If you’re one of the 140 million or so people affected by Equifax’s failure to keep its data secure, the credit bureau is offering free access to its TrustedID credit monitoring service (though we don’t recommend you enroll in it). At the same time, the company is continuing to charge everyone else for access to TrustedID, and some consumers affected by the breach are inadvertently paying for a service they can get for free. That’s why dozens of state attorneys general are asking Equifax to stop trying to sell TrustedID for the time-being. [More]

credit monitoring

Target CEO Apologizes For Hack, Explains 4-Day Delay For Alerting Customers

As you all know, between Black Friday weekend and December 15, Target’s in-store credit and debit card processing system was compromised, allowing attackers to make off with more than 100 million card numbers and other information. Last night, Target CEO Gregg Steinhafel went on TV to (repeatedly) apologize and to explain why Target didn’t acknowledge the hack until Dec. 18. [More]

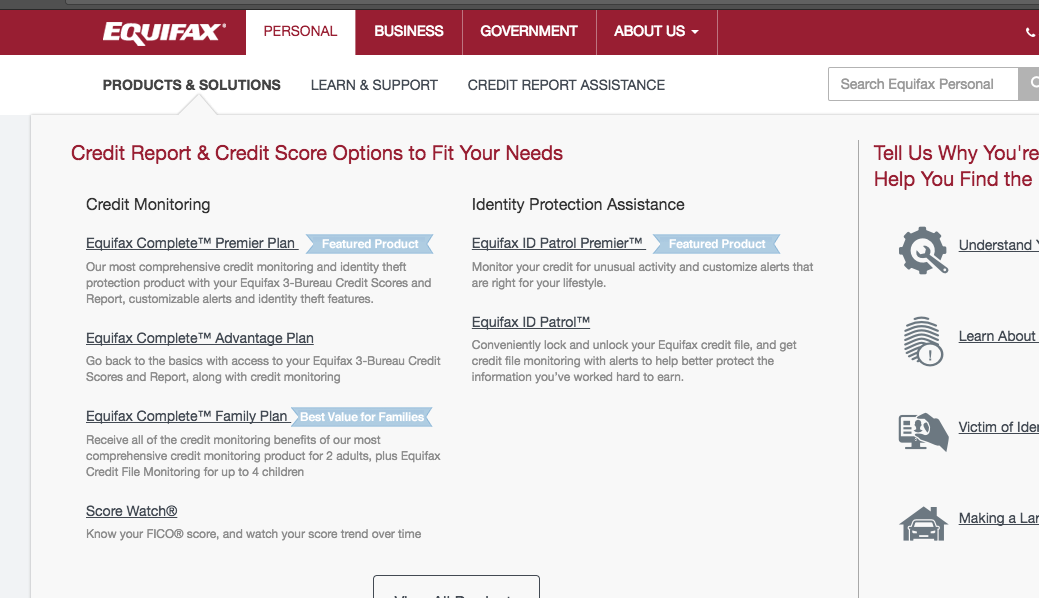

Are Credit Monitoring Sites Really Worth The Money?

Now that everyone is so obsessed with their credit reports and FICO scores, credit monitoring services have popped up everywhere. For a modest recurring fee–one that easily adds up to over $100 a year–you can have a company constantly watch your credit report and alert you of any changes in it, so you can always be on top of your creditworthiness. But should you bother? The consumer director of the U.S. Public Interest Research Groups federation (U.S. PIRG) tells BusinessWeek that credit monitoring is a “protection racket” that turns people into “financial hypochondriacs… who are scared of their own financial shadows.” [More]

Chrysler Won't Let Customers Out Of Credit Monitoring Service Without A Fight

Chris and his wife bought a Jeep were automatically enrolled in a free credit monitoring service. When they decided they no longer wanted the service, they got a hassle from a CSR and worry they’ll have to go through the process again to cut the cord.

One Day Left To Register For TransUnion Class Action Lawsuit

September 24, tomorrow, is the last day to register for the class action against TransUnion for selling consumer’s private data to businesses without permission. If you held a credit card between January 1, 1987 to May 28, 2008, you’re eligible to receive benefits. You can choose from one of three options:

Ex-Countrywide Employee Sells Your Data, They Offer Credit Monitoring Service, Hang Up When You Ask For It

Re: Countrywide Sends Fraud Alert Letters: ‘Your Info May Have Been Sold,” Reader Esqdork writes, “Yesterday, I phoned Countrywide to get them to extend the credit monitoring service [that they offered in their apology letter] to my co-borrower and was promptly hung up on.” The only surprise here is that they even picked up in the first place.

Countrywide Sends Fraud Alert Letters: 'Your Info May Have Been Sold'

I received a letter from Countrywide today that says: