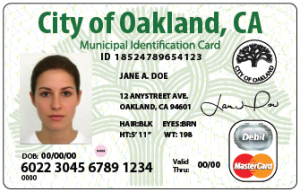

Oakland Residents Will Be Slammed With Fees If They Use City IDs As Debit Cards

Our cohorts at Consumers Union recently talked to the San Francisco Chronicle about the abundance of fees on the new Oakland ID cards, like the $2 charge for enrolling it in a federal benefits program, or the $1 charge for each time federal benefits are direct-deposited onto the card.

The cardholder also pays $.75 on each purchase, a $2.99 monthly fee, a $1.50 fee for using in-network ATMs, $1.75 for each call to customer service, and a $1 fee to load the card with cash at a Western Union location.

“I’ve never seen anything like that before,” says Michelle Jun, a senior attorney for Consumers Union, adding that most debit cards charge either a monthly fee or a per-purchase fee, but rarely both. “It seems like they’re gouging those recipients.”

While the intention of adding the debit card functionality to the IDs was to provide a bank-like option to Oakland residents currently without bank accounts, CU says there are already a variety of prepaid debit cards out there that won’t slam the holder with such heavy fees.

The city and SF Global, the company that helped Oakland set up the debit portion of the card, claim that its fees are below the median for prepaid debit cards, the Chronicle checked out the fees for cards offered by Chase Liquid, Green Dot, and Approved Card, and found that each had lower fees than the Oakland card.

CU’s Jun says the fact that the city itself is marketing this product to residents is worrisome because people might assume they can’t get a better deal elsewhere.

“It’s targeting a very captive audience in the way it’s set up,” she explains. “People who are going to Oakland to obtain a city ID will likely see it has this other aspect to it. It’s on-the-spot marketing right there… They might not be aware there are similar products with better fees out there in the marketplace.”

Of particular concern is the per-purchase fee. Since the debit card functionality is aimed mostly at lower-income residents, it’s unlikely that these consumers will be making many larger purchases where a $.75 fee won’t sting.

Then there’s the charge for calling customer service. Without brick-and-mortar locations to visit, cardholders have no other way to resolve an issue other than by paying the fee to call customer service.

A representative for SF Global tells the Chronicle that it’s unfair to compare the combo ID/debit card to prepaid cards because “Nobody is going to be able to provide these services for free… This is the first card of its type in the nation.”

But Jun maintains that a prepaid debit card is a prepaid debit card and fees are fees.

“A city should provide products that serve consumers best and not rip people off,” she said. “There will be a number of cards cheaper than this card.”

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.