accounts, and to allow the bank to recoup any money it lost by covering the overage. But a new report claims that these fees have become such a profit center for banks that it’s now in their interest to push account-holders with low-balance bank accounts toward overdrafting. [More]

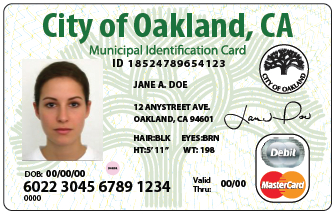

Oakland Decides It Doesn’t Need All Those Fees On Its Combination ID/Debit Cards

A few weeks back, we told you about the new photo ID cards being issued by the city of Oakland that could also be used as prepaid debit cards. We also told you about how these debit cards came loaded with sky-high fees. Now it looks like the city has decided to ditch some of these exorbitant charges. [More]

New Legislation Seeks To Rein In Overdraft Fees

Bank overdraft fees can pile up rapidly, making it increasingly more difficult for a consumer to get back to zero, which is why Congresswoman Carolyn Maloney of New York recently introduced legislation aimed at limiting how much and how frequently banks can ding account holders for these fees. [More]

Chicago Transit Prepaid Debit Cards Also Fully Loaded With Fees

Yesterday we told you about the sky-high fees associated with the combination photo ID/prepaid debit card being issued by the city of Oakland. Now comes a report that Chicago-area residents who choose to opt in to the prepaid debit option on their transit cards will also see their cash eroded by fees. [More]

Oakland Residents Will Be Slammed With Fees If They Use City IDs As Debit Cards

The city of Oakland has begun offering ID cards that can also double as prepaid debit cards. Not inherently a bad idea, except for the fact that these cards come loaded with fees that will chisel away at the user’s funds. [More]

How Do Different Credit & Debit Cards Stack Up In Terms Of Consumer Protection?

We’ve mentioned any number of times how federal laws offer more protection to consumers who make purchases with credit cards because $50 is the most you can be held responsible for a fraudulent purchase, while the sky could be the limit with debit cards. But how do the various networks compare? [More]

Bank Employee Explains Why It Takes So Dang Long To Process Debit Card Fraud Claims & Disputes… And Other Fun Stuff

We hear a lot from readers who say their debit cards were charged for services they didn’t receive — whether by fraud or by ineptitude on the part of a merchant — and who are now waiting for their bank to please put back the money that was wrongfully taken from them. [More]

PayPal Blocked Access To My Account After Denying Me A Debit Card

Consumerist reader “A.M.” has a small business running a Minecraft server that brings in a bit of money via PayPal. He recently applied for a PayPal/Mastercard debit card, only to be denied. That wasn’t such a big deal; the real problem was his sudden inability to access the money in his PayPal account. [More]