Reader Ben writes:

credit crunch

Citi CEO Emails To Inform You Of Citi's "Bold Steps," Neglects To Tell You What The "Bold Steps" Are

Countrywide Still Asking Consumers To Lie About Their Income

Countrywide would like you to believe that it put all that messy “predatory subprime lending” business behind it and is no longer coaching consumers to lie on their loan applications in order to qualify them for loans they can’t afford… but are they telling the truth about telling the truth? One woman who recently contacted Countrywide about refinancing her home told NPR that sketchy mortgage lending is alive and well at Countrywide.

Jose Canseco Makes "Mathematical Decision" To Let Mansion Go Into Foreclosure

Was ex-American League MVP and admitted steroid abuser Jose Canseco too busy counting the money from his Major League Baseball tell-all books to remember to pay his mortgage? Nope. When the California market tanked, Canseco made “a mathematical decision” to walk away from his mortgage, says the Wall Street Journal.

No Help For 70% Of Homeowners Facing Foreclosure

A new study shows that despite the best efforts of lawmakers and mortgage-service companies, little is actually being done to help homeowners facing foreclosure, says the Wall Street Journal.

Real Estate Speculation: From A Trailer Park To Foreclosure On 4 Homes

The Minneapolis Star-Tribune has a fascinating article about real estate speculation in Minnesota. The article focuses on Bradley and Sarah Collin, a couple with three children who were living in a trailer park when they were suckered by a local “property management company” that (illegally) paid the couple $20,000 cash to buy 4 houses in a new subdivision.

Bank of America To Stop Making Private Student Loans

Bank of America, the nation’s largest bank and one of our largest student lenders, today announced that it would stop making private student loans and instead “do more lending under a federally guaranteed program,” says the Wall Street Journal.

1 in 33 Homeowners Predicted To Be In Foreclosure Within Next 2 Years

For those of you hoping that foreclosure crises has hit bottom, we’ve got some bad news. A new report released by the The Pew Charitable Trusts says that 1 in 33 homeowners is expected to be in foreclosure over the next two years, due primarily to subprime mortgages made in 2005 and 2006.

WaMu CEO Compares Mortgage Meltdown To The Great Depression

WaMu announced today that they lost $1.14 billion in the first-quarter and CEO Kerry Killinger said that nothing of this scale had happened “since the Great Depression.” Comforting!

“Nothing of this scale has happened since the Great Depression,” Chief Executive Kerry Killinger said at WaMu’s annual meeting. “This is the toughest credit cycle I have seen in my years in the industry.”

WaMu says it will cut 3,000 more jobs, including that of Mary Pugh, chair of their finance committee who “had been fiercely criticized for failing to protect Washington Mutual from overexposure to subprime and other risky mortgages,” according to Reuters.

../../../..//2008/04/02/bankrate-offers-some-advice-for/

Bankrate offers some advice for those of you suffering from the dreaded frozen HELOC. [Bankrate]

../../../..//2008/03/24/jp-morgan-has-raised-its/

JP Morgan has raised its Bear Stearns offer from $2 to $10. [NYT]

FDIC: Banks Are Going To Fail, But Don't Worry About Your Money

Sheila Blair, Chairman of the FDIC, wants to let you know that a few banks will probably fail during the current credit crisis, but you shouldn’t worry about your money because its insured up to $100,000 for a regular bank account and $250,000 for a self-directed retirement account (IRA).

Q: What if banks fail in the credit crisis? Will customer money be safe?

Is Your Pleasant Suburb The Next Slum?

At Windy Ridge, a recently built starter-home development seven miles northwest of Charlotte, North Carolina, 81 of the community’s 132 small, vinyl-sided houses were in foreclosure as of late last year. Vandals have kicked in doors and stripped the copper wire from vacant houses; drug users and homeless people have furtively moved in. In December, after a stray bullet blasted through her son’s bedroom and into her own, Laurie Talbot, who’d moved to Windy Ridge from New York in 2005, told The Charlotte Observer, “I thought I’d bought a home in Pleasantville. I never imagined in my wildest dreams that stuff like this would happen.”

Federal Reserve Extends Its Lending Authority In Bear Stearns Bailout

For the first time securities dealers, effective today and for at least the next six months, may borrow from the Fed on much the same terms as banks. The Fed also lowered the rate charged on such borrowings from what’s known as its discount window by a quarter of a percentage point, to 3.25%, and extended the maximum term to 90 days from 30.

JP Morgan, Fed To Bail Out Bear Sterns

Bear Stearns, facing a grave liquidity crisis, reached out to JPMorgan on Friday for a short-term financial lifeline and now faces the prospect of the end of its 85-year run as an independent investment bank.

../../../..//2008/03/14/wamu-has-bad-credit-says/

WaMu has bad credit, says the AP:

Moody’s Investors Service cut Washington Mutual Inc.’s credit rating Friday and said the country’s largest savings and loan will need at least $4 billion more than it expected to cover bad mortgages in 2008.

[AP]

Congress To Subprime CEOs: How Come You Got Paid Millions To Wreck The Economy? Hm?

Congress got to ask the subprime CEOs what everyone else is thinking: Why did you get millions and millions of dollars to fail so spectacularly?

Countrywide's Risky Mortagages May Be Ballooning Out Of Control

“Pay-option mortgages” are loans in which homeowners can choose to pay the interest or even just part of the interest on their mortgage each month. If they do this, the unpaid interest is added to the principal resulting in a mortgage that actually grows over time.

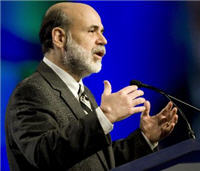

Fed Chairman Asks Banks To Forgive Mortgage Debt

Fed Chairman Ben Bernanke is urging lenders to “forgive portions of mortgage debt held by homeowners at risk of defaulting,” says Bloomberg.