Check your credit card statements for fraudulent charges from a company called “ICH Services,” reports KETV. They’re defrauding consumers across the country at $9.95 a pop with unwarranted credit card charges. If you notice it on your bill, call up your credit card company or bank and dispute the charge. And since your information is now in the hands of criminals, you may want to close down the account and get a new card while you’re at it.

credit cards

Bennigan's Decides To Tip Itself $5

A little tale to remind you to keep an eye on your credit card statements from reader Rebecca. What you’re charged may not always be what you signed.

I was recently at the Bennigan’s on Route 22 in New Jersey for dinner with some friends. I had never been to this particular Bennigan’s but my friends had warned me that the service was extremely bad their last visit. I enjoy Bennigan’s the most out of the fast food chains and it was the closest one so we decided to give it a shot anyways.

Chase Reactivates Dead Card Without Your Permission

Erica writes:

Recently, my husband and I got two new Chase credit cards in the mail. I didn’t look closely, assuming that this was a new card for our never-used Chase Mastercard account. This account has been around for seven years, but we prefer another card with a rewards system; the Mastercard account is open only to benefit our credit rating. Therefore, no urgency in activating it — I dropped it in the bill pile to deal with later.

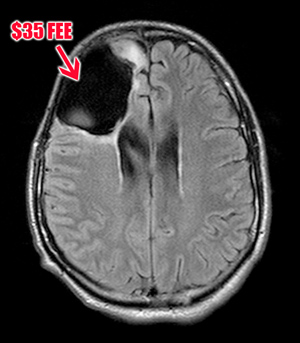

HSBC Refunds $35 Fee, Not To Correct Their Mistake, But Because You Have A Deadly Brain Tumor

I made an electronic payment online with my one of my bank’s check card. Turns out this was the wrong one, and I immediately canceled the payment (as there’s a very easy to find and large button allowing you to do this immediately as well), and resubmitted it through the correct bank. So, to sum up, the payment was made, about two weeks before it was due. I figured all was cool and I was being a good customer for paying more than the minimum balance, way ahead of the due date, online, so there wouldn’t be any “problems” with a check or the postal service. Then I look on my statement and I’ve been charged a $35 Returned Payment Fee.

Chase Rep Cancels Credit Card Because Of Mint

A hyper-vigilant Chase CSR canceled a woman’s credit card and issued her a new one when she called in to confirm her interest rate, because Mint was showing a slightly higher rate. A Mint representative confirms that “while we can generally get pretty good info about APR, APR can vary widely by customer & there won’t always be a 100% match (that’s why we allow customers to edit their account information).”

Capital One Invents New Way To Rip You Off For $500

Capital One accidentally sent a customer with a closed Capital One credit card a check for $500. She cashed the check and now CapO wants its money back… so badly that they reopened the closed credit card just so it could bill her. They also added a $1.42 finance charge. When asked by The Oregonian, a consumer advocate and official with the Office Of The Comptroller of Currency both said they had never heard of a company reopening a closed credit card for this reason before. What a brilliant new scam, here’s a check for $500 dummty dum dum two months pass oh wait guess what that was actually a loan, pay up, bitch. In all seriousness, don’t cash unexpected checks, you’re just asking for trouble.

Asking For Lower APR Gets Juniper iTunes Rewards VISA Card Closed Against Man's Will

Thomas writes:

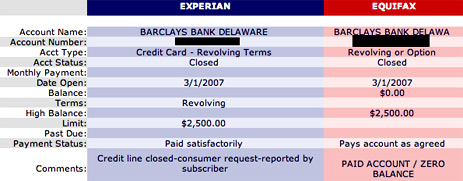

If you don’t use your Juniper iTunes Rewards VISA (issued by Barclay’s) for an entire year, they close the card and report to the credit agencies that you requested to close it. I’ve learned that when I called to inquire about a lower rate on 2/26, the agent canceled my account.

Go Buy A Shredder Right Now

A shredder is an indispensable tool for keeping your identity safe and secure. If you receive credit card offers or have old bank statements littering your files, then you can’t do without a cross-cutting shredder to slice and dice your personal information into an indecipherable medley of confetti. Frugal For Life points out a few of the many reasons we all should be devout shredders.

"For Security Purposes, This Card Is Not Active" Is A Lie

When you get a new or replacement credit card in the mail, you have to call the number on the back to activate it, or else you can’t use it, right? Wrong. Despite the sticker on the back that says, “For security purposes, this card is not active,” credit card companies are mailing out cards that can be used without phone activation. This is a problem if the letter containing your credit card is intercepted by an identity thief, like what happened to reader PC Guy. The kicker? He didn’t even request the card, it was a forcible reissue when his store-branded card switched from Visa to Mastercard. His story, inside.

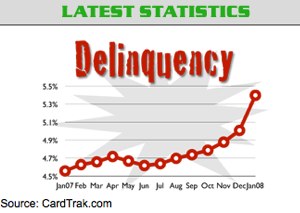

Late Payments On Credit Cards Highest In Three Years

CardTrack.com says “the percentage of people delinquent on their credit cards is the highest it’s been in three years,” according to CNN. Over the past year, U.S. consumers have charged “more than $2.2 trillion in purchases and cash advances.” The article gives the usual advice: Stop buying stuff!

Very Strange Circuit City iPod Touch Bait And Switch

Ian writes:

Last Thursday 2/14, I ordered a 32GB iPod touch from CircuitCity.com at $474 + tax for a total of about $514. After thinking about it for a bit, I logged back in and canceled the order – just a bit too steep for an iPod, you know? I figured I’d have to wait a while for the price to drop, and left it at that. Well, believe it or not, I received a call at work today from a Circuit City sales rep at corporate telling me he’d offer me the iPod at a discount, so CC could keep my business. I was baffled – nothing like this has ever happened to me before, but the price he gave me $420 + tax… was too good to pass up.

How To Avoid Pre-Screened Offers Of Credit

Joseph writes in with a helpful reminder:

Now might be a good time to remind people that they can opt-out of pre-screened offers of credit. In light of the HSBC debacle I’ve been victim of, I checked out my credit report yesterday. I was amazed at how often the major credit card companies (AMEX, Capital One, Bank of America, etc…) access my credit history in order pre-screen me for promotional purposes. Consumers can opt-out at: www.optoutprescreen.com

Apple Store Apologizes For Refusing Purchase Without ID

I wanted to inform consumerist that the manager from the Apple Store at Stonestown called me back to apologize about the incident and to invite me back to the store. She apologized for the employees making ID a requirement of purchase and that they were doing it to protect from fraud. She then mentioned that they understand they were not following the merchant agreements but will do so here on out. I will go back to make my purchase!

Retail Management: "We Have To Check ID Or We Get Screwed By Credit Card Companies"

Scott, a member of management for a retail chain, wants to share the other side of the checking-ID debate:

Your website continually runs stories about how merchants aren’t allowed to ask for ID during a credit transaction. I work on the management team at a nationwide retailer, and credit card fraud occasionally hits our location. Every so often, we are hit with something called a ‘retrieval request’ from one of the big 4 credit authorization companies (Discover, AMEX, MC, Visa). This means we have 48 hours to provide a legible signed receipt, and video evidence of my staff checking a photo ID to verify the cardholder.

Is HSBC Straining Under An "Unprecedented" Wave Of Fraud Activity?

If you’re an HSBC customer, check your account, as there may be a wave of fraudulent activity hitting your bank. Two days ago we wrote about the guy in the U.S. who discovered his account had been drained by someone in Bulgaria. Later that day we received an email from Emily in NYC who was having similar problems, only her fraud-buddy was in California and Canada making withdrawals on her account.

Emily’s fiancé wrote back to us today with an update, and according to Emily, the HBSC Fraud Investigator who spoke to her “said that their fraud department was so overwhelmed, it was ‘still in the developing stage of how we’re going to handle’ it. I asked if she knew how many customers were affected and she stated ‘We don’t even know.'”

Apple Demands ID With Credit Card Purchases, Violates Merchant Agreement

We received the following strangely awesome, if a bit strange, letter from a consumer who was not allowed to purchase something at the Apple store because he would not show ID. It was sent to Steve Jobs and William Rhodes (of Citibank.) Let’s listen in:

../../../..//2008/02/19/bank-of-america-still-isnt/

Bank of America still isn’t giving customers, and now, reporters, a straight answer when asked why they’ve been jacking up people’s interest rates to 23, 29%. [Star-Telegram]