Last year Citigroup pledged to abandon the customer-screwing policy of universal default, where an unrelated late payment or credit score change can trigger an interest rate increase on your Citibank card. They even used a marketing phrase to promote their promise: “a deal is a deal.” According to the New York Times, Citigroup is “quietly reconsidering its pledge” and may decide to reinstate universal default as early as this week.

credit scores

Use Your Credit Card At A Marriage Counselor, See Your Limit Get Reduced

The FTC claims that CompuCredit didn’t properly disclose that it monitored spending and cut credit lines if consumers used their cards at certain places. Among them: tire and retreading shops, massage parlors, bars, billiard halls, and marriage counseling offices. “What they didn’t say was that you could be punished for specific kinds of purchases.”

Third-Party Debt Collectors Misusing Courts To Increase Profits

The Chicago Tribune writes that “More than 119,000 civil lawsuits against alleged debtors are clogging [Chicago] courtrooms,” but since collection agencies make money off of volume business, the suits filed are based on too little information. The result: cases based on mistaken identities, or for debts already settled, or against debtors who have made good-faith efforts to work out repayment plans. “The system is out of control,” one attorney tells the paper.

Sallie Mae's 100+ Point FICO Drop Error Getting Fixed

Sallie Mae has publicly apologized for a coding error, potentially affecting around 1 million customers, that caused some consumers credit scores to drop over 100 points, and some consumers report that their dinged scores are already back up. If your score is not back to normal and you are in the middle of a transaction where your good credit is at stake, Sallie Mae said it will provide a credit reference letter. You can also call Sallie Mae customer service at 1-888-2-sallie. Sallie has pledged that the fix is in, but consumers can still take matters into their own hands by pulling their free credit report from annualcreditreport.com and disputing the incorrect information with Experian. Note, it’s against Federal law for creditors to report false information to credit bureaus, and consumers can sue violators up to $1,000.

FICO Scores Drop Over 100 Points After Sallie Mae Recode, Potentially Millions Affected

Consumers are complaining that a change in how Sallie Mae decided to recode some loans caused their credit score to drop by over a hundred points. That’s enough to make a $93,240 difference in a home loan’s total cost. Here’s what happened.

Over Your Credit Limit? Get Ready For Higher Interest Rates!

Next time you brush past your credit limit you may get hit with more than a hefty over-the-limit fee. The Red Tape Chronicles reports that credit card companies are starting to slap exuberant spenders with penalty interest rates. Compounding the danger to consumers, creditors are simultaneously rushing to slash credit limits.

How Much Do Credit Scores Really Matter?

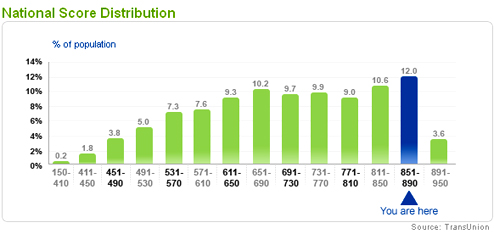

Obsessing over a number that’s only three digits long sounds a little OCD, until you realize how much a hundred or so points on it can cost you. I’m referring to credit scores. This three-digit number that lenders use to determine how favorable a loan to give you can affect many of your financial transactions, but it especially becomes a big deal when you take out a mortgage on a house. Let’s look at a home loan for $300,000 with two different sets of scores:

Know Where To Fix Your Credit Score By Getting Your Reason Codes

If you want to improve your credit score, a score from 300-850 that lenders use to determine whether you qualify for a loan and how much interest to charge you if you do, you’ll want to know your “reason codes.” These are 2-digit numbers that come with you credit score when you purchase it. Each bureau usually gives you four reason codes with their report, so get your score from each one for a total of 12. One wiki tutorial says that reason codes are listed in order of importance. Armed with that, The Mechanics Of Credit site decodes all the reason codes and prescribes solutions for each one. With this info and tactics, you should be able to boost your score a couple of points and save a bundle.

Woman's Credit History Goes Missing, Giving Her A Credit Score Of Zero

When Cindy X pulled her credit report from TransUnion recently, it was blank. “I am 48, have an active credit history, and my other credit reports were accurate,” she writes in to Kiplinger. TransUnion, however, told her that she was on her own to fix the problem and would have to contact her creditors individually.

6 Reasons To Keep More Than One Credit Card

Keeping a second credit card won’t lead to financial ruin, and may prove useful in several situations. Bankrate offers six reasons to stash away a spare card.

MedFICO In Development, It's FICO For Patients!

From the folks that brought you the credit score system in all it’s glory, here’s MedFICO! It’s a new business project underway with the goal of assessing patient’s ability to pay their medical bills. The system would gather patient’s bill payment history from hospitals around the country and then assign patients a score similar to a credit score. Critics are worried if the same problems with people getting erroneous information in their credit report and then having an insanely difficult time cleaning it up would also affect MedFICO. They also worry whether hospitals would use MedFICO to determine the level of care offered, like whether the person gets a hospital stay or not. FICO scores are now being used by some employers to screen out potential employees, would they use MedFICO to see who might take a bigger chunk out of the health benefits?

../../../..//2008/01/17/when-53-bank-acquired-another/

When 5/3 Bank acquired another bank, a computer glitch in the records merging splooged incorrect information into thousands of customer accounts, in some cases totally fudging up their credit reports and credit histories. The bank says it’s fixed everything but one customer says that’s not true and lost three loans due to the errors. [Orlando Sentinel via U.S. PIRG Consumer Blog]

Ben Popken On Fox Business News Chatting About FICO '08

Here’s the clip of yours truly, Ben Popken, on Fox Business News discussing some of the changes in store for FICO ’08, the credit-scoring system lenders use to determine how punitive a rate they get to charge you. You may notice that I have a strange look on my face at the beginning.

../../../..//2007/12/31/consumerist-editor-ben-popken-will/

Consumerist Editor Ben Popken will be on Fox Business News Monday at 12 noon to discuss the changes in store for FICO 08. UPDATE: It looks like our video slave is home today, so if anyone wants to DVR Ben’s appearance and email the video file to tips@consumerist.com, we’ll like, make you a cake or something.

How FICO 08 Changes Your Credit Score

The FICO system, whose credit scores lenders use to determine whether you’re credit-worthy and how favorable to set the terms, is set for a makeover. An article in today’s WSJ reveals more of the changes in store than previously disclosed, here’s how they’ll affect your credit score: