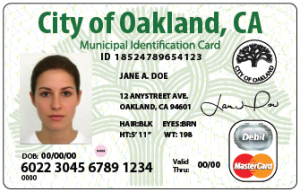

Oakland Decides It Doesn’t Need All Those Fees On Its Combination ID/Debit Cards Image courtesy of A sample of the new ID card.

According to the San Francisco Chronicle, the city has eliminated the $2 charge for enrolling the card to receive government benefits. Also gone is the $1 charge for each time those benefits are placed on the card.

Finally, while there is still a $.75 charge for each purchase made using the card, the city says those fees will be capped at $12.50/month. So any purchases made after the monthly cap is reached will not be hit with the charge.

Our cohorts at Consumers Union had derided the fees on the Oakland ID card, saying they had never heard of fees so high for allowing a card to accept government benefits.

Now CU’s Michelle Jun, an attorney and expert on prepaid cards, says the changes made to the fee structure are a “step in the right direction.”

However, given both the card’s target customer base of lower-income residents and the fact that this card is provided and endorsed by the city, CU feels that it should not still have fees that are higher than average for commercially available prepaid debit cards.

For instance, there is the $1.75 charge for each call to customer service. Since there is no physical bank or credit union associated with the card, that means the customer must pay in order to resolve a simple customer service issue. Such charges discourage customers from seeking a resolution for minor errors.

The card also continues to charge a $1.50 fee for in-network, domestic ATMs, so having access to cash will cost you cash no matter where you go.

[via DefendYourDollars]

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.