If you’ve ever been turned down for a credit card, auto or student loan — or maybe your application was accepted but you didn’t get the best interest rate — and wanted to see a copy of the actual credit score used in the lender’s decision-making process, you were probably out of luck. But starting July 21 lenders will be required to show you the score. [More]

credit scores

Denied For A Credit Card Or Loan? Lenders Will Soon Have To Show You Your Credit Score & More

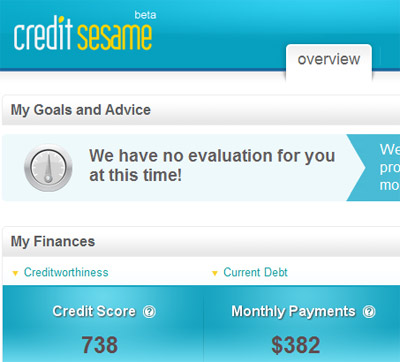

Get A Free FICO-esque Score From Credit Sesame

Credit Sesame is an advertising-supported service that gets you your credit score for free. No hidden fees, singers in Renaissance garb or gotchas. It’s not quite your FICO, but it’s close. [More]

TransUnion Wants You To Share Your Credit Score On Facebook

Social media may have created a culture of over-sharing, but what’s too personal to share with your Facebook friends? Michael was checking his credit report, and was surprised to see a “Share on Facebook” button directly below his credit score. [More]

Trying To Ruin Your Ex's Credit Score Is Not A Good Way Of Getting Revenge

When a romance goes south, it’s not unheard of for at least one of the parties involved to begin dreaming up clever ways to continue making the other person’s life hell. And one thing you definitely don’t want to do is try to screw with your ex’s credit score. [More]

Someone Explain To Experian How American Express Cards Work

How does American Express work? Michael writes that Experian doesn’t seem to understand how the company’s credit limits work. His card technically has no limit, and this confuses Experian. They coped with the confusion by showing that instead of having theoretically infinite available credit, he had $0, making his pristine record look pretty bad to potential lenders. [More]

Being 30 Days Late On House Payment Can Knock 100 Points Off Credit Score

Usually very closed-mouth about how it calculates scores, FICO released a whole bunch of data about how being late on your mortgage payments affects your credit score. For instance, being 30 days later on a mortgage payment can chop your 780 credit score down to 670. And a short sale or deed-in-lieu of foreclosure will hurt your score just as bad as a foreclosure if the service reports it as having a deficiency amount or an unpaid balance. Yikes! Here’s some sexy tables with more details: [More]

Get A Bad Deal On Your Loan? Now You'll Know Why

If you applied for a loan and got denied or received a higher interest rate than other borrowers with better credit scores, starting July 21st, the lender has to send you a free copy of your credit score. [More]

Want Just A Credit Report From TransUnion? Too Bad

Michael wanted to pay a copy of his Transunion credit report. In theory, this shouldn’t be a problem: he gives Transunion money, they give him a credit report. If only it worked that way. It turns out that just buying a single copy of your report from Transunion is like trying to buy a mobile phone in America from a retail store: you can get it for “free” with a subscription to monitoring service, or as part of a package deal with other services, but you can’t just hand over cash for a credit report. [More]

Capital One Burrows Into Your Wallet, Makes Your Life Hell

Gerard, now 26, has spent his entire adult life fighting with Capital One. No, we are not exaggerating: he got his first credit card with the company at age 18, and they have been causing him payment and credit-report headaches ever since. [More]

Too Good To Be True Rental Listing Leads To Credit Score Scam

We’ve been getting a few emails about a new kind of rental scam where they try to lure you into giving over your credit card and personal information to a “free credit score” site. One was from Reader Benjamin, who was looking for a house to rent when he and his wife stumbled across a too good to be true deal, a fully-furnished 3-bedroom house in Maryland for only $1200. Seeing as they had nothing to lose, they emailed the lister, just to see what would happen. [More]

Man Wants Verizon FiOS, Keeps Getting Credit Score Dinged Instead

Todd’s subject line to us was, “Verizon FiOS hates me,” and maybe he’s right. Each time he tries to sign up for their package deal, they check his credit score, proceed with the sign-up process, then cancel everything at the last minute due to a “technical glitch.” They say he can try a third time if he wants. [More]

Convincing The Credit Bureaus I Wasn't Dead

A writer for Slate shares the tell of her trying to convince Experian and Transunion that she is not deceased, as being dead is a bit of a problem when you’re trying to buy an apartment. Transunion only took one phone call and one fax to Lazarus her, but Experian was an abyss of despair, until, out of the darkness, a ray of hope emerged… [More]

Help, Expedia Sold My Chargeback To A Collection Agency!

Ed and his wife successfully filed a chargeback against Expedia for a canceled trip earlier this year. Now he’s being dunned by a collection agency for the amount that Amex refunded him. [More]

Mortgage Broker Told Me To Open Up A Bunch Of Credit Cards, Should I?

One of our readers is looking to buy a house and his mortgage broker suggested that he open up about four credit cards to establish some credit history. Should he? [More]

25 Percent Of American Consumers Now Have Low Credit Scores

Before the recession hit, roughly 15% of Americans had FICO credit scores below 600. But after the past couple of years of late payments, defaults, and foreclosures, that number has grown to 25%, or about 43 million people. At the same time, the number of people with excellent scores (800 to 850) has increased nearly 5% from pre-recession average, which the Associated Press says is partly a result of people cutting spending and working to pay off loans more quickly. [More]

How To Dispute Credit Report Errors

Over 80% of credit reports have errors on them, errors which could be lowering your credit score and keeping you from getting credit or paying more for it than you should. Here’s how to fix them: [More]

Washington Wants Better Oversight Of For-Profit Colleges

Enrollment in for-profit colleges like the University of Phoenix, DeVry University, and Kaplan University–Gawker calls them fake colleges–tripled in the past decade, and has become such a fast-growing segment of the education market that some members of Congress think it needs better oversight. [More]

Stop Believing In These Credit Score Myths

Budgets Are Sexy sifts through the mysterious black magic that goes into establishing your credit score and reveals 10 myths to note when you’re making financial decisions that may affect the score. [More]