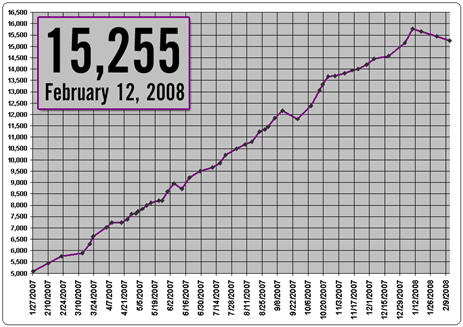

The Countrywide Foreclosures Blog keeps a running tally of the amount of repossessed or REO (Real Estate Owned) properties Countrywide has for sale on their website.

credit crunch

Consumer Confidence Plunges To Recession Levels

Reuters says that consumer confidence has plunged to levels associated with the recessions of the ’70s, ’80s, and ’90s.

The Reuters/University of Michigan Surveys of Consumers index of consumer sentiment dropped to 69.6, the lowest reading since February 1992, and below analysts’ median forecast for a preliminary reading of 76.3.

Mortgage Meltdown Isn't Just A Subprime Problem Anymore

The New York Times says that the mortgage meltdown isn’t just a subprime problem anymore, but has spread into the prime market where consumers with good credit are now struggling to pay their bills.

Online Bank Cancels Cards On "Risky" Customers

Egg, a Citibank-owned online bank in the UK, announced this past weekend that it’s canceling the accounts of 161,000 of its customers after “conducting a one-off, extensive risk review.”

Fed Cuts Rate 1/2 Point To 3%

Financial markets remain under considerable stress, and credit has tightened further for some businesses and households. Moreover, recent information indicates a deepening of the housing contraction as well as some softening in labor markets.

FBI Starts Investigating The Entire Mortgage Industry

The New York Times says that the FBI has begun an investigation that includes almost the entire mortgage industry—from the lenders to the brokers to the Wall Street banks who packaged the loans as securities. They’re cooperating with the SEC and wouldn’t name which firms they’re targeting, but the Times said that it includes 14 companies.

Buyers Sue Agent For Inflating Real Estate Appraisal

The New York Times has an interesting article about a couple in California who are suing their real estate agent (who is conveniently also a mortgage broker) for allegedly artificially inflating the appraisal on their home by $100,000. A few days after moving in to their new home, says the NYT, “they got a flier on their door from another realty agent. It showed a house up the street had just sold for $105,000 less than theirs, even though it was the same size.”

World Economy Feels The Mortgage Meltdown

On a day when United States markets were closed in observance of Martin Luther King’s Birthday, the world’s eyes were trained nervously on the United States. Investors reacted with what many analysts described as panic to the multiplying signs of weakness in the American economy.

Who Wasn't Investing In Subprime Mortgages?

The money transfer services provider’s stock lost half its value Jan. 15 after the company disclosed a plan to recapitalize its balance sheet that depends on its ability to shed its risky loan portfolio.

../../../..//2008/01/15/home-prices-may-bottom-out/

Home prices may bottom out in 2008, says the Mortgage Bankers Association.

../../../..//2008/01/11/american-express-says-the-credit/

Are you a cardmember? [MarketWatch]

Stockton, California Shows Us How Bad The Mortgage Meltdown Can Get

Steve Carrigan is in charge of economic development for Stockton. He says bank loans made it a party every day.

Fed Cuts Interest Rates By Quarter Point

The Fed cut interest rates again today as they continue in their attempt to swoop in and save the economy from the credit crunch. Much like Superman, but boring and not as effective.

Freddie Mac Loses $2 Billion, Needs Cash

Government-sponsored mortgage lender Freddie Mac, the second largest U.S. mortgage company, posted a $2 billion loss for the third quarter and warned that it may not have enough cash to cover its mortgage commitments.

HSBC Says Subprime Meltdown Spreading Into Credit Cards, Other Loans

HSBC warned today that the subprime meltdown is spreading into credit cards and other types of consumer loans, says the NYT. The bank announced that it will be taking a larger write down than it forecast, due to the spreading delinquencies.