Most corporate credit card data theft happens at the database level, like the massive T.J. Maxx breach. But Hannaford has notified investigators that the recent theft of 4.2 million accounts was caused by malware that was installed on the servers at each of its 300 locations. The software “intercepted data from customers as they paid with plastic at checkout counters and sent data overseas,” reports CNET.

credit cards

AT&T Lets You Close Your Account, But Not Stop Paying For It

Reader Steaming Pile is waiting, not so patiently, for AT&T to give him back his $160. He had an account set up with automatic bill pay, and when his contract was up in September he canceled the account. This should have been the end of his dealings with AT&T. A few months later, he was perusing his post-holiday credit card bill when he noticed a charge from AT&T. Reviewing his statements more closely, he noticed that while he was successful in terminating his service, he hadn’t convinced AT&T to stop taking his money every month. Thanks to automatic bill pay and (let’s admit it) his own negligence, AT&T had pocketed $160 for a closed account. In fact, when he called to terminate the automatic bill pay, not only did he have to argue for the credit, he’s still waiting for his money three months later. Check out his very angry email below.

Credit Card Expert Disputes Erroneous Charge, Frustration Ensues

Georgetown law professor and Credit Slips blogger Adam Levitin is having trouble disputing an erroneous $176.96 charge on his Citibank Amex card from PACER, the federal court’s online docket system, which he accesses for free. The professor is a consumer credit expert and should have no problem understanding and fixing the error, right? Fat chance.

LEAKS: Best Buy Internal Doc Says Their "Extended Warranties" Are A "Myth"

An internal Best Buy training document sent to The Consumerist reveals Best Buy’s position on the “Extended Warranty” debate. Best Buy says they don’t sell those pesky “extended warranties” that get so much bad press— instead they sell “performance service plans.” The document also instructs Best Buy employees on how to sell these warranties to Upscale Suburban “Barry” and “Jill.” It’s important for consumers to be familiar with these tactics so they are able to recognize them while shopping in a high pressure sales environment such as Best Buy. Understanding the sales pitch puts you on equal ground with the salesperson.

Trinkets Entice College Students To Sign Up For Crappy Credit Cards

What does it take to get hungry, naive, and cash-strapped college students to sign up for crappy credit cards at on-campus booths? Not much. Based on a survey of over 1500 college students, here is the list of the most common and their percentage as documented by the Public Interest Research Group in a new campaign available on their microsite, truthaboutcredit.org. Nothing like a tshirt with a 23% APR.

Watch Out For High Interest Rates On Store Credit Cards

Seems whenever you check out at a store these days the clerk is always asking if you want to sign up for the store credit card. They’ll tell you that you can save 15% today, but what they’re not telling you is how high the interest rate is: an average of 21.96% and in some cases, as high as 23.99%, says a survey by Congressman Anthony Weiner. That’s almost as high as the default rate you would pay on a normal credit card. Before biting, make sure you read the disclosure agreement in full to find out the APR. If you end up not paying off that balance in full, that one day of savings could eventually be erased by compounding interest. Inside, the interest rates and grace periods for the in-store credit cards of 35 top retailers…

KidsStuff.com Silently Charges $18 Subscription Fee To Grandparent Who Shopped There Two Years Ago

C writes in with another lesson on why you should check your statements frequently:Two years ago I purchased items for my grandchildren at KidsStuff.com. This month (March 2008) I found an $18.00 charge from them on my American Express card.

Buffalo, Where The Debt Collectors Do Roam

Who would’ve guessed that credit card debt and the subprime meltdown would be the saving grace for one of New York’s decaying cities? Buffalo now hosts over 100 collection agencies that employ 5,200 people who spend their days prodding delinquent consumers to pay their bills. The cottage industry relies on the “strong work ethic [and] even-handed temperament” of Western New Yorkers, who once powered long-departed industrial giants like Kodak and General Electric.

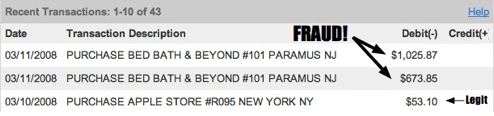

Fight Fraudulent Credit Card Charges

A thief charged over $1,600 to my credit card at Bed Bath & Beyond. Here’s how I responded:

Bad Voodoo: Transforming Student IDs Into Debit Cards

Cash-strapped colleges are partnering with banks to transform student IDs into debit cards. The deals are a windfall for the institutions, but force students to open accounts laden with hefty penalty fees and surcharges.

