Four years after federal regulators shut down a debt relief operation that promised to help customers pay down credit card debt, but in reality only relieved customers of their cash, a man who worked for the scheme has been ordered to spend two years in prison and to refund $1.2 million to his victims. [More]

credit card debt

Which Cities Have The Highest/Lowest Credit Card Debt Burden?

The average amount of credit card debt varies quite a bit from city to city, as does the ability of consumers to pay down that debt in a timely manner. A new study claims to show that the cities with the least amount of credit card debt burden aren’t necessarily the cities with the least amount of debt. [More]

The 5 States (Plus D.C.) With The Highest Levels Of Credit Card Debt

If you were asked to guess which states had the highest average credit card debt, you might assume it would be dominated by places with high real estate costs, where consumers need to spread out their other purchases in order to make the rent or mortgage every month. Or you might go the other way and guess that states with low costs of living but high unemployment rates would top that list. But a new analysis of credit card data paints a different picture than either of these assumptions. [More]

Credit Card Debt Is Up & We’re Not Being So Good About Paying It Off

We’ve been credit carding it up (yep, it’s a verb) lately and as a result, Americans have collected more credit card debt than we had a year ago during the same time period, according to new figures from a credit reporting agency. But while we’re spending more, we’re not being so good at actually paying off that debt — which makes for a particularly unwinning economic combination. [More]

Americans Are More Responsible With Credit Cards Than We’ve Been In A Decade

Times may have been tough on our wallets over the years, but somehow despite a recession and its ensuing after-effects, Americans have become a lot better at making their credit card payments on time. The amount of delinquencies on credit cards issued by banks is at its lowest level since 2001, according to a new report from a banking group. [More]

Lenders Didn't Learn The Lesson Last Time, Return To Wooing Risky Clients

You know who definitely shouldn’t be getting back into debt right about now? Those same risky clients who have spent months and even years climbing out of bankruptcy, credit card and auto loan debt. But that isn’t stopping big lenders from starting to woo those troubled customers. [More]

Would Capping Credit Card Interest Rates Help Or Hurt Consumers?

Many Americans are carrying more than $10,000 in revolving credit card debt, some with an APR of over 20%. But while the idea of putting a more reasonable ceiling on these rates might seem like a way to help get these folks out of debt and back in the black, some say it would likely have no positive effect on the economy at large. [More]

Late Credit Card Payments At Lowest Rate Since Mid '90s

We mentioned a few weeks ago that more Americans have begun paying down their credit card debt during the last two years rather than maxing out their accounts with stuff they can’t afford. Now comes another sign of more responsible behavior… the rate of late credit card payments is the lowest it’s been in 17 years — .That’s an entire Bieber! [More]

Americans Actually Trying To Pay Down Credit Card Debt

From 2004 to 2008, while we all were busy flipping houses and blindly investing in luxury condo developments in Appalachia, credit card users were also spending $2.1 billion more in purchases than they were in bill payments. Since 2009, that tide has turned drastically. [More]

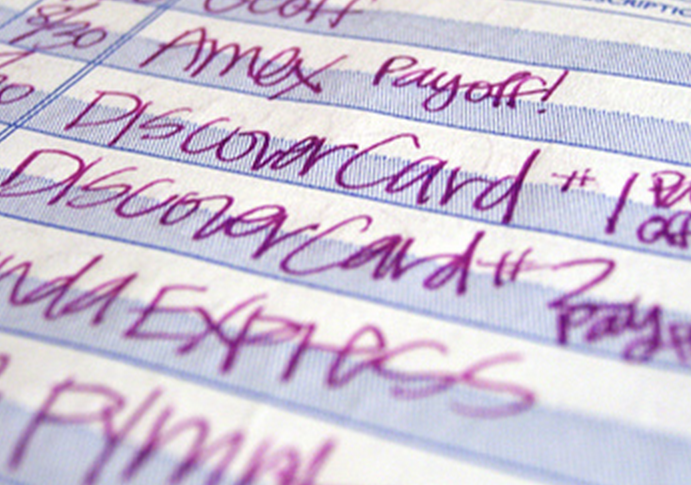

How One Couple Dug Out From $83,000 In Credit Card Debt

It’s pretty easy to amass a mountain of credit card debt, especially if you’re a married couple with nine credit cards on which you only pay the minimum. But there’s no simple way to bulldoze that mountain once it’s reached Everest-like heights. As one couple in Atlanta learned, erasing $83,000 in debt requires time, determination and humility. [More]

Beware: Credit Card Minimum Payments Are Messing With Your Mind

Credit Card minimum payments are supposed to help keep the accumulation of interest on credit card debt from getting out of control — but a new study reported in the Economist suggests that minimum payments do more harm than good.

Attention: Credit Card Companies Have Realized That You Are Broke

The New York Times has an article detailing what promises to be the next fun financial crisis — credit card debt! Apparently, credit card companies have only just now realized that you people are broke! Whoops.

Does The Citi "Payment Partner Program" Work?

For several years and in different forms, Citi has had an interesting idea to get you/help you to pay off your credit card called the Citi Payment Partner Program. How it works is if you enroll and make above the minimum payment due for four months, on-time, at the end they will match 10% of the amount you paid off above your minimum payment. The max cap is $550. But there are two important caveats: