The housing bubble that imploded spectacularly in 2008, taking a big chunk of the U.S. economy with it, has a second wave waiting to strike in the form home equity lines of credit (HELOCs). Having learned from the lesson that preventing a disaster rather than recovering from one might, in fact, be a better way to go, lenders — at the urging of regulators — are now working proactively with borrowers to stave off potential doom before it happens. [More]

heloc

Banks Working With HELOC Borrowers To Prevent Potential Loan-Default Disaster Before It Happens

Old Wells Fargo Contract Allows Bank To Basically Do Whatever It Wants At Any Time

A California couple is finding out the hard way that the contract for the home equity line of credit they’ve had for decades with Wells Fargo isn’t really what most people would consider a binding contract so much as an agreement that allows the bank to change the terms however it wants to and whenever it chooses to do so. [More]

Woman's Late Brother Pays $217,000 To Online Scammers Now She's Facing Foreclosure

We’ve written these words too many times to count, but they obviously merit repeating once more: “Never co-sign a loan unless you are prepared and willing to pay back the entire thing — plus interest and penalties — if the other person defaults.” It’s a lesson a New Jersey woman has spent the last four years learning, and who now faces foreclosure because her dead brother was taken by scammers. [More]

HELOC Cuts, The Hows And Whys

Did your Home Equity Line of Credit (HELOC) suddenly trail off in the forest recently? Here’s some straight-talk on why, and what, if anything, you can do about it. [Examiner.com] (Photo: Getty)

How To Thaw Your Frozen HELOC

According to Yahoo Finance, there are several things you can do if you are one of the many homeowners who found out that their home equity line of credit was frozen by the lender. If your HELOC is frozen you can:

Is Your HELOC In Danger Of Being Frozen?

If you have an open home equity line of credit you were counting on for renovations or other projects, you might want to read CNN Money’s article about how lenders are freezing them around the country. The main triggers for HELOC freezing are credit score changes and a rapid drop in home value in your area. The freeze may also be a computer-determined action, so if your HELOC suddenly goes away and you don’t think it was justified, it may be worth checking your FICO score and then contacting the lender to reopen the line or renegotiate it.

../..//2008/04/02/bankrate-offers-some-advice-for/

Bankrate offers some advice for those of you suffering from the dreaded frozen HELOC. [Bankrate]

Sorry, Your House Isn't An ATM Anymore

For years homeowners have been using their soaring-in-value homes as ATMs, drawing money out to finance whatever they wanted. No more. Falling home prices mean that your house is no longer a source of cash.

Whoops, Where'd My Mortgage Go?

NPR interviewed a would-be Brooklynite named Claudia who is trying to buy an apartment for herself and her teenaged sons. Everything seemed settled, when all of a sudden the lender that was going to be offering Claudio her HELOC loan decided they didn’t really want to anymore.

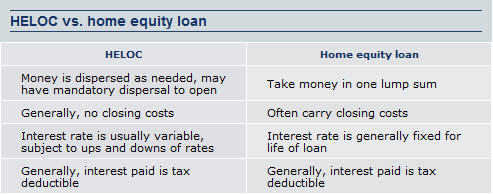

A Bunch Of Information About Home Equity Loans

Got questions about home equity loans and home equity lines of credit (HELOC)? You’re not alone. Thankfully, Bankrate has tons of information about this very topic, and when we say tons… We’re not kidding. This should keep you busy for awhile. —MEGHANN MARCO