Mugger Used Our Credit Card, Now CapitalOne Sued Us Without Us Knowing For $1200 And Won

Andrew’s wife got mugged, the thief rand up purchases on her credit card, and now CapitalOne has sued them for $1200 and won. How can this be? Andrew writes:

In May of 2005 my wife was mugged at one of the elevated train stations in Chicago. After calling the police and filing a police report, she started calling each credit card company to cancel each account. Except she forgot about one card, her CapitalOne card. A card hardly ever used and only had a $500.00 limit…

Macy's Keeps Lowering Shopper's Credit Limit Without Warning

Trey is upset. Four times in the past year, Macy’s has reduced the credit limit on his card without advance notice, even as his card membership level keeps going up. (Apparently he really likes liked to shop at Macy’s.) “I lit into them for not advising me of my credit limit decrease, especially considering just three days before I received a brand new Macy*s platinum card in the mail, where they had the perfect opportunity to let me know it was now only $800.”

Credit Card Victims Muzzled, Ordered To Release Financial Histories Before Sharing Their Experiences

Four credit card victims were ordered to sign waivers allowing their creditors to release their private financial records to the public before they could testify before the House Financial Services Committee. The consumers had flown in from across the country to share their stories at a hearing on the Credit Card Bill of Rights, but credit card companies insisted—and Republicans and Democrats agreed—that it would only be fair to release documents like credit scores and a list of recent purchases in order to rebut the consumer’s claims. “Fair is fair,” Congressman Spencer Bauchus (R-AL) barked, as he defended the absurd request. Ultimately, the consumers didn’t testify, but one invitee, Steven Autrey, released his prepared statement, which slams creditors for their abusive and predatory business practices.

Weekend Project: Photocopy Your Wallet

We’ve all been there, that sickening feeling as you reach for your back pocket, only to find your wallet gone. A frantic search turns up nothing. You feel sad. But you wouldn’t feel that sad if you had photocopied the contents of your wallet. Then you would have a legal copy of your license to use until it got replaced, and all your account numbers and the phone numbers you need to call for replacements. So take a second this weekend to pop your wallet into the photocopy or scanner and keep the paper in a safe place. You might be very glad some day that you did.

Walmart Saves You $10 By Refusing To Sell You Anything

Last night I was grocery shopping at my local Walmart, to beat the insane weekend crowds. Upon finishing checkout, I swiped my card and signed. Then the system beeped, the cashier asks to see ID. I tell her that I don’t have it on me. She gets the manager. The manager informs me that due to a recent 8 incidents of credit card theft that she won’t process my transaction unless i can prove who I am. I normally do keep my driver’s license on hand. I do not carry cash. I have had a credit not work in the past and the manager gladly processed my purchase by manually punching in the numbers. It’s insane that a billion dollar company is concerned about $130 cart of groceries. If I was a thief, my cart would have had more than just milk,eggs and bread in it.

Dell Is "Too Cheap To Realize That I Have A Defective Laptop"

Reader Jake says he just opened his 45 day old laptop and the LCD cracked for no reason. Now Dell doesn’t believe his story and won’t cover it under his warranty. That sucks.

Jack In The Box: That'll Be A $30 Minimum Charge For Credit Or Debit, Please

This last evening I was hungry and decided that I wanted Jack In the Box. So I went to the Manhattan Beach, CA store on Sepulveda Ave. When I pulled up and was beginning to determine what I wanted for dinner I noticed a sign on the order board. It stated that in order to use a credit card it required a 30 dollar purchase, ID and a signature. While I have seen minimum payment requirements before at various liquor stores and restaurants I have never seen one so high especially for a drive thru window…

Sample Script To Get Your Credit Card Rate Lowered

Want a lower interest rate on your credit card? Call up your credit card company and say, “I think I’ve been a good customer. I’d like to stay with you, but I really want you to lower the rate on my card. Can you help me?” If they say no, ask to speak to a supervisor and say the same thing. CBCnews approached 10 shoppers at random in a mall and had them call up their credit card company and tell them exactly what we told you. Six of them got their interest rate reduced. Those sound like odds worth playing to me.