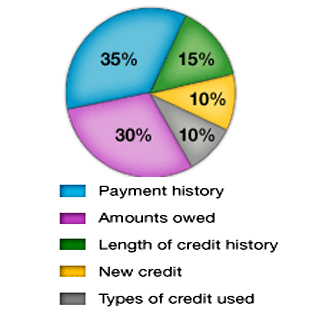

How the heck do they figure out your FICO credit score? The five different factors, in order of decreasing importance are: 1) payment history 2) amounts owed 3) length of credit history 4) new credit 5) types of credit used. For a bit more detailed explanation on how each of these plays out, the “What’s in your FICO score” at myFico.com is a good place to start.

credit scores

A World Where A 340 FICO Is "Excellent"

At first glance, this ad for CreditReportAmerica seems to have the credit score system reversed, with 350-619 listed as “excellent” and 750-840 listed as “poor”…but then you realize it’s actually a graphical depiction of the system shady mortgage brokers used to get when whoring up the sub-prime mortgage orgy. Travel blogger Mark Ashley says he spotted the ad on the frontpage of Yahoo Finance. At the bottom, the ad says the service does not include credit scores. Remember folks, the place to get a free credit report is annualcreditreport.com.

Paying Cards Off Doesn't Mean Reported Balances Are Zero

Personal finance columnist Liz Pulliam Weston saw Rebekah’s story yesterday, “Is It OK To Use Credit Cards For Everything, If You Pay Them Off Every Month?” and wanted to clarify something important. If you pay off the cards in full, the balances reported to the credit bureaus will not be zero. More likely, it will be the balance from your last statement. Liz writes:

Scamming The FreeTripleScore.com Scam

Just saw a (horribly produced) ad last night for freetriplescore.com, the latest in a long string piece of crap “free” credit score sites. As Chris Walters noted when he wrote about it, for the most part it’s a ripoff. But maybe there’s a way to pull a fast one of you own and get a free credit score…

Your Inactive Credit Cards Could Be In Danger

If you’ve got a few credit cards lying around that you haven’t used in a while but don’t want to lose, you might want to talk them out for a walk.

Staying Out Of The Red Is The New Black

All of a sudden, everyone is interested in how their banks, credit cards, credit scores, credit reports, mortgages, and money actually work. Staying out of the red is the new black. Have you found yourself talking more about money matters and strategies with friends, family, co-workers, and even strangers?

Judge Orders Credit Reporting Bureaus To Strike Forgiven Debts From Records

The three big credit reporting agencies—Experian, TransUnion, and Equifax—have been inaccurately reporting debts on millions of consumers’ credit reports even after the debts have been forgiven during bankruptcy filings. Once forgiven, the debts are supposed to be removed from credit reports, but the agencies are continuing to report them as active. They have until October 1st to comply with Judge David O. Carter’s order to “revamp their systems,” writes Jane J. Kim on the Wall Street Journal’s finance blog. Now if you’re in debt trouble, you can look forward (?) to having either unpaid debts on your credit report, or a bankruptcy filing, but hopefully no longer both at the same time.

Equifax Double-Reports Student Loan, Still Hasn't Corrected It 12 Attempts Later

So what exactly is the problem? After 12 online (and phone) disputes to Equifax and 14 calls (and faxes) to the Direct Loan Servicing Center, each party seems to blame the other.

PRBC Helps You Create A Credit Score From On-Time Rent, Bill Payments

Payment Reporting Builds Credit (PRBC) is an alternative credit reporting agency that will record your payment histories for things like rent and utilities bills. PRBC says you can then use this verified credit history to supplement your FICO score and credit history from the big three reporting companies. It’s meant in part as a way to help people who don’t have extensive standard credit histories, or who have always paid monthly expenses on time but have other blots (like medical bills) on their official credit histories.

../../../..//2008/09/11/just-a-reminder-you-can/

Just a reminder: you can get free credit reporting services for at least six months by participating in a class action settlement against TransUnion. Carey posted details about it back in June; the deadline to participate is September 24th. (Thanks to Michael!)

FreeTripleScore.com Will Cost You $30 Per Month

The rip-off site “freecreditreport.com” has a new competitor, and it’s running fear-mongering spots on the “we’ll air any commercial” cable nets (by which we mean G4). Freetriplescore.com warns you that your credit score can keep you from getting a job! But they’ll give you you “free” scores from the big three credit reporting agencies if you sign up for their $30 per month membership plan. Remember, the only “free” credit report website you should ever use is AnnualCreditReport.com. For free credit scores, on the other hand, check out Ben’s post.

Don't Let Your Credit Card Rate Get Spiked

Credit card companies are raising interest rates and canceling cards left and right. Bankrate has seven ways to avoid getting caught up in the “risk repricing” spree. It all comes down to keeping everything looking normal.

Beware Long-Term Cardholders With Perfect Payment Histories, Your Credit Lines May Be Slashed

Oliver paid off his Citibank platinum card on time, in full, every single month since 1989, but that didn’t stop Citibank from slashing his credit limit when a minor mistake popped up on his credit report.

Montgomery Ward's Hacked 6 Months Ago, But Victims Weren't Told

Somewhere between 51,000 and 200,000 records were stolen from Montgomery Ward’s servers last December—the company says it’s the smaller number, but CardCops, the group that spotted the hack in the first place, “spotted hackers touting the sale of 200,000 payment cards belonging to one merchant” in June, which is how the story became public. Montgomery Wards knew about the breach when it happened, and although they reported the crime to federal investigators, they didn’t tell any of the victims. The CEO of Direct Marketing Services, which owns the Montgomery Ward name, told the Associated Press that after he alerted investigators he felt his company “had met its obligations.”

Capital One Will Ruin This Guy's Credit One Way Or Another

Joseph is having problems paying his Capital One card, mainly because Capital One keeps making it hard for him to pay it, and then reports his payments past due after they’ve cleared the bank. Now he wants to know what he can do to remedy the situation